Published

- 02:00 am

Fime has been recognized by Mastercard to test solutions in line with the Mastercard’s Enhanced Contactless specifications. The Ecos specifications look to future-proof contactless solutions against new technologies such as quantum computing. This allows consumers, merchants and financial institutions to benefit from enhanced convenience, trust and privacy.

Contactless payments are showing no signs of slowing down. Providing flexibility to merchants, convenience and security to consumers is key to the continuation of this trend. Fime is offering, consulting, tools and testing expertise, to device manufacturers, acquirers and merchants, to enable fast, secure and effortless contactless payments.

Lionel Grosclaude, CEO at Fime comments: “As contactless use cases continue to grow, it’s fundamental that we protect the whole value chain. Security, trust and privacy are key as the digital payments landscape evolves. Fime is dedicated to supporting the roll out of quantum-resistant technology to deliver next-generation contactless solutions.”

To learn more about how Fime is supporting stakeholders to launch their contactless solutions quickly, easily and safely, visit our website.

Related News

- 03:00 am

Help available through digital payment solutions can ease transition as COVID-19 support schemes conclude

After debt charity StepChange said £370m of rent arrears have been built up through the pandemic[i], PayPoint is backing the National Residential Landlords Association’s (NRLA) request to supply further support for the financially vulnerable.

The NRLA wants interest-free, government guaranteed hardship loans for tenants. Digital payments solutions expert, PayPoint, believes this is an important step but if this support is not forthcoming it is suggesting that there is another solution for those who have fallen behind on bills since the first UK lockdown began in March 2020. PayPoint is urging service providers to offer flexible payment arrangements to consumers to ease the burden for all.

Danny Vant, Client Services Director of PayPoint, commented: “There is a perfect storm of factors likely to put some tenants at a severe disadvantage in the next few months. The furlough scheme will not be extended despite lockdown measures remaining in place for a month longer than planned, yet the ban on evictions has come to an end. The application deadline for payment holidays has also now passed. These circumstances will hit every individual differently and, with many already struggling, could push them into real, long-lasting financial problems. The best way for organisations to help tenants through this period is by offering tailored solutions and clear, on-going communication.”

PayPoint’s MultiPay allows businesses to collect due or arrears payments with care, engaging with customers sensitively and responsibly. Importantly, it provides customers with payment flexibility, putting them in control whilst improving cashflow for the business awaiting payment. This can also minimise unnecessary payment chasing, which is a key burden on call centres. These tools are applicable to charities, social housing sectors, landlords, and local councils.

Danny Vant concluded: “By working with customers, considering their individual financial challenges and providing flexible payment structures, businesses will help them navigate the difficult year ahead and the end-result will be mutually beneficial.”

PayPoint is attending the Social Housing Strategy Forum on 1 and 2 July to further discuss the benefits that PayPoint’s digital payment solutions can provide to landlords, social housing organisations and renters.

Related News

- 07:00 am

- Future of Finance Lab will further develop Contour’s product offering and create new standards for global trade

Contour has opened an innovation lab In Singapore where it will collaborate closely with its growing network of banks, corporates and ecosystem partners to research and develop novel, digitally native trade finance solutions.

The Future of Finance Lab will further Contour’s mission to develop the digital infrastructure to address longstanding inefficiencies in trade by removing barriers, simplifying workflows, and making trade more accessible to all.

The Lab is anchored in Singapore, leveraging its conducive environment for innovation, flourishing fintech ecosystem and supportive regulations. Singapore also offers the strategic advantage of being a vibrant and important trade hub.

Global trade is set to bounce back in 2021 following the pandemic, with an estimated growth in volume of 8%[1]. Contour and its network are supporting this growth by building an end-to-end Trade Service that connects businesses, financiers and partners seamlessly across the financial and physical supply chains. The Lab will enable continued refinement and enhancement of this offering.

Contour is widely recognised for pushing the boundaries of innovation in trade. It was recently named Leader in Trade for Digitalisation at the 2021 GTR Awards and as Best New Trade Finance Technology Solution Provider in Asia and Singapore at the 2021 Global Banking & Finance Awards.

