Published

- 09:00 am

Leading global pay provider CloudPay today announced the public launch of CloudPay NOW. The newest solution in CloudPay's extensive offerings, CloudPay NOW, addresses the financial wellness pressures of today's employee pay experiences. CloudPay NOW enables multinational organizations to offer earned wage access in advance of payday through a global technology solution. As the first earned wage access solution that can be deployed globally, CloudPay NOW has already won a prestigious CODiE™ award and was field-tested across 12 countries by one of the world's leading premium lifestyle brands.

Global industry analyst Josh Bersin highlighted the growing need for more flexible pay options in a recent research report. On-demand pay – also known as earned wage access – enables workers to tap into their own pay balance as early as the day it is earned. In direct contrast to existing credit card debt and payday loans that charge steep fees, this real-time pay system reduces financial stress for employees. With CloudPay NOW, employers can better retain workers, increase engagement and improve employees' financial wellbeing.

"Workers in every country face increasing pressure from financial stress. That's why CloudPay is expanding its offerings to help employers better position themselves to attract global talent in a competitive job market," said Josep Elias, CloudPay's chief strategy officer. "Employee pay is more than just a paycheck — it's about access, control and most importantly, flexibility. CloudPay NOW enables companies to deploy on-demand earned wage access as a global benefit to support employee wellbeing and retention."

Bersin refers to earned wage access as "The ATM for your pay." CloudPay NOW allows employees to access their wages on any device as needed, with complete data privacy. CloudPay NOW is fully integrated with CloudPay's global payroll and treasury solutions, allowing CloudPay to deploy this new earned wage access product across 130+ countries.

For employees, the CloudPay NOW mobile app includes real-time multi-language support and resources to empower them to take control of their finances, reduce financial stress and make informed decisions about their pay.

"As a leader in global pay, it was important that we take the time necessary to deliver an earned wage access solution with the same robust qualities our clients expect," said Paul Bartlett, CloudPay's chief executive officer. "The expectations of workers have changed significantly in the last year, making CloudPay NOW a benefit that every global employer needs to offer."

Related News

- 07:00 am

- FICO Platform operationalizes predictive models and scores to deliver fairest customer experience and help borrowers manage debt repayments

- Between 20,000 and 40,000 decisions rules implemented per country, starting with Germany and UK

- Hoist makes 1 million customer decisions a day using FICO® Platform

- Phase two will deliver a further €8.5m (£7.4m) in annual staff savings as lending book grows 40 percent

Hoist Finance, the consumer debt purchaser working with banks and financial institutions across Europe, has accelerated its digital transformation using the FICO® Platform. By rolling out a centralized approach to managing decisions on customers, Hoist has improved the customer experience, streamlined operations and sped up the process of change. Hoist Finance is now making 1 million real-time decisions each day in the UK and Germany using FICO technology — including FICO® Blaze Advisor® decision rules management system, part of the FICO Platform — to establish the best actions for borrowers.

For its achievements, Hoist and FICO have won the Best Use of Technology category in the Credit Excellence Awards 2021.

Centralizing Decisions on a Single Platform

Hoist Finance manages 18 million accounts across 10 countries, and before working with FICO customer decisions were managed using 14 different systems. Hoist sought to unify decisioning technology across all regions, deploy new strategies faster, and improve results through testing and simulation. It also wanted to make better decisions by calling on multiple external data sources and using advanced predictive models and AI.

“We have hit all of our key targets with FICO Blaze Advisor,” said Fabian Zwanzig, head of operations for Germany, Hoist Finance. “This solution has delivered game-changing results for the business, with a clear path now plotted for extensive, future benefits. We have exceeded the targets in our business case by 400 percent.”

Hoist Finance is currently live with the FICO® Platform’s rules management system in Germany and the UK, with five more countries due to go online in the next few months. Each country involves some 20,000-40,000 rules that are automated in the FICO Platform. The solution automates customer engagement and negotiation processes, enabling Hoist to resolve 20 percent of cases automatically at the group level, and 33 percent of cases in the UK. The platform operationalizes predictive models and scores and provides multiple, simultaneous challenger strategies.

