Published

- 09:00 am

Market research firm Corinium today released a new report, The Intersection of Data Privacy and Cybersecurity, which examines how data privacy, governance, and security leaders are empowering cyber-secure digital transformations within their organizations. Research uncovered that the vast majority of participants (94%) ranked data privacy compliance as a top priority for their organization. Yet nearly half (45%) aren't concerned about regulatory fines and penalties despite a growing number of regulations and data breaches. Instead, their motivations are focused more on building trust with their customers and partners. The study of 125 data privacy, governance and security leaders was conducted throughout April and May and sponsored by Okera, the Universal Data Authorization company.

Among the key findings, respondents ranked ensuring data security at a fine-grained level as the top benefit of centralizing data authorization and control. Fine-grained access control provides data owners the ability to dynamically hide, mask, or tokenize data to prevent inappropriate access to confidential, personally identifiable, or regulated data. Further, two-thirds of organizations (64%) report taking a zero-trust, least privilege approach to secure data access all or most of the time.

“It has never been more important for all business leaders to understand the relationship between their organization’s privacy and cybersecurity programs, how the two overlap, where the challenges are, and how they can build upon one another to protect customers, employees, partners and the organization’s brand,” said Nick Halsey, Okera CEO. “It’s clear that as the market continues to grow, more sophisticated organizations will transition to a centralized platform for data authorization and control to ensure access to sensitive data at the fine-grained level, particularly if they want to retain the trust of their customers and partners.”

Reflecting market maturity, the study found that organizations are taking a strategic approach to complying with multiple data privacy laws with nearly half (49%) automating and standardizing enforcement compared to just 6% that are focused on only one privacy regulation. Nearly three-quarters of organizations (72%) have moved at least half of their data to the cloud, and an impressive 70% of leaders stated they’re very or extremely confident they know where all of their data is.

“You take a reputational risk when you fall out of regulatory compliance. If you lose customer trust, you can’t simply pay a fine to fix it,” said Raj Badhwar, SVP and Global CISO, Voya Financial, a participant in the study.

Another participant in the study, Rick Doten, VP, Information Security & CISO at Carolina Complete Health, commented, “We need to know where our data is, what it is, which applications access it, and who uses those applications. Then, we need to be able to tag it and control it. Data governance is the answer.”

Additional Highlights

Zero Trust isn’t easy – While 64% of businesses see taking a zero-trust, least privilege approach to data security as a guiding principle, many companies still struggle to centralize their data management capabilities, which is the only way to ensure fine-grained access control over all sensitive data.

Better regulatory compliance is the leading driver of data privacy investments – The top three drivers of investments into the secure access of confidential, personal, and regulated data are better regulatory compliance (54%), improved business efficiency (50%), and managing costs (44%).

Most effective business case – To secure budgets for data privacy and security initiatives, CPOs and CISOs should focus on the most significant risks affecting business operations.

The full report can be downloaded here.

Okera is participating in the Data & Analytics Live US conference taking place this week from June 22-24. Connect with the team during the event to dig into the report findings and discuss how the Okera Dynamic Access Platform can minimize data security risks.

Related News

- 01:00 am

Marc Terry, International Managing Director for Cardtronics said:

"The launch of the new £50 is a clear sign that cash is alive and well and demonstrates the Bank of England's clear commitment to the UK's essential cash economy for many years to come. The predictions of a cashless future are not only misleading, they are dangerously incorrect and risk alienating huge swathes of society. Over 8 million people are believed to rely on cash for their day-to-day lives so safeguarding the future of cash is clearly extremely important. Even during the lockdown when cash usage was at its lowest, the ATM network still dispensed a billion pounds in cash every week and now that restrictions are being lifted, cash usage is returning. The anti-cash lobby has tried hard to use the pandemic to promote other forms of payments and extinguish cash use and yet our latest research shows as many as three quarters (74%) of UK consumers believe that all retailers should offer the option to pay in cash. If politicians are serious about keeping access to cash and supporting their electorates' right to use cash then they need to do more to ensure that LINK and the banks support the cash infrastructure of the UK. Cash provides us all with choice, freedom and security for times when technology fails us, we must protect it."

Related News

- 06:00 am

After a decade of being at the core of the financial services industry, having thousands of conversations with the brightest minds on our stages, hosting hundreds of workshops, and getting in the trenches with leaders solving real-world challenges, for the first time in our history, Money20/20 is proud to release our expert predictions in a thorough report about where our industry is headed over the next five years.

