Published

- 09:00 am

Partnering with Coins.ph and SBI VC Trade, SBI Remit Will Deliver A Superior Customer Experience With Faster and Cheaper Remittances Starting in the Philippines

Ripple, the leading provider of enterprise blockchain and cryptocurrency solutions for global payments, announced today the launch of RippleNet’s first live On-Demand Liquidity (ODL) service implementation in Japan, in collaboration with SBI Remit Co., Ltd, the largest money transfer provider in Japan and one of the leading mobile wallet services in the Philippines, Coins.ph.

This expanded partnership will see SBI Remit connect with Coins.ph and digital asset exchange platform SBI VC Trade on RippleNet for faster and more affordable cross-border payments from Japan to the Philippines. With ODL now available in Japan, RippleNet customers can leverage the digital asset XRP to eliminate pre-funding and reduce operational costs, unlocking capital and fuel the expansion of their payments businesses.

“The expansion of our relationship with SBI Remit to kickstart RippleNet’s ODL service in Japan marks a major milestone in one of our largest markets. SBI Remit has been a leader when it comes to embracing new technology to deliver the best customer experience,” said Asheesh Birla, General Manager of RippleNet at Ripple. “We are excited to partner with forward looking companies like SBI that see the value in blockchain technology and to support them in preparing for a crypto-enabled future.”

Driven by long-term growth trends of foreign workers and cross-border e-commerce in Japan, there is an expected increase in low-value, high-frequency remittances. The Filipino diaspora is currently the third largest in Japan - in 2020, remittance flows from Japan to Philippines sent by overseas Flipino workers totaled approximately 1.8 billion U.S. dollars. On top of that, Japan has one of the highest cross-border payment fees in the world. According to The World Bank, remitting from Japan incurs an average cost of 10.5%, while the average cost of sending remittances from G8 countries is 5.92%.

“We see tremendous potential in leveraging blockchain technology to transform not only the way payment transactions are made but in how we manage our business by unlocking trapped capital,” said Nobuo Ando, Representative Director of SBI Remit. “The launch of ODL in Japan is just the start, and we look forward to continuing to push into the next frontier of financial innovation, beyond real-time payments in just the Philippines, but to other parts of the region as well.”

The APAC region is exploding with growth and opportunities for RippleNet in response to progressive crypto regulation and innovative companies, such as SBI Remit, looking to lead in the crypto space. Asia Pacific is one of the fastest growing regions for Ripple with transactions growing 130% year-over-year. In this next phase of the partnership, SBI Remit will connect with other established partners on RippleNet and utilize XRP to accelerate their high performance payments business.

“Fintech innovation is the key to achieving quicker and more secure financial transactions,” said Nauman Mustafa, CEO of Coins.ph. “With the support of SBI Remit and Ripple, we look forward to enabling greater customer experiences by bringing faster and cheaper cross-border payments between Japan and the Philippines, taking a step closer towards revolutionising the financial system.”

As more enterprises look towards integrating crypto-enabled services into their offerings, SBI Remit will join existing ODL customers in APAC, such as Novatti and Tranglo, in playing a vital role on RippleNet as fiat on and off-ramps. SBI Holdings is an investor and shareholder of Ripple.

Related News

- 04:00 am

Amidst great uncertainty regarding the situation of global markets and their prospects, leading online trading brand InvestingCrypto has announced new benefits and tools open to all its account holders. These surpluses are divided amongst all types of accounts, in a manner which grants advantages to every registered user. All of these changes are effective immediately, making all new features accessible as of today.

"In this turbulent trading reality, we can't afford to offer our clients yesterday's trading conditions," commented Donald Reilly, spokesperson for InvestingCrypto. "That's why we've come up with these new and improved accounts, and I can promise our users that we're not going to stop there. We will keep upgrading and bettering our offer, in order to stay ahead of the game."

Giving traders an edge over the rest

According to the company, the new accounts are a result of months of planning, including thorough global market analysis, in order to figure out what it is that can take trading to the next level under the current conditions. Among the new features is an annual summary with a certified tax specialist, granted to Gold account holders, personal chief portfolio managers, granted to VIP account holders, monthly sessions with certified accountants, granted to Standard account holders, and more.