Results include:

- 30% increase in data-driven, digital payment plans

- 87% decrease in plan breakage rate

- 97% lower carbon footprint for each digital resolution, resulting in annual savings of 442 tons of carbon for every 10% increase in digital collections – the amount of carbon that 35.3 people in the UK generate in a year

Further Collections Success

In addition, Hoist Finance used FICO’s collections technology to standardize its approach across countries, with seven countries using it so far.

“It is central to our business proposition that we deliver the best possible customer experience for our bank clients’ customers,” added Zwanzig. “We also wanted to improve profitability by standardizing our collections approach across the company. It was, therefore, essential to find a scalable system that works 24/7, 365 days a year. FICO’s technology put us in position to streamline operations and standardize our approach, whilst maintaining best-in-class standards for the borrower experience. We expect to deliver a further €8.5 million in operational efficiencies as our debtor book grows 40 percent in phase two.”

“FICO’s Decision Requirement Analysis Workshop (DRAW) process was key to structuring Hoist’s decision requirements to help achieve its goals,” added Steve Hadaway, vice president and general manager for FICO in EMEA. “Through this process, we turned their needs into a comprehensive set of structured decisions. And by standardizing on a single platform, Hoist has rolled out the technology to new countries in just three months. Their multi-country, platform approach is the future of collections.”

The FICO® Platform unleashes the power of analytics and AI to enable smarter business decisions at scale. Enterprises using the FICO Platform are more ready to offer superior customer experiences because they can get to know their customers deeply and offer services and value that delights the individuals. FICO was named a leader by Forrester Research in The Forrester Wave™: Digital Decisioning Platforms, Q4 2020.

Related News

- 02:00 am

The Bank of England’s latest Financial Stability Report, released this week, points to the particular vulnerability of the SME sector as the economy emerges from COVID-19 restrictions.

The twice-yearly reports, compiled by the Bank’s Financial Policy Committee, sounded a warning about increased corporate indebtedness, in particular amongst smaller firms with weaker balance sheets.

SUMMARY

- Insolvencies will increase as government support unwinds

- The reinstatement of Winding-up Petitions in September will be significant

- The end of VAT and Rent Deferrals could be a catalyst for business distress

“As the economy recovers and government support unwinds as planned, some businesses may face additional pressure on their cash flow and insolvencies could increase.

For example, businesses may face substantial repayments as VAT and rent deferrals begin to lapse, costs could increase as broader government support such as the CJRS unwinds, and businesses that have borrowed under government support schemes will need to start making repayments on them. Additionally, the end of the temporary ban on winding up petitions in September 2021 is likely to lead to an increase in insolvencies over the next twelve months.”

Bank of England Financial Stability Report, July 2021

UK Business Sectors in Distress

Sectors ‘that are more affected by economic activity being curtailed’ find themselves in particular jeopardy, the report notes.

Bank staff analysis demonstrates that as of January 2021, 11.8% of SMEs in these sectors are already in arrears on their outstanding loans or have formally defaulted

https://www.companydebt.com/articles/bank-of-england-warns-of-sme-debt-vulnerablity/

Related News

- 04:00 am

Exactpro, a leading independent provider of software testing services for mission-critical financial technology, will launch its subsidiaries in Lithuania and Sri Lanka in 2021.

Commenting on the decision, Alexey Zverev, co-CEO and co-founder of Exactpro, says: "It has been a great honour for Exactpro to serve its clients worldwide for more than a decade. The past and future growth of our software testing delivery centres in Europe and Asia is an example of our commitment to being responsive to our clients' needs, including the need to have the presence of their trusted software testing partner in optimal geopolitical locations."

According to Doing Business 2020, a World Bank Group flagship publication, Lithuania ranks 11th out of 190 countries evaluated for ease of doing business. It also came 15th out of 178 countries ranked by The Heritage Foundation in its 2021 Index of Economic Freedom. The country boasts a young and talented labour pool, a business-friendly environment, a great quality-to-cost ratio, a world-class infrastructure, and a perfect living pace. Lithuania's focus on tech education helps it to further build its reputation as a highly attractive location for global tech businesses.