We are on the cusp of a new wave, Fintech 2.0, where fintech becomes intrinsically more connected to the economy. The prior wave of financial technology primarily focused on the digital distribution of existing products and services. Now, we're eagerly watching to see how the industry will shift its activity and enable digitally-native financial services to be fundamentally reimagined from the core out.

Are you ready for what’s next?

Related News

- 02:00 am

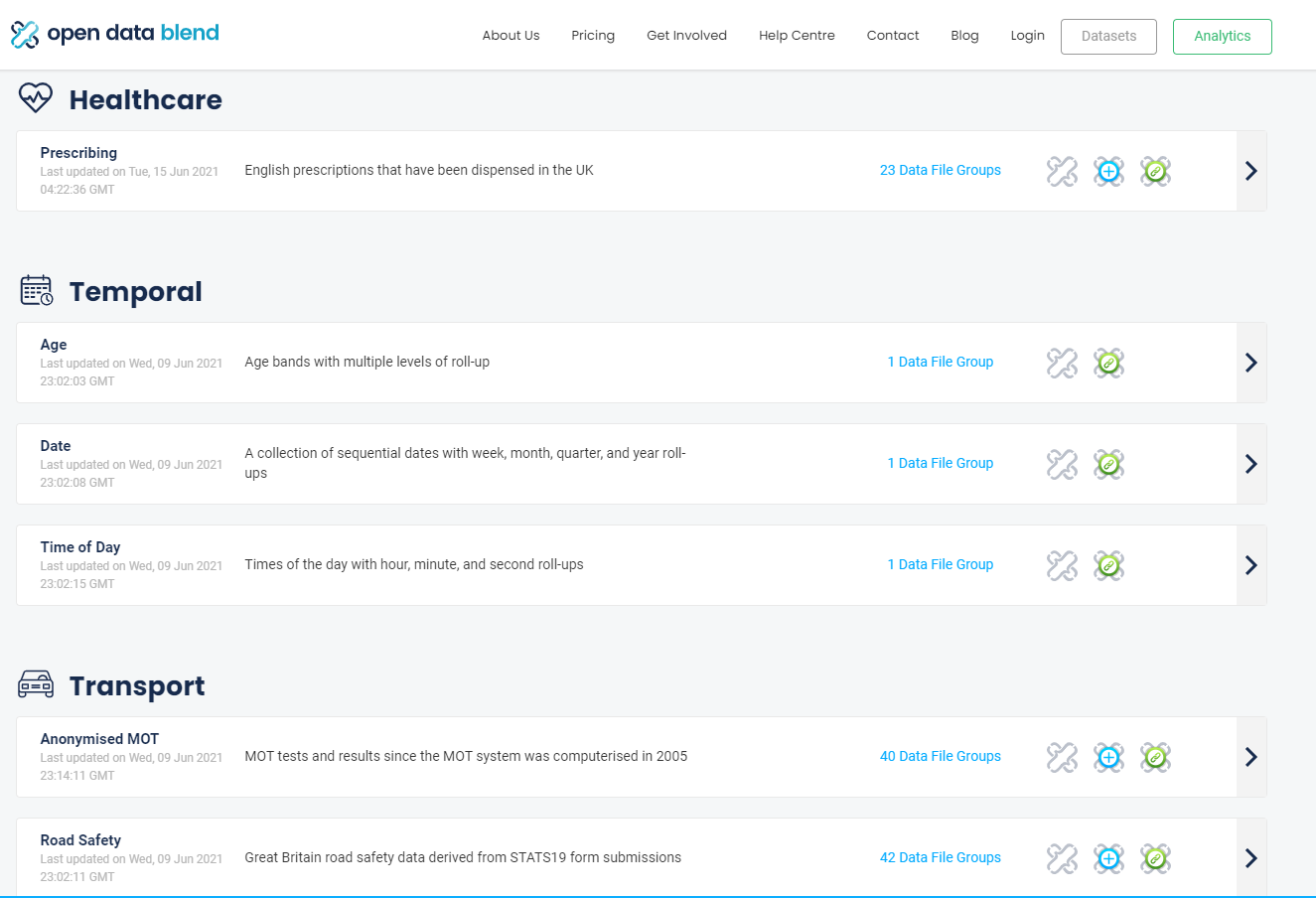

London-based analytics company Nimble Learn has announced a breakthrough in the accessibility of large and complex open data sets.

Open Data Blend is the collective name for a set of services that are designed to produce analysis-ready open data and reduce the time and cost of sifting through large open data sets.

It’s primarily aimed at data engineers, data analysts and data scientists, with potential applications in areas as diverse as pharmaceuticals, road safety and car maintenance.