"For us, it's not just about giving our customers everything that the market has to offer," added Reilly, "it's also about providing them with that extra touch they can't get anywhere else. Whether it's our outstanding support service, our enriching educational tools, or our cutting-edge trading platform, we always want to be one step ahead of the rest. That's the way it has been ever since our foundation, and we see no reason to change this strategy."

Related News

- 05:00 am

Workiva Marketplace debuts with both Workiva-built and partner offerings that simplify complex reporting and compliance problems

Workiva Inc, today launched The Workiva Marketplace, filled with more than 140 Workiva-built and partner templates, services and 60 no-code connectors that streamline existing processes and solve new business problems all within the Workiva cloud platform’s connected and secure ecosystem.

The Workiva Marketplace’s offerings include: process checklists, carefully organised and linked reports, style guides, perfectly formatted presentations, and more. Accounting, audit, financial planning & analysis, financial services, and legal teams can easily add templates or connectors directly into an existing Workiva workspace and optimise workflow with process automation, practical examples, and industry best practices.

Comments on the News:

· “There is an enormous opportunity for organizations to scale their business operations efficiently and cost effectively by leveraging Workiva’s connected ecosystem,” said Julie Iskow, COO of Workiva. “The Workiva Marketplace allows users to find tools, templates, connectors and applications that make using our platform faster and easier. It also easily connects customers with our trusted, best-in-industry consulting and technology partners and can extend the value of our platform for our users."

· “For years, corporate accounting and financial reporting teams have operated separately due simply to the nature of data collection and reporting processes, and this can lead to a myriad of complications at the end of the reporting period,” said Mike Whitmire, CEO & Co-founder of FloQast. “Using FloQast’s direct API connector available in The Workiva Marketplace, accounting and finance teams automate and accelerate the financial close and disclosure process, bridging the gap between them, which adds value by providing greater visibility into the close and reconciliation process, and enabling a more accurate and efficient reporting process.”

· “As a partner, Clearview Group is thrilled to join Workiva for the launch of the new Marketplace,” said Scott Freinberg, Director of Advisory Services at Clearview. “Clients and partners will now be able to more efficiently access industry-leading templates and tools to transform their processes and technology. Workiva consistently works to enhance their products and services for their customers, and we could not be more honored to partner with them on this initiative.”

· “I am really impressed with the variety of templates and connectors available in the new Marketplace, especially with SOX, Internal Controls, and Management reporting,” said Trevor Harris, SOX Manager of NXP Semiconductors. “I like that the Marketplace is easy to navigate and that my team can easily incorporate these industry best practices immediately. The time savings alone from not having to start at square one is going to be priceless. This will really let me do more with my data inside the Workiva platform.”

Workiva Marketplace Innovators:

Partners are extending the use of the platform with mutual clients by creating new services and solutions on top of the Workiva platform that solve customers’ unique business challenges.

Argyle, BlackLine, Business Wire, CFO Solutions, Clearview Group, Column5 Consulting, Fastpath Solutions, F.H. Black & Company Inc., FloQast, Keyrus Consulting, OneCloud, Planalytix, PwC, Sentieo, and Trintech are among the Workiva partners that played a crucial role in the launch of the Marketplace by contributing meaningful templates, services and content that is readily available for customers to add to their workspaces and use.

Workiva has a strong partner ecosystem, with over 200 industry-leading business and technology advisory firms that are available to assist customers as they expand their use of the Workiva Platform.

Additional Resources:

· Learn more about the Workiva Marketplace and adding value across organisations with the Workiva platform.

· Browse available Workiva Marketplace Templates.

· Browse available Workiva Marketplace Data Integration Connectors.

· View the full list of Workiva Marketplace Partners.

Related News

- 04:00 am

Recognition by FX Markets marks Avelacom’s third industry award in 2021

Avelacom, the low latency connectivity, IT infrastructure, and data solutions provider for global financial markets, has won the FX Markets Award for best connectivity, hosting and co-location services for electronic FX trading.