Beyond its fully digitised Letter of Credit (LC) service that is currently in live production, Contour will soon expand into other areas of trade finance to bring greater value to its members. It has formed an in-house development team to experiment with new trade product offerings and is expected to double the team size in the next year.

Carl Wegner, CEO at Contour said: “With the launch of the Future of Finance Lab, we are excited to further ramp up our innovation efforts as we develop the digital infrastructure for the industry, making trade more accessible, simple and efficient for all. Singapore is the perfect environment for innovation, and we look forward to collaborating with our network both locally and globally as we work together to build the future of trade.”

Sopnendu Mohanty, Chief FinTech Officer at the Monetary Authority of Singapore (MAS) said: “Digitalising trade processes through an accelerated adoption of new technology and innovation has been a focus area in MAS’ fintech agenda. As we emerge gradually from the pandemic, we believe that various digital solutions and connectors interoperating seamlessly can make trade borderless, more efficient and hence, accelerate the recovery of global trade. We are delighted that Contour has chosen to anchor its Future of Finance Lab in Singapore and look forward to its further contribution to the digital trade ecosystem in Singapore and beyond.”

Watch Contour’s Josh Kroeker introduce the Future of Finance Lab: https://vimeo.com/569256279

Related News

- 06:00 am

Leading fintech enablement partner, Ukheshe Technologies has confirmed the establishment of a new joint venture with ForexPeople, one of South Africa’s most trusted names in forex with over 20 years’ experience, to seamlessly facilitate cross border payments from South Africa into Africa.

The service will extend from South Africa to more than 40 countries across Africa, including Africa’s largest economies. The joint venture comes at a time when the demand for online money transfers is at its highest due to the Covid-19 pandemic and consumers become more comfortable with digital-first payment solutions.

Over USD$48 billion are remitted throughout Africa annually, a figure which is expected to more than double in the next two years.

Clayton Hayward, CEO, Ukheshe, says that the collaboration is a significant move for the rapidly growing solutions-driven company: “We are very excited to offer increased payment convenience with a seamless cross-border transfer service via boostXB. The service will enable more people to pay and get paid via their mobile devices.” boostXB is already in partnership discussions with various institutions to extend its service offering to millions of Africans who struggle to remit cash due to the complex procedures and prohibitive costs involved.

Richard Beddow, Founder of ForexPeople, says that credible fintech propositions are tipping the market towards streamlined solutions that answer the needs of more people, who until now, have been left outside of traditional financial services: “boostXB is a distinctly African product, answering a real demand for faster, safer and more cost-effective ways of transferring cash from South Africa across the continent.”

boostXB will take a mobile-first approach to digitising remittances to make these services more convenient, particularly for migrant workers. In many markets across the globe, the vast majority of remittances are sent via a physical agent, and is usually subject to high transfer fees.

“This is another great move towards the greater vision of financially including more and more people across the continent,” says Hayward.

Related News

- 08:00 am

Smart Engines, an OCR solutions developer, has announced an expansion of Smart Document Engine SDK by adding payment slips as a new document type for its automatic scanning. The integrated solution will help entities reduce the reliance on manual data entry and make payment procedures in several European countries more efficient. The software instantly detects the payment slip while scanning in a video stream and in photos.

Payment slips, a common payment form in the European Union, contain plenty of information and various fields to transcribe: currency code, amount, document date, account type, IBAN, etc. Developing scanning algorithms for payment slips to help users avoid the nuisance of manual data entering has become increasingly sought after by many of our customers. As stated, a lot of companies worldwide receive payment slips in paper or digital format and input all the data manually. Thus, at a high request, Smart Engines now provides its clients with outstanding technology for European payment slips scanning. With this software, the users are able to make any payment quickly by pointing the camera of their mobile phone to the payment slip, and all the data is digitised automatically. The state-of-the-art technology recognizes all the document fields, as well as the barcode if present from any electronic format.