Sri Lanka with its attractive and pro-business environment is a pivotal global centre for doing business. Its sophisticated and transparent regulatory and legal framework offers safety of foreign investments. Several open-market free economic and trade policies as well as bilateral investment protection agreements with many countries makes Sri Lanka's economy one of the most liberalized in South Asia. According to a recent “Sri Lanka IT-BPM Industry: State Of The Industry 2019/20” report by PwC and Sri Lanka Association for Software Services Companies (SLASSCOM), the IT-BPM industry has been a key contributor within the Sri Lanka’s service export segment and “accounts for over 90% local value addition, delivering world-class IT products and knowledge services.” As Island of Ingenuity, a general audience website owned by the Sri Lankan Export Development Board, puts it: “From electric supercars to powering one of the most active stock exchanges in the world, Sri Lankan businesses are at the forefront of technological innovation.”

"Our research and prior experience of Exactpro staff working in Sri Lanka during business assignments show that the country is one of the best places in South Asia to conduct business. The country has many highly qualified professionals with extensive experience in many fields, including ICT, a fast-developing infrastructure, and a great quality of life. This makes Sri Lanka a natural choice for us to expand our operations into the region and be closer to a few of our key clients", says Iosif Itkin, co-CEO and co-founder of Exactpro.

Currently employing over 650 specialists, Exactpro is proud to have been able to attract and retain a team of experienced and talented specialists and looks forward to continuing the delivery of its services to clients out of both the existing and new locations.

Related News

- 04:00 am

- The Visa Ready Program enables partners to build and launch payment solutions that meet Visa’s global network standards.

- The partnership will enable Modulr to accelerate its growth through access to Visa’s global network and expertise.

- By collaborating further with Visa, Modulr provides payment services to small businesses in the UK and EU.

Modulr, a Payments-as-a-Service API platform for digital businesses, today announced that it has secured Visa Ready certification, which supports clients in choosing best of breed payment solutions that meet Visa’s global standards. Securing this status validates Modulr’s position as a leading provider of Visa products.

Through this extended collaboration with Visa, the world leader in digital payments, Modulr is helping businesses automate payment flows, embed payments within their proposition and launch entirely new features and services.

As lockdown restrictions ease, it is vital that SMEs recover quickly and take every advantage offered by the digital economy. Research from Modulr highlighted the pressure SMEs face in curbing the rising cost of payment services on the one hand and meeting rising customer expectation of payment experiences on the other.

Achieving Visa Ready status certifies the Modulr infrastructure and gives customers peace of mind they’re using the highest technological standard of Visa payment solutions.

Jill Docherty, Head of Business Development, UK&I at Visa comments: “We’re delighted to be part of Modulr’s continued growth and proud they have achieved Visa Ready certification. Small businesses continue to be some of the hardest hit by the pandemic and together with Modulr, we’re committed to supporting them as they build for recovery. Through this extended partnership more businesses will be able to access the crucial tools and resources they need to benefit from the digital economy.”

Myles Stephenson, Chief Executive at Modulr comments: “Securing Visa Ready certification is a critical step in achieving our goal of striving for greater innovation and payment improvements across the industry for every size of business. Working with Visa, our mission is to further expand our platform in the coming months so every UK and EU business can easily and efficiently benefit from the power of embedded payments.”

Read more about Modulr’s services here, or achieving Visa Ready Certification here.