This latest award recognizes Avelacom’s excellence as a global leader in network services and IT hardware solutions tailored for the financial industry and specifically FX trading firms, one of the largest groups in capital markets.

Avelacom is highly regarded for its continuous commitment to, and investment in the FX industry. Banks and trading firms continue to focus heavily on IT infrastructure efficiency as a key success factor, yet the growth and volatility of the FX markets over the past year led to greater challenges for these firms to compete. As a result, there is a high demand to deploy best-in-class technologies like Avelacom’s ready to-go low latency connectivity, IT infrastructure and data solutions.

Over the past 12 months Avelacom has been expanding its network and IT infrastructure, with 50% of its revenues reinvested in its hardware, capacity building and latency optimisation. As clients have demanded access to trade more EMFX, Avelacom has increased its points-of-presence (PoPs) and enhanced its fiber backbone across Asia, Latin America, India, Eastern Europe, Middle East and Africa, making these new markets easier and more efficient to access.

London <> Tokyo and London <> Singapore ultra-low latency fiber routes are recognized as leaders in Avelacom’s product portfolio, due to significant market demand, driven by increased trading volumes and the rise of new FX matching and pricing engines in Singapore. Unrivaled network performance metrics on these particular routes strongly differentiates Avelacom in the FX space.

With increased global acceptance of cryptocurrency as an asset class Avelacom has adapted its solutions to enable institutions to easily enter digital assets trading. Avelacom’s infrastructure provides low latency access to all major crypto exchanges globally, which is in high demand among institutions with an FX trading background.

Aleksey Larichev, CEO of Avelacom, said: “We are very pleased to receive this latest award. FX is a key asset class for us since we launched our London to Tokyo ultra-low latency route, which helps drive new arbitrage opportunities for institutions. The FX industry is fast growing and dynamic which encourages us to keep improving latency, increase capacity across our network and launch new points of presence to allow access to even more FX markets. This ongoing commitment demonstrates Avelacom’s ambition to remain the leading connectivity, hosting and co-location service in the FX and crypto markets globally.”

Related News

- 05:00 am

UK reports £5.7m in cyber crime financial loss so far this year – with one third coming from businesses

From the start of 2021, the UK has reported a total of 14,883 instances of cyber crime, with the total losses of £5.7m

Despite 90% of offences being made against the public, UK businesses have reported £1.9M of losses - a third of the total figure

Offences involving hacking, social media and email account for 6.3k of reported incidents

Primary targets for cyber crime appear to be tech-savvy individuals under 40

British people and businesses have suffered financial losses of £5.7m from a reported 14,883 cyber crime incidents since the start of the year.

The new study from click fraud prevention experts PPC Shield indicates that malicious hacking, fraudulent use of social media accounts and email scams are the most common form of cyber crime so far this year – accounting for 43% of all reported incidents since 1st January. Also in the high-ranking categories are reports of malware/viruses, personal hacking and extortion.

Data compiled from the National Fraud Intelligence Bureau indicates that those under 40 reported the most incidents this year, at a total of 5,000. This suggests that scammers and hackers are predominantly targeting younger, more tech-savvy generations; Those used to juggling multiple social media accounts, email addresses and banking apps.

Though cyber crime against corporate bodies only accounts for 10% of the UK’s reported offenses, their financial losses of £1.9M accounts for a third of the total figure.

Concerning the effects on victims of cyber crime - ONS data from the Crime Survey for England and Wales (CSEW) indicates that 72% of those affected by cyber crime expressed that they had been emotionally affected by their experiences, with almost a third stating a moderate to severe impact as a result of the offense – predominantly annoyance and anger.

A further 1 in 10 individuals experienced emotions such as anxiety, depression, fear or difficulty sleeping.

Despite the personal nature of the crimes, 81% of offences were committed by an individual person (as opposed to a group) that was not known to the victim.