Open Data Blend is the result of over six years of research and development into open data publishing, data engineering and modern data warehousing, and more analysis-ready datasets are due to be added over time.

Michael Amadi, founder of Nimble Learn, said: “Our data engineering team have been hard at work building out a sustainable service that curates large open data from the UK, transforms it into analysis-ready datasets, enriches it with derived values, and makes it available through a frictionless open data catalogue."

“We have the fundamental belief that everyone should have access to refined and frictionless open data, and Open Data Blend is a significant step along that path.”

The openly-licensed data features a fast, lightweight data catalogue user interface, as well as an open access data catalogue and bulk data API that is built on open standards.

Initial data sets include data relating to drugs prescribed by NHS England, MOT test results since the system was computerised in 2005, and road safety statistics in Great Britain.

Another service, Open Data Blend Analytics, enables data analysts and data scientists to analyse the datasets “at the speed of thought”, thereby allowing for much quicker insights and ultimately business value.

“Open Data Blend Analytics surfaces our datasets through a rich semantic data model that can be connected to and analysed from BI tools like Excel, Power BI and Tableau,” added Amadi.

Browse through the Open Data Blend Datasets, or find out more information about Open Data Blend Analytics.

Related News

Bhairav Trivedi

CEO at Crown Agents Bank

A Central Bank Digital Currency (CBDC) is essentially a regular currency but in a digital form, so it would still be highly regulated. see more

- 01:00 am

Leading UK RegTech specialist SmartSearch has warned against the dangers of rushing through anti-money laundering checks, in a bid to beat the upcoming stamp duty holiday deadline at the end of June.

Thousands of homebuyers are expected to benefit from the temporary lifting of Stamp Duty Land Tax (SDLT) for properties worth up to £500,000 in England and Northern Ireland, following the decision to extend the holiday from March.

However, as the deadline gets ever closer there are concerns that mortgage applications and contracts may be rushed through, providing opportunities for criminals and fraudsters to take advantage of a system under pressure.

Martin Cheek, managing director at West Yorkshire-based SmartSearch, said there had been increasing levels of fraud and money laundering attempts since the outbreak of coronavirus, as criminals can easily bypass manual security checks.

He said: “In a busy market as we have today, which is driven by the rush to beat the stamp duty holiday, it’s a sad fact that criminals and their enabling agents, will look to exploit the opportunity.

“Property transactions remain the number one target for money laundering and with the volume currently going through the system there is a danger that some AML checks and procedures may be rushed through.

“But in a way the bigger danger is from agents and legal firms still using manual methods of verification for anti-money laundering processes. Document forgery is a major industry with highly sophisticated products available on the black market.

“It’s almost impossible for even the most experienced broker or agent to tell the difference. If they’re under time pressure, or just seeing a passport image copied into an email, there is a real danger criminal applications will get through unchecked.”

According to Cheek, regulated businesses operating in the property market should be looking to switch to electronic verification as a secure, fast and accurate method of onboarding new customers and remaining compliant with Financial Conduct Authority (FCA) regulations.

He adds: “Financial services firms who are unwittingly processing applications from criminals will be held responsible by the FCA so it’s clearly in their interest to do everything they can to prevent them even getting through.

“The most effective way of doing that is by switching to electronic verification for Know Your Customer (KYC) procedures. With the technology available today it takes two seconds to carry out an individual search, across multiple global data bases, with just a name, address and date of birth.

“Manually checking hard copy documents is no longer necessary, or secure. The switch to digital is long overdue for many businesses who would not only save themselves time and money, but ensure criminals are kept out of the system.”

For more information, please visit www.smartsearch.com

Related News

- 05:00 am

Scienaptic, the world’s leading AI-powered credit decision platform provider, announced its partnership with 700Credit, the global leader in credit data for the automotive industry. This alliance will enable Scienaptic to tap 700Credit’s credit and compliance reports to enhance decisioning for its auto lending clients.

700Credit is the largest provider of credit reports, compliance, and soft pull products to over 14,000 Automotive, RV, Powersports and Marine dealerships across the U.S. 700Credit’s offerings include credit reports, pre-screen and pre-qualification platforms, OFAC compliance, Red Flag solutions, MLA, synthetic fraud detection, identity verification, score disclosure notices, adverse action notices and more.

“Using rich data, auto lenders are empowered to make more informed decisions while safely extending credit to new applicants,” said Ken Hill, Managing Director of 700Credit. “Scienaptic’s AI-driven credit underwriting platform, paired with our data, will allow auto lenders to approve more customers with confidence, mitigate risk, and deliver faster credit decisions. We are pleased to partner with Scienaptic to help auto lenders make better loan decisions for their customers.”