Related News

- 04:00 am

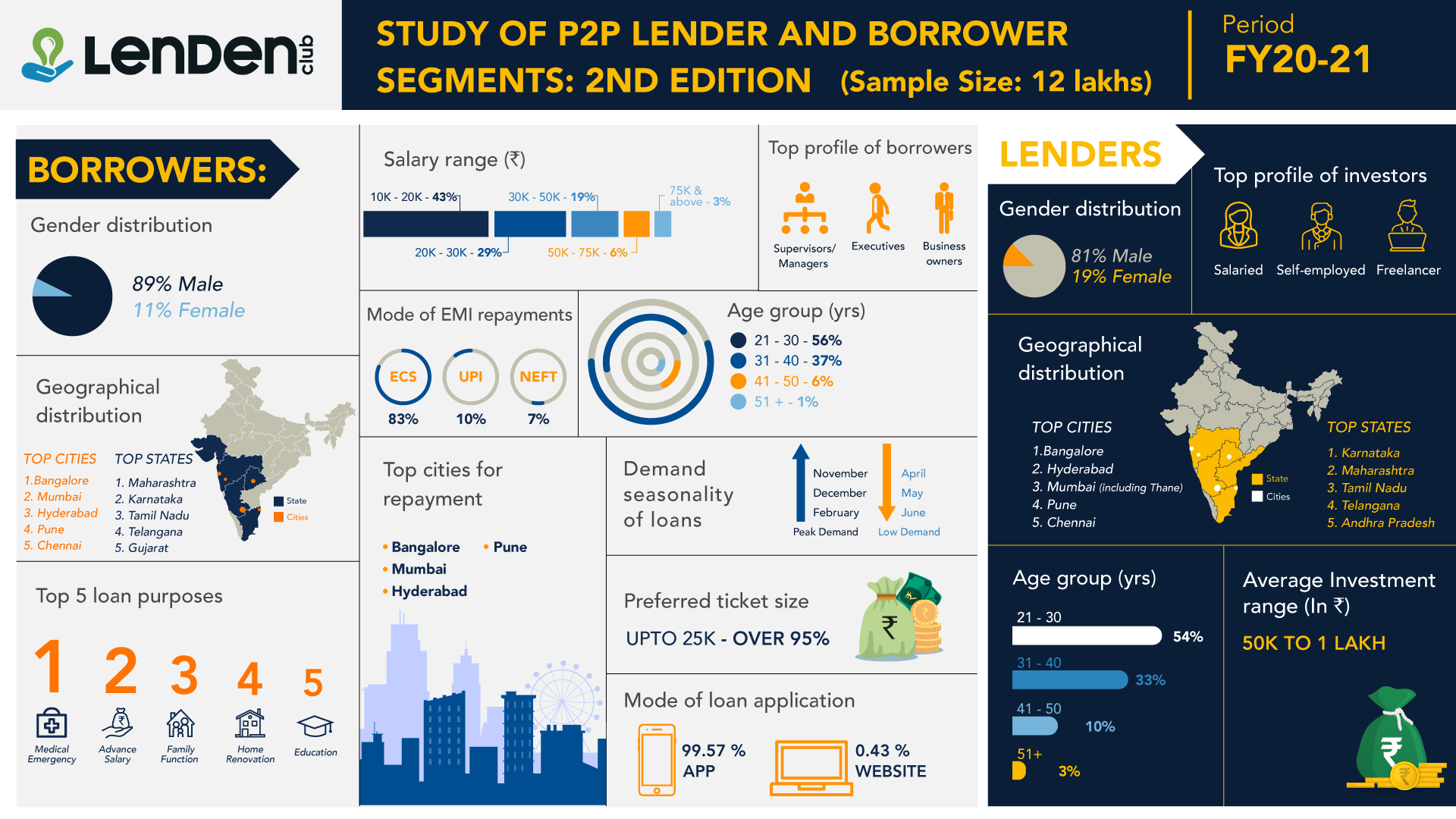

LenDenClub releases its 2020-21 study of P2P lender & borrower behaviour

- Bengaluru, Mumbai and Hyderabad - top cities in terms of both borrowing and lending

- Medical emergencies during the pandemic was the top reason for borrowing followed by advance salary and family functions

- Up to 25,000 is the most preferred ticket size among borrowers

- 50k to 1lakh is the most preferred investment range among investors

- Salaried professionals -- CXOs to mid-managerial level topped the chart as investors

- November, December and February witnessed peak in demand for loans

Millennials dominate as the most influential cohort as both borrowers and lenders on peer-to-peer (P2P) lending platforms, says study. LenDenClub, the country’s largest P2P lending platform, today released its 2020-21 report on the key borrowing and lending behaviour of its consumers (borrowers and lenders).

According to the report by LenDenClub, young and tech-savvy Indians are much ahead of the previous generations when it comes to borrowing or even availing the platform for a new asset class as an investor. According to the report released by LenDenClub, millennials belonging to the age group of 21-30 years were the most active as both borrowers (56%) and lenders (54%) on its platform. This was followed by the cohort belonging to the age group of 31-40 years accounting for 37% in case of borrowers and 33% in case of lenders.

India’s silicon city, Bengaluru, topped the chart in terms of people having the highest credit demand. Interestingly, the highest number of lenders too hailed from the tech city of Bengaluru. Other major lending and borrowing markets were Mumbai, Hyderabad, Pune and Chennai, showing a clear dominance of west and south.