The new feature of payslips recognition is available in Smart Document Engine SDK 1.4.0. The document scanning is run directly on end-user devices in offline mode without network data transmission to third-party services for manual input, which allows companies to provide their customers with the security of processing personal and sensitive data. Smart Engines software has proved to be very useful for organizations that operate with data and documents handling.

Related News

- 08:00 am

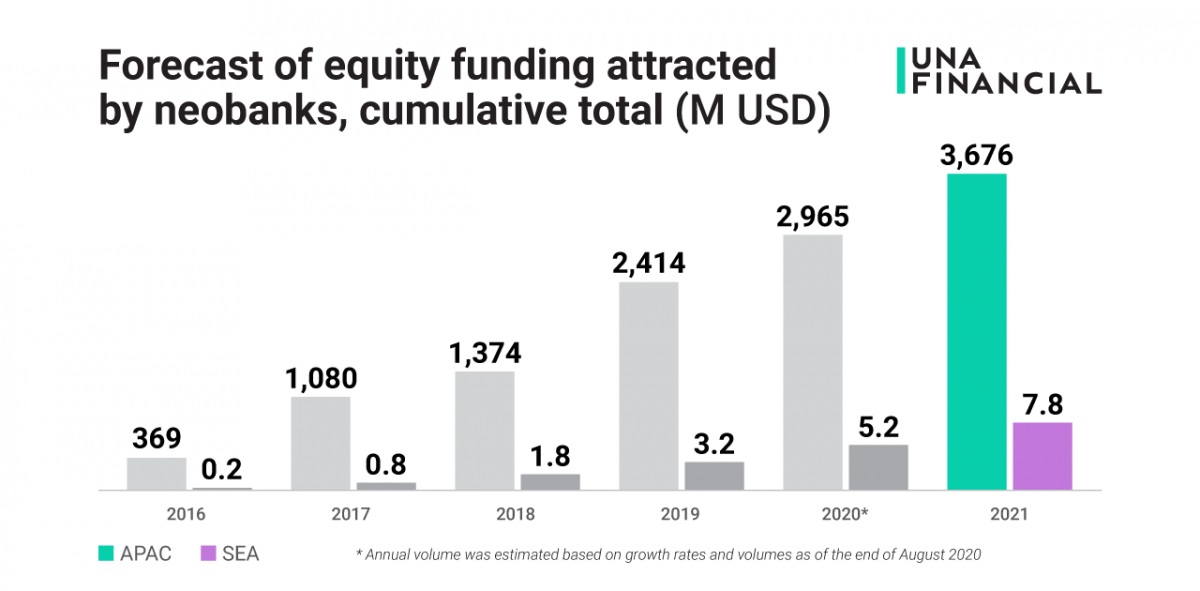

While the pandemic has slowed down the development of neobanks in 2020, it has created strong potential for the segment. Analysts of UnaFinancial revealed that in 2021 the neobanking market will grow by 24% in APAC, and by 50% - in Southeast Asia.

One of the factors contributing to this emerging growth is the delayed entry of new players last year. In January 2020, 21 companies applied for digital banking licenses in Singapore, and 4 companies did so in Malaysia. However, the pandemic disrupted these plans: in Singapore, only 4 licenses were issued, and in Malaysia, the licensing process was completely suspended and moved to 2021. However, by the end of 2020, 5 neobanks had already entered the South- and Southeast Asian markets, with at least 10 companies following them in 2021. This marks the resumption of the neobanks development in the foreseeable future.

The demand for online banking services among the population has also contributed to the growth of neobanking. Despite the general cautiousness, online banking saw a rise in popularity due to lockdown restrictions and remote work. Thus, according to the data from the UnaFinancial survey, in India, 64% of respondents would prefer an online service when taking a loan in 2021, and 46% would choose a bank among other sources of borrowings.

Following a steady upward trend, funding of neobanks in APAC countries in 2020 increased by 22.8% compared to 2019. Based on this, UnaFinancial has been able to estimate the growth of neobanks funding in 2021. Thus, the market is expected to grow by 24% in APAC, and by 50% in Southeast Asia. In SEA, the development of the segment will be led by Indonesia, Singapore, Malaysia and the Philippines, while in South Asia the leading country will be India.