"Integration of AI with rich data is radically changing credit underwriting," said Pankaj Jain, President of Scienaptic. "Through this partnership, Scienaptic and 700Credit will combine resources and expertise to focus on delivering a ‘best-in-class’ credit decisioning solution for auto lenders.”

Related News

- 01:00 am

Clearpay, a leader in “Buy Now, Pay Later” payments known as Afterpay (ASX: APT) outside the U.K. and Europe, announced that it has reached two million active customers in the UK, just as the business introduces its first major global brand campaign, ‘Pay Better’.

Pay Better

Clearpay's 'Pay Better' campaign aims to empower people to not just pay later but pay better through having the freedom and flexibility to pay over six weeks and never pay interest. The overarching campaign shines a light on the ways consumers can reclaim control of their financial lives through responsible spending.

The “Pay Better’ campaign is timed with re-opening of British retail and includes a multi-million pound investment in innovative digital, social and out-of-home creative - with high impact billboards, taxi wraps, bus wraps and more. The campaign can be seen in more than 17 markets worldwide- including London, Manchester, Birmingham, Leeds, Liverpool, Nottingham and more in the U.K.

Clearpay’s Head of U.K. Rich Bayer said: “It is an exciting time at Clearpay, hitting our 2 million customer milestone alongside our Pay Better campaign launch. All of this comes just as we are reaching our two year anniversary in the U.K. We are excited by the growth and opportunity in this market, and look forward to continuing to offer a way to pay that empowers customers to budget and pursue financial wellness.”

Over Two Million Customers

Clearpay’s more than two million customers can shop from more than 6,000 brands and retailers offering, or in the process of offering Clearpay to their customers. A full list of brand and retail partners can be found on Clearpay’s Shop Directory. The company refers more than 30 million leads to its global merchants each month.

Clearpay’s campaign will run from 31st May to mid-July, and will cover Large format OOH/DOOH, Taxi Supersides, Bus T-Sides, Tiktok in-feed videos, social, web and CRM.

Clearpay is known as Afterpay (ASX:APT) in the US, Canada and Australia.

Related News

- 05:00 am

The Depository Trust & Clearing Corporation (DTCC), the premier market infrastructure for the global financial services industry, today announced the appointment of Jennifer Peve as Head of Strategy and Business Development. In this new role, Peve will have overarching responsibility for the firm’s global corporate strategy, digital product development and strategic partnerships and alliances, reporting to DTCC President & CEO Michael Bodson. Peve will also join the DTCC Management Committee. This appointment is effective July 2, 2021.

At a time when the speed and breadth of technology advancement, especially in digital innovation, continues to accelerate and drive industry-wide change, Peve will be charged with maintaining strategic alignment across DTCC and ensuring coordination and adaptability in the formulation and execution of the firm’s strategy. She will also bring increased focus on leveraging new technologies to enhance the post-trade environment and position DTCC as the bridge between legacy and emerging technologies, building on successful initiatives she has led, including Project Ion (DTCC’s future vision of an alternative digital settlement service) and Project Whitney (DTCC’s digital product offering for private securities).

“Jennifer is a proven leader who has the unique ability to understand, conceptualize and shape the future of the post-trade environment as well as the application of new and emerging technologies to drive the creation of creative and effective products and solutions for our clients,” Bodson said. “Jennifer will bring together our corporate strategy, digital product development and strategic partnerships and alliances as we continue to make significant advances in transforming the post-trade environment and introducing and utilizing new technologies to drive down costs and risks for our clients.”

Peve joined DTCC in 2015 as Executive Director, Business Development and Fintech Strategy Office. She was promoted to Managing Director in 2018 and assumed expanded responsibilities for Global Partners and Innovation. She previously served as Executive Director, OTC Product Management, at CME Group.

Related News

- 04:00 am

The Extraordinary Shareholders' Meeting of SIA, which met today under the chairmanship of Federico Lovadina with the participation of 96.1% of the Company's share capital, approved the plan for the merger by incorporation of SIA S.p.A. into Nexi S.p.A.

The completion of the merger is subject to the fulfilment of certain standard conditions precedent for transactions of this type, including the attainment of the relevant authorizations, including that of the competent Antitrust Authority.

The transaction represents a strategic opportunity to integrate the activities of SIA and Nexi, thus creating a new Italian paytech, leader in Europe able to cover the entire digital payments value chain and serve all market segments with the most complete and innovative range of solutions.