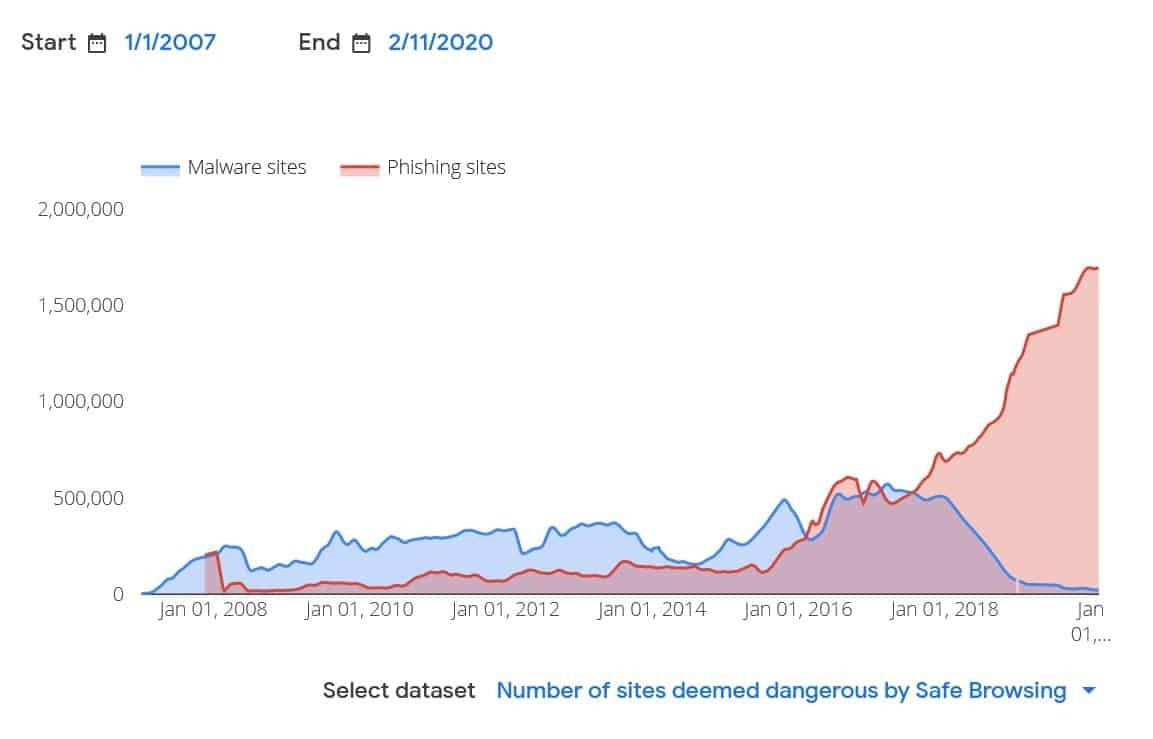

Concerning the tools used to commit cyber crime, malware (software designed to cause damage to a computer, server, client, or network) is at its lowest point since 2007, according to Google’s Transparency Report. In contrast, phishing websites - which seek to gain passwords, credit card numbers and other private information without the use of applications - have seen an increase of more than 750% since 2007.

In all cases of cyber crime that resulted in financial loss, one in three individuals discovered the offence through communications from their bank, building society or other financial institution.

Including non-cyber assisted fraud, the UK has logged 253,736 reports that equate to total financial losses of £1.2bn this year. Health minister Lord Bethell has previously commented on the rise of phishing scams conducted over the course of the COVID-19 pandemic, with an increase in fraudulent text and calls to mobile phones, with individuals posing as bank employees, HMRC and even the NHS charging for fake COVID tests and track & trace.

A spokesperson for PPC Shield comments: “With the internet such an essential part of our daily lives, taking care online and using robust security measures are of utmost importance. Always be aware of what you are clicking on, and be especially wary of phishing sites and emails sent from companies or individuals that you are not familiar with.”

The analysis was conducted by PPC Shield, which enables brands and businesses to optimize their online ad campaigns by filtering out and blocking fraudulent clicks to ensure an advertising budget is not wasted.