Related News

- 04:00 am

Taulia, the leading fintech provider of working capital solutions, has today announced the appointment of Ali Ansari as Director for Global Supply Chain and Payables Solutions.

Ansari will be responsible for managing and expanding Taulia’s world-class supply chain and payables solutions globally, with immediate effect. In this newly created role, Ansari will be based in London and report to Kathleen Nugent, Global Head of Product.

With over 25 years in the trade and finance industry, Ansari, a qualified Chartered Accountant, has held senior positions with top-tier organisations including J.P. Morgan, ABN AMRO and Bank of America Merrill Lynch. Prior to joining Taulia, Ansari was Global Head of Products in HSBC’s Global Trade and Receivables Finance Development, where he was responsible for managing and developing Guarantees, Financial Institution Trade and Risk Distribution Products.

Ansari said: “Joining Taulia is a wonderful opportunity to fully use my experience, help the team expand and meet the growing demand globally for technology solutions in supply chain finance. I thrive when driving change and solving problems. Taulia provides a powerful platform to customers, which enables them to get access to liquidity as and when they need it.”

Cedric Bru, CEO of Taulia, said: “Ali joins us at an exciting time as we are experiencing rapid growth; having just announced our expansion into both China and Singapore, and our new Inventory Management solution. We are excited to welcome Ali to the team. He brings a wealth of knowledge to the role, and his extensive experience in the industry will be tremendously impactful as we look to further grow Taulia’s payables finance capabilities and drive innovation for our customers.”

Related News

- 02:00 am

Streaming Capabilities Support Customers with No-Code Capabilities, Ease-of-Use, and Interoperability

TIBCO Software Inc., a global leader in enterprise data, empowers its customers to connect, unify, and confidently predict business outcomes, solving the world's most complex data-driven challenges. Today, TIBCO announced it has been named a Leader in The Forrester Wave™: Streaming Analytics, Q2 2021. In the report, top streaming analytics providers are evaluated against each other in a stringent process that includes 22 clearly defined criteria relevant for analytics and AI applied to streaming data.

“For many digital-first applications, what’s in the rear-view mirror can be irrelevant. Streaming analytics help you predict the best move now based on real-time data, and with efficient no-code application development, real-time apps can be built faster than ever before,” said Mark Palmer, senior vice president, engineering, TIBCO. “We are excited to be recognised by Forrester, as the report is a source of real value for companies looking to select a partner for their streaming analytics needs.”

According to Forrester, “TIBCO Software analyses streaming data to both automate and augment analytics. TIBCO Streaming is designed for real-time insights whether they are embedded in applications to automate decisions or surfaced in operational dashboards for business experts. Developers and business intelligence professionals alike can get up and running quickly with rich, no-code visual development tools. Developers can always drop to code when needed or desired. Its integration with TIBCO Spotfire visual analytics also makes it an ideal core technology to power real-time command centers of any flavour as well as busy analysts at their desks.”

TIBCO is a leader in the end-to-end delivery of real-world analytic applications, platforms, and solutions with deep expertise and experience supporting mission-critical applications across a wide range of industries, in the cloud or on-premises. TIBCO technologies enable extremely low-latency, high-throughput data streams, driving complex rules or AI-model-based decisioning, and dynamic learning directly from the data. Such intelligent data streams can be visualised in real time, or drive effective automation, applications, and processes.

TIBCO offers streaming analytics on premises and in the cloud via TIBCO Cloud Data Streams, a zero-install, cloud-based, easy-to-deploy solution. Streaming is also an embedded component of the market-leading TIBCO Data Virtualization, making it easier to tap streaming data and weave it into an enterprise data fabric.

To learn more about TIBCO’s comprehensive solutions driving today’s most successful organisations, please read our blog to download the full report and see how our customers have benefited.

Related News

- 07:00 am

Power Block Coin launches SmartFi decentralized and centralized cryptocurrency services

Power Block Coin LLC announces the launch of SmartFi, a new, regulatory compliant range of decentralized and centralized cryptocurrency services, aimed at individuals, companies and institutions.