It further stated that medical emergencies accounted for 35% of digital loans that were availed during the year. As two consecutive waves of the Covid-19 pandemic took a toll on the Indian healthcare system, there was a huge spurt in medical emergencies reported through the year. LenDenClub witnessed huge demand for credit for medical emergencies on its platform which also accounted as the top reason for borrowing. It was followed by ‘advance salary’ accounting for 33% and ‘family functions’ accounting for 10%.

Salaried professionals ranging from CXOs to mid-managerial level, topped the chart as investors on the platform. The report further stated INR 1.81 lakhs was the average investment amount on the platform while INR 50,000 to 1 lakh was the most preferred amount among lenders, accounting to approximately 50% of the pie in terms of value. Owing to the festival season, November (2020) and December (2020) and February (2021) were the top three months when demand for credit was the highest. Whereas, during Apr-Jun 2020, the demand for credit was the least.

In terms of loan repayment -- ECS payment was the most preferred mode accounting for 83 % followed by UPI (10%) and NEFT (7%). In addition, the data also revealed that males continued to dominate the platform with more than 80% participation.

Bhavin Patel, Co-founder & CEO, LenDenClub said “Covid-19 has accelerated digital penetration and uptake across every industry, and the lending sector too, has seen transformation beyond imagination. During the global health crisis, medical emergencies continued to be the top reason for borrowing, and we are honoured to help those who lack credit or lie outside the financial inclusion fold, meet their needs. Interestingly, millennials also actively participated as investors availing P2P lending as an aspirational asset class offering lucrative returns. Thanks to e-commerce and penetration of new-age technology which has built an all-new tech empowered segment of Indians across tier-II and tier-III cities from where we witnessed fresh bouts of demand.”

LenDenClub, the P2P platform that offers loans ranging from Rs. 5,000 to 10 lakhs, has analysed annual data of over 4 lakhs users, to study the key trends in industry. P2P is a fast growing and upcoming industry for alternative investment avenues. P2P NBFC is an RBI recognized lending platform which started picking up in India in the last few years. The report has multiple data points and key insights showing the typical demographic and professional profiling of the consumers.

LenDenClub is the largest peer-to-peer platform in India, having disbursed more than ₹500 crores worth of loans. With a 100% funding record for its borrowers, LenDenClub currently enjoys a user base of one and a half million from all over India and disburses an average of 2.5 lakh loans annually. LenDenClub, with usage of technology, disburses 82% loans within 5 hours to its borrowers.

Related News

- 02:00 am

New Analytics Plus brings advanced cash flow and business forecasting directly into Xero

Xero, the global small business platform, today announced Analytics Plus, part of a new suite of planning and forecasting tools, powered by artificial intelligence and designed to help businesses and advisors plan for the future with confidence.

Available from today, Xero Analytics Plus combines cash flow forecasting featuring advanced predictions and insightful business reporting tools, directly available in Xero. The tools are the culmination of rigorous testing and development with the broader Xero community during a challenging period for small businesses, and build on the company’s commitment to be the most insightful and trusted platform for small businesses.

Xero has also officially released Analytics, a free tool for all Xero Business Edition subscribers that combines the existing short-term cash flow tool, which visually projects cash flow over 30 days, and business snapshot tool, providing up to date insights on their business performance. Since their initial release in pilot last year, the cash flow tool has been redesigned with an all-new look and the ability to view future scheduled invoices and bills, while the business snapshot report can now be viewed on a cash or accrual basis.

“To truly grow and thrive, every business needs to have access to trusted, insightful data that helps them understand where they are now, make decisions for today and where they might be headed in the future,” said Xero Chief Product Officer, Anna Curzon.

“Over the past two years, we’ve worked closely with small businesses and advisors all around the world to build simple, beautiful and powerful tools and reports that give them access to that data, all on the Xero platform. As our business scale has grown, we now are able to provide powerful AI-powered products that use rich, trusted data, to help small businesses not only understand their current position, but make decisions with confidence based on their future potential.”

AI-powered forecasts with Xero Analytics Plus

Analytics Plus supercharges forecasts and reporting to give growing small businesses greater flexibility and foresight over their business.