In all cases of cyber crime that resulted in financial loss, one in three individuals discovered the offence through communications from their bank, building society or other financial institution.

Including non-cyber assisted fraud, the UK has logged 253,736 reports that equate to total financial losses of £1.2bn this year. Health minister Lord Bethell has previously commented on the rise of phishing scams conducted over the course of the COVID-19 pandemic, with an increase in fraudulent text and calls to mobile phones, with individuals posing as bank employees, HMRC and even the NHS charging for fake COVID tests and track & trace.

A spokesperson for PPC Shield comments: “With the internet such an essential part of our daily lives, taking care online and using robust security measures are of utmost importance. Always be aware of what you are clicking on, and be especially wary of phishing sites and emails sent from companies or individuals that you are not familiar with.”

The analysis was conducted by PPC Shield, which enables brands and businesses to optimize their online ad campaigns by filtering out and blocking fraudulent clicks to ensure an advertising budget is not wasted.

Related News

- 01:00 am

The new API is part of Binance’s broader strategy to expand user protection and risk management protocols

Binance, the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider, will launch Tax Reporting Tool, a new API that enables Binance users to easily keep track of their crypto activities and streamline reporting requirements.

With the Tax Reporting Tool, users can transfer their Binance transaction history to third party tax vendors, as well as obtain real-time overviews of their local tax liabilities.

The new Tax Reporting Tool will be part of Binance’s broader strategy to expand user protection and risk management protocols. Recent updates under this initiative include revisions to daily withdrawal limits and updated leverage limits for Futures accounts.

“The fact is that in many countries around the world, crypto regulations are still evolving and we are all discovering the right path for this promising, young and exciting industry,” said Changpeng Zhao (CZ) Co-founder and CEO, Binance. “We are working hard to not only align with evolving regulatory standards but to also provide a better experience for our users, from updating safeguards to introducing new products like our Tax Reporting Tool.”

The Tax Reporting Tool will be available from 28 July, 4:00 AM UTC. Users will be able to access the Tax Reporting Tool via “Account” and “API Management'' on both the Binance Website and Binance App.

For more information on the new Tax Reporting Tool, head to How to Obtain Tax Reporting on Binance & Frequently Asked Questions.

Related News

- 04:00 am

- YouTrip also revealed Singaporean users' top 10 overseas shopping sites in the past 12 months, with international marketplaces being key drivers of cross-border spending

- Purchases of bikes and K-pop merchandise saw standout growth, more than doubling and tripling in transactions of their respective products

YouTrip, Singapore's leading multi-currency wallet, registered an 84% year-on year increase in online overseas purchases by Singaporean users from July 2020 to June 2021[1]. This builds on the previous spike in overseas spending recorded by the company in the first half of 2020, reflecting a greater appetite for goods from foreign retailers by locals in this time of disrupted travel.

Cross-border spending makes up a key component of Singapore's thriving e-commerce market, which is poised to reach US$8 billion in 2025[2]. The continued closure of borders has also encouraged the frequency of transactions from overseas retail sites. A separate YouTrip survey showed that three in five local consumers purchased from overseas shopping sites at least once a month, and half spent an average of $51 - $150 per transaction[3].

International marketplaces key drivers of overseas spending

Global marketplaces continue to be hugely popular among local consumers, with key players from China and the US driving most of the overseas spending from Singaporeans.

- According to YouTrip's data, international marketplaces - Taobao (#1), Amazon (#2), Alibaba.com (#3) and eBay (#5) - dominated the list of top 10 overseas websites frequented by Singaporeans in the past 12 months.

- Singaporeans were also not shy about increasing their spending with these online retailers. Transactions more than doubled on Taobao (131%) and Alibaba.com (120%) from the year before, and consumers ramped up purchases on eBay, resulting in a 98% increase.

In terms of spending habits, peak transactions were registered in the mid and end of the calendar year, specifically in the months of June, November and December. These are in line with mega sale events launched by overseas marketplaces during that period, such as the 618 Taobao Festival and Amazon Prime Day in June 2021, as well as the 11.11 Singles' Day, 12.12 Shopping Madness, Cyber Monday and Black Friday sales in time for the end-of-year shopping season.