The SmartFi launch builds on the success of Power Block Coin, which since 2017 has delivered high touch execution and financing services to institutional and high net worth clients. A pioneer in the emerging crypto-currency industry, Power Block Coin has offered cryptocurrency-backed loans, coin-interest accounts, spot markets and OTC derivatives trading in BTC, ETH, and various other digital assets. Power Block Coin has completed over $1 billion of loans and spot-market transactions.

Power Block Coin was founded as an energy infrastructure company to support the development of cryptocurrency mining operations, by a group of US energy industry veterans. These include former Utah state legislator Aaron Tilton and Tom Retson, who was an executive at GE Nuclear Energy. Other team members are drawn from investment banks, trading institutions and regulatory agencies.

The experience and skills of the SmartFi team have enabled them to utilize proven strategies and techniques from other areas of financial services and capital markets. They have adapted and modified them with proprietary features to provide answers to the challenges faced by cryptominers and cryptocurrency users. SmartFi has now automated a number of those solutions, creating a suite of complementary decentralized and centralized tools. These will provide users with simpler and safer options to create wealth.

SmartFi CEO Aaron Tilton commented: “For a number of years there has been a growing demand by consumers for greater individual choice in wealth generation. The strategies, processes and tools of the current cryptocurrency landscape are sometimes complex, restrictive and risky. SmartFi is providing users with a new range of options, to give them more flexibility, more control and will open up new opportunities to customers worldwide.”

Related News

- 03:00 am

Tribe Payments, a payment technology provider, today announced it has agreed a partnership with ClearBank to provide Tribe’s fintech customers with access to payment schemes using ClearBank’s award-winning agency banking and banking-as-service product sets. The partnership will strengthen Tribe’s Bank Connect solution by allowing its fintech clients to quickly and easily integrate Faster Payments, CHAPS, BACS and Direct Debit payments to improve the functionality of their offerings. The integration will allow end-users to instantly make and receive funds from their account, as well as initiate salary payments via BACs, and set-up Direct Debits.

Tribe Payments’ Bank Connect solution has been integrated with ClearBank’s API first platform. Bank Connect helps fintechs that have a card programme or digital wallets on Tribe’s platform, to add banking services to their payment products. The integration lets Tribe’s fintech clients offer the following capabilities to their customers:

- Faster Payments: Real-time instant payments for transactions up to £250,000, allowing customers to make and receive payments within minutes, and have near-instant access to funds.

- CHAPS: High-value, bank-to-bank, and settlement risk-free payment capabilities with same-day payment guarantee. Although not instant, CHAPS is highly flexible, with no limits on the amount of money that can be sent.

- BACS & Direct Debit: Allows issuers to initiate salary payments via BACS on behalf of its customers. Users will also benefit from ClearBank’s improved Direct Debit functionality, which notifies customers 24 hours in advance of payment being taken, to ensure they have the correct amount of funds ready in their account.

“ClearBank is dedicated to helping fintechs gain simple, secure and compliant access to banking systems and rails. These systems and rails were once the preserve of the few, but our partnership with Tribe means that more service providers can now utilise the payments schemes they need to drive innovation and competition in the market,” said Simon Jones, Chief Customer Officer at ClearBank. “Through technology partnerships like this we are transforming the way financial products are built and delivered for the better.”

“Fintechs need access to banking systems to create more powerful convenience-driven customer propositions,” said Alex Reddish, Chief Commercial Officer at Tribe. “Bank Connect helps to standardise access to these banking systems, cutting out complexity and unnecessary third-parties. Thanks to our collaboration with ClearBank, we can add vital payment functionality through a single API integration, giving firms the ability to provide their customers with choice, plus the chance to expand their reach, and reduce cost.”

Tribe’s clients can use the new capability from ClearBank in conjunction with Tribe’s Digital Banking solution or its core processing platform, ISAAC. Alternatively, it is also available as a stand-alone connection that can be easily integrated via APIs into existing client payment systems.