Using pattern-matching and predictive algorithms, short-term cash flow in Analytics Plus can detect and predict regular cash expenses and income over the next week, month or quarter. Businesses can see their future potential cash flow, the impact of upcoming expenses and discover opportunities to bring cash into the business by invoicing customers sooner, changing payment times or requesting a deposit. Owners can also plan for multiple scenarios by manually adding transactions to see how they might affect their cash position into the future.

A more powerful business snapshot tool gives small businesses a quick, easy-to-understand summary of their business performance to help them have meaningful discussions about their plans with their advisor. In Analytics Plus, businesses can see their performance over multiple years, drill into the details to analyse trends and identify areas for improvement.

All customers can try Xero Analytics Plus for free up until 31 January 2022. Once the free period ends, the standard pricing will apply. More information on pricing can be found here.

Last year, at the height of the pandemic, Xero rolled out pilot versions of its short-term cash flow and business snapshot tools to customers for free to help them plan in uncertain times.

Xero Analytics and Xero Analytics Plus inclusions

Related News

- 01:00 am

BidFX and XTX Markets are pleased to announce the full roll-out of XTX Markets Execution Algo on BidFX Algo Hub. It is an implementation shortfall execution algorithm that BidFX clients can now access as algorithmic trading in FX continues to increase.

BidFX Chief Revenue Officer, John McGrath commented: “XTX Markets is one of the largest market makers in the world and their expertise in market microstructure and the reduction of signalling and information leakage aligns with our client’s sophisticated requirements in regulatory, functional and execution strategies. XTX Execution Algo went live on BidFX during 2020 in an initial targeted client roll-out and has the ability to reduce slippage to arrival price. We are happy to see increasing usage of this algo across our global client base in 2021 as well as making it available for clients to add to their Algo Wheel.”

Matt Clarke, Head of Distribution and Liquidity Management for EMEA at XTX Markets, commented: ‘We are pleased to expand our relationship with BidFX through their hosting of our execution algo and are delighted at the strong uptake from clients already. We look forward to continuing to give BidFX’s clients access to our low impact, market leading liquidity and further strengthening their algo platform as a result.’

Related News

- 03:00 am

Proptech company also signs deal with Rightmove

RO Capital Partners, the RO Group’s investment arm, is pleased to have co-led a £1.1m funding round together with the Cass Enterprise Fund in Bamboo Auctions (or “Bamboo”), a leading provider of online auction technology to estate agents and auction houses. The round was supported by follow on capital from existing investors and new angel investors.

Launched in 2015, Bamboo Auctions’ technology allows properties to be sold with immediate and legally binding contracts. Its marketplace makes transactions faster, more certain, and more transparent. The business has continued to grow quickly since inception with over 1,000 properties, representing a total value of over £200m, having been sold using Bamboo’s platform in the last 12 months. Customers of Bamboo include Clive Emson, Stags, Bradleys, Hunters and Webbers.

Bamboo will use the growth capital to invest further in its technology to ensure it remains the best in the market, as well as introducing new features and partnership integrations. It will also be deployed in intelligent advertising and marketing to drive further sales growth; as well as maintaining the company’s high level of customer service.

Robin Rathore, Founder and Director, Bamboo Auctions explains more:

“The average property transaction takes around 20 weeks, but using our technology, agents can reduce this time to just five weeks. Around 35% of transactions will fall through before reaching completion, but using Bamboo agents can increase transaction certainty to around 99%. The speed and certainty that our technology brings to the transaction has given our agent customers an invaluable advantage in the market, not just because it has allowed them the space and time to sell properties during periods of lockdown, but also because it has helped to increase the number of instructions, increase the number of sales, and increase average fees overall.

“Auctions are evolving, and Bamboo is at the centre of this movement. We are continuously innovating, and by listening to our agent customers, we are focusing on making our core service the best in the market. Ultimately, we are here to help our agent customers sell more properties. That drives everything that we do at Bamboo.”

Commenting on its partnership with Rightmove, he added:

“We are delighted to have entered into an arrangement with Rightmove, which means that properties listed by agents through Bamboo’s platform will automatically be tagged as an auction property and will have up to date timer and bid status. Agents will also benefit from additional calls to action and clearer, more standardised information on each property listing page. This is a great example of the partnerships we are developing as we roll out our technology and brand in the coming months.”