Crossing borders to meet more of their everyday needs

Clothing apparel and footwear emerged as the top category[4] for overseas shopping among Singaporeans. Consumer electronics as well as furniture and household items followed behind, as locals integrated this work-from-home normal into their daily lives.

Beyond these popular categories, the company's latest data also showed that Singaporeans were becoming more health-conscious during the pandemic, turning to trusted overseas retailers for products to boost their overall well-being.

- Health supplement retailers - iHerb (#4) from the US and Australia's Chemist Warehouse (#10) - were two credible sites that Singaporeans frequented to get their dose of nutrition, whereas Lululemon HK (#8) was the go-to overseas brand for their choice of activewear.

- Singaporeans have also turned up the gears on their cycling game in the past year. Cycling-related transactions more than doubled in the last 12 months, and cycling enthusiasts were visiting leading specialist bike shops - such as Evans Cycles (#9) from the UK - to pick up their own bike and cycling accessories.

In addition to fitness, overseas retailers also provided a source of solace for Kpop fans in a time when live concerts are halted. Transactions on Weverse Shop (#6) - the global merchandise store for top idols such as BTS and GFRIEND - saw a staggering triple in growth, as legions of local fans spare no expense to purchase merchandise that will bring them closer to their favourite pop stars.

Price is king for consumers

When asked about the reasons for purchasing from overseas retailers, around eight in 10 respondents[5] indicated the lower cost of items on foreign sites as the key drawcard. This was followed by a wider variety of products offered by international brands, and the lack of availability from local retailers pushing consumers to approach overseas alternatives.

"Singaporeans are becoming seasoned shoppers of marketplaces and brands from around the world. We're expecting this overseas spending behaviour to persist when travel resumes, as echoed by nine in 10 of our users[6] who have indicated their preference to continue shopping from foreign retailers after borders reopen. This high consumer demand positions Singapore as a key market for international retailers," said Caecilia Chu, Co-founder and CEO of YouTrip.

She added, "The continuation of this digital habit is also exciting for us at YouTrip, as we double down on our innovation and expand our e-commerce offerings to offer consumers a convenient, reliable payment experience with the best exchange rates."

Offering true value to YouTrip consumers

YouTrip continues to lead the multi-currency market with its unique edge of being the cheapest way to pay online through best exchange rates and with no markups in over 150 currencies. Recognising that shoppers always care for a great deal, YouTrip has also developed their blog into a one-stop resource guide with curations of online shopping deals & shipping guides for the price-conscious.

Singaporeans' top 10 overseas shopping sites

Overseas shopping websites that YouTrip users in Singapore purchased from (July 2020 - July 2021)

Rank | Overseas shopping site | Currency |

#1 | Taobao | CNY |

#2 | Amazon | USD |

#3 | Alibaba.com | USD |

#4 | iHerb | USD |

#5 | eBay | USD |

#6 | Weverse Shop | USD |

#7 | LuluLemon HK | HKD |

#8 | ASOS | GBP |

#9 | Evans Cycles | GBP |

#10 | Chemist Warehouse | AUD |

[1] YouTrip Internal data: Transactions by Singaporean users in July 2019 - June 2020 vs July 2020- June 2021

[3] YouTrip survey, Singapore users, n=425, Question: How frequently do you purchase from overseas sites (i.e. transactions made in foreign currencies)?; Question: What's the estimated cost per transaction? July 2021

[4] YouTrip survey, Singapore, n=425, Question: What items do you purchase from overseas vendors? July 2021

[5] YouTrip survey, Singapore, n=425, Question: What are the reasons for purchasing from overseas retailers? July 2021

[6] YouTrip survey, Singapore, n=425, Question: How likely are you to continue shopping from overseas retailers even after travel resumes? July 2021

Related News

- 07:00 am

Paymaya, the leading, mobile money and payments provider in the Philippines has chosen Iliad Solutions as its payments testing supplier.