Edward Rowlandson, Group Managing Director, the RO commented:

“We launched RO Capital Partners in April 2021 to invest in active, early stage tech businesses and proptech was a key market for us given our wider real estate experience.

“We are hugely excited by Bamboo, its offering, and its use of technology to innovate the real estate market. Robin and his team have demonstrated that, even though it is still in its early stages, Bamboo has a winning business strategy and great growth potential and we are delighted to lead this round alongside Cass and existing investors. “

Steve White, Group Commercial Director, the RO added:

“The online auction market has seen significant growth during the past year, and we are excited to be investing at such a pivotal stage in Bamboo’s journey as they experience tremendous growth and fast uptake by estate agents and auction houses who are becoming increasingly aware of the benefits of the Bamboo offering.”

Helen Reynolds, MD and Investment Director of the Cass Entrepreneurship Fund commented:

“We have been impressed with the skills and expertise of the Bamboo CEO and his team and the strong relationships built thus far with customers and partners. We look forward to working with Robin through the next stage of Bamboo’s growth and supporting the company’s success.”

Related News

- 09:00 am

Railsbank, the leading global Embedded Finance platform, has raised USD$70 million in its latest funding round.

The latest fundraise was led by Anthos Capital and attracted a range of investors including Central Capital (VC arm of Indonesia’s largest privately held bank), Cohen and Company (the founder of Bancorp), and Chris Adelsbach’s new fund Outrun Ventures. Existing investors also participated.

Railsbank will use the funds to further expand its various Embedded Finance products (Banking as a Service, Cards as a Service, and Credit as a Service) across Europe, Asia Pacific and North America, to help its customers remodel and democratise access to the financial services industry. The Railsbank platform is used by customers such as fintechs, telcos, supermarkets and consumer brands to innovate fast and radically improve the way millions of consumers and SMEs access, use and manage their money.

Railsbank is unique in the Embedded Finance market, offering the only truly global platform; by having rails directly connected into the financial system thus bypassing the industry legacy infrastructure; and being both a regulated financial institution and principle card issuing member of Visa and Mastercard. It maintains that many of the Embedded Finance and BaaS providers in the market today are just software layers sitting on top of legacy financial institutions. This means that although customers benefit from improved APIs, they still have to endure the underlying industry legacy infrastructure, operations, risk policies and ways of working.

“Think of Railsbank as being the financial services layer of the Internet,” said Nigel Verdon, CEO and co-founder of Railsbank. “We are transforming the finance industry in the same way that Apple did to the music industry when they created iTunes. Too much of the current global financial services system is made up of aging legacy technology and operational processes, making it unnecessarily complicated, highly expensive and nearly impossible for innovators to create the ‘Spotify’ of financial services.

“We are changing that at Railsbank by combining our ‘zero legacy’ platform with deconstructing financial services into individual digital components. Because we have created these individual financial components, our customers can easily embed financial products directly into their own customer experiences at exactly the point where consumers and SMEs need financial services, not at the point when traditional providers forced them to. This will finally make financial services customer centric and inclusive, rather than the situation today which is institution centric and exclusive.”

Betsy Cohen, Chairman of Fintech Masala and founder of Bancorp, added: “The market has evolved so rapidly since we founded the world’s first BaaS business, the Bancorp. As we move into the $7 trillion embedded finance market, it has been great watching Railsbank's growth story. With this investment, it's a privilege to continue to be part of the journey with a global leader like Railsbank.”

Chris Adelsbach, Managing Partner of Outrun Ventures, commented: "Outrun Ventures are thrilled to support Railsbank in their recent financing. I've had the benefit of being on the front-line of Railsbank as an early investor and Advisory Board member and have been incredibly impressed by their growth. More importantly, as an early stage fintech investor, I've witnessed a remarkable change in the volume of companies that are building next generation businesses using Railsbank. I speak to dozens of founders every week and I've rarely gone through a week where a company doesn't tell me that they are working with Railsbank. When I asked them 'why', their collective responses gave me the conviction to make a later stage investment. Embedded finance makes financial services far more accessible for customers and Railsbank has a solution that is in a league of its own.”