Iliad Solution’s products and services, used by leading financial institutions around the globe, help to minimise the risk when deploying new payments technology, reducing the costs associated with testing and improve the speed of launching new systems.

Paymaya has licenced t3:Switch, Iliad Solution’s dynamic test platform, to assist in the testing of the interoperability of their solutions with global payment schemes. The t3:Portal orchestrates and simplifies the process of payment testing and certification. Sophisticated controls can be applied to projects at every level, with real time data available via intuitive dashboard views. Paymaya can now test complex transactions with international schemes simply and with efficiency - tests are fully automated and can run at up to 5000 transactions per second.

Anthony Walton, Iliad Solutions CEO commented: “The Philippines is one of the most dynamic adopters of digital payments in Southeast Asia. It is moving away from cash payments at pace and using state-of-the-art technology and new digital channels to do so. Paymaya is a leader in this space and Iliad are very proud to be helping them remove friction from the complex process of getting new payments initiatives to market through simplified and automated testing.

Southeast Asia is a strategic market for Iliad, given the territory’s adoption of innovative approaches to payments, typically through mobile technology. We look forward to working with Paymaya as it builds out its multi-channel offering. It is Iliad’s second significant project in 2021 in the Philippines and we are very pleased to bring our expertise and perhaps more importantly learn, about this exciting market.”

For more information, please visit: www.iliad-solutions.com

Related News

- 05:00 am

Profile Software, the international financial solutions provider, announced today the operational use of the omni-channel digital banking platform integration project at Optima bank (ex-Investment Bank of Greece). Optima bank was launched on July 31, 2019, following the acquisition of Investment Bank of Greece from IREON INVESTMENTS a fully subsidiary of “MOTOR OIL" Group. The platform went live under strict deadlines as per bank’s requirements with great success.

By heading this implementation project and offering a single access environment, based on Wso2 platform, Profile’s new “integration layer” services connect the Digital Banking platform by Netinfo, to the bank’s existing Core Banking System as well as to other systems of the bank.

Capitalising on 30 years of experience in the financial services domain, delivering similar projects in Greece, the UK, France, etc, Profile provides integrator services to the bank, following a vendor assessment, to deliver a new digital platform which offers flexibility, speed and security to the bank’s customers, offering a new platform with modern design and innovative technical characteristics.

In particular, the solution offers convergence to a centralised architecture to leverage the bank’s existing assets, data and APIs, and create a common environment that enables security, scalability, governance and traceability. This approach was selected to greatly benefit the bank since it delivers an integration project in the most comprehensive manner much faster and at low risk. In addition, the platform improves efficiency and reduces implementation costs across departments. The delivery approach ensures integration agility, by following best practices. The platform is customisable and delivers the needed flexibility to the end user to adjust the dashboard to his/her own preferences.

Moreover, Profile led the execution of the overall “Digital Banking Platform” project by offering its Project Management Services for the successful planning, co-ordination among the different Vendors and the Digital Banking solution implementation according to the bank’s requirements. The project is of strategic importance to Profile for the region as it aims to leverage its experience in the international marketplace to empower a growing Hellenic Digital Bank with cutting edge technology, to successfully meet the market needs for digital transformation. It is worth mentioning that Optima bank invests heavily in modern technologies and fintech services so as to offer the best possible user experience.

Related News

- 03:00 am

Okan Ozaltin, GM Payment Solutions, Signifyd;

"As consumers increasingly adopt APM (alternative payment methods) for online transactions, potential lower transaction costs and instant receipt of funds are making some bank-to-bank payment methods popular with merchants.

Supporting a full range of payment methods is important to convert customers and grow CLV, but increasing decline rates can make this a double-edged sword. Merchants are however struggling to cope with the increased complexity and lack of data required to make accurate decisions on genuine customers vs fraudsters.

Fraud will still be an issue regardless of the payment type used and merchants need to ensure their payment tool kit includes specialist tools to automate fraud reviews and increase approval rates for all types of payments."