Published

- 07:00 am

August 12 is International Youth Day, a date designated by the United Nations General Assembly in 1999 to recall the role played by young people in development and peacebuilding. Sber timed its research on the investment habits of young people to coincide with this date.

Understanding the stock market is a fundamental aspect of financial literacy. In fact, a great many young people aged 18–35 would like to learn the basics of investing: 50% of all brokerage accounts opened with Sber over the past year (between June 30, 2020, and June 30, 2021) belong to people in this age group. In absolute numbers, that is 1.5 million people. Residents of Moscow opened 34% of those accounts, with St. Petersburg (3% of accounts) following well behind the capital. Heightened interest in the stock market on the part of young people was also recorded in Samara, Yekaterinburg, Novosibirsk, Perm, Voronezh, Ufa, Chelyabinsk, and Volgograd. Forty-eight percent of accounts were opened by women and 52% were opened by men. In terms of general trends, 32% of brokerage accounts with Sber were opened by people aged 30–35, 29% by people aged 21–24, 21% by people aged 25–29, and 18% by people aged 18–20. Young women have a higher average portfolio size than young men: RUB 150,000 compared to RUB 130,000. Young investors tend to invest in shares and bonds. Gazprom, Sberbank, and Nornickel securities are the most popular Russian-issued shares among men, with Tesla, Apple, and Alibaba being the most popular foreign-issued shares. Women prefer to invest in Sberbank, Gazprom, Nornickel, Tesla, Alibaba, and Boeing. Transactions usually take place several times a year (50% of men and 53% of women). Twenty-six percent of young men and 27% of young women trade several times per quarter, 15% and 14% trade several times in six months, and 9% and 6% trade several times per month, respectively. Both young men and women prefer to trade based on investment analytics, which is why 83% selected the Investment plan, which provides them with access to exclusive analytical reviews. There are a lot of young people in the stock market now: 47% of all active brokerage accounts with Sber were opened by clients aged 18–35. That means that 2.3 million accounts belong to young investors. Forty-two percent of them have both a brokerage account and a personal investment account. Although so far Sber counts more men in this age group among its clients (59% of accounts opened), young women are quickly catching up. We strive to make our investment products as convenient as possible for young people and to help them achieve the financial results they desire.

In terms of general trends, 32% of brokerage accounts with Sber were opened by people aged 30–35, 29% by people aged 21–24, 21% by people aged 25–29, and 18% by people aged 18–20. Young women have a higher average portfolio size than young men: RUB 150,000 compared to RUB 130,000.

Young investors tend to invest in shares and bonds. Gazprom, Sberbank, and Nornickel securities are the most popular Russian-issued shares among men, with Tesla, Apple, and Alibaba being the most popular foreign-issued shares. Women prefer to invest in Sberbank, Gazprom, Nornickel, Tesla, Alibaba, and Boeing.

Transactions usually take place several times a year (50% of men and 53% of women). Twenty-six percent of young men and 27% of young women trade several times per quarter, 15% and 14% trade several times in six months, and 9% and 6% trade several times per month, respectively. Both young men and women prefer to trade based on investment analytics, which is why 83% selected the Investment plan, which provides them with access to exclusive analytical reviews.

There are a lot of young people in the stock market now: 47% of all active brokerage accounts with Sber were opened by clients aged 18–35. That means that 2.3 million accounts belong to young investors. Forty-two percent of them have both a brokerage account and a personal investment account. Although so far Sber counts more men in this age group among its clients (59% of accounts opened), young women are quickly catching up. We strive to make our investment products as convenient as possible for young people and to help them achieve the financial results they desire.

Related News

- 04:00 am

Fraud, AML, compliance, customer treatment, systems and controls top the list of 2,754 separate allegations logged by 1,046 whistleblowers in the last year

The Financial Conduct Authority (FCA) has received a total of 2,754 separate allegations of misconduct, including fraud, money laundering and compliance complaints, according to official figures. The data, analysed by a Parliament Street think tank and contained in the FCA’s newly published Annual Report and Accounts 2020/21, details the allegations, which were provided by a total of 1,046 whistleblowers in the last 12 months.

The report also revealed that there are 184 individuals and firms under investigation for carrying out unauthorised business, and £189.8 million in financial penalties had been handed out over the same period, alongside a number of prosecutions alleging insider dealing, investment fraud or money laundering.

The FCA revealed it has strengthened its AML supervisions over the last year, becoming more data-led and drawing from a range of information sources. As a result, at the end of March 2021, the body said that it had increased the number of firms required to submit financial crime-related data.

The 1,046 ‘whistleblowing’ reports – staffers reporting against their own organisation – is a small reduction when compared to the 1,100 reports in 2019/20, and, this year, 15 led to ‘significant action’ to mitigate harm, which may have included enforcement action.

In a further 135 cases they took ‘action’ to mitigate harm, which included writing to or visiting a firm, requesting further information, or asking a firm to attest to compliance with the rules. 145 cases were said to have helped inform the FCAs work, and were relevant to the prevention of harm, but did not lead to any specific action; 97 cases were not considered relevant, and 654 cases were still being assessed at the time the report was published.

The retail banking sector was also subject to scrutiny by the FCA in the recorded period and, in February 2021, a ‘Dear CEO’ letter, detailing the risks of harm that retail banks’ activities were causing, was issued. The regulator handled 97 cases involving AML in the retail banking sector, put in place one Voluntary Requirement Notice (VREQ), progressed

5 s166/skilled person assessments and progressed 15 enforcement cases related to

AML failings, one of which was a new case for the period.

FY 20/21 also marked the first full financial year when the FCA was responsible for accessing the Anti-Money Laundering (AML) measures of cryptoasset businesses, which pose ‘increase risk of financial crime’. The report revealed that 138 firms that appeared to be trading without having applied for registration had been placed on a public-facing register.

Wayne Johnson, CEO, Encompass Corporation, comments:

“This year, more individuals are attempting to use the chaos of the pandemic to carry out financial crime. Therefore, it is important that the FCA is taking the necessary to steps to tighten their control and increase visibility over new sectors and payments technologies, such as cryptocurrencies, which are being used to launder money.

“But, the fight against financial crime can’t be won by the regulators alone, and businesses from all sectors must improve the efficiency and effectiveness of their onboarding processes, compliance and due diligence, not just for the sake of ‘ticking boxes’ and averting regulatory fines, but to help prevent even more financial crime and dirty money running through critical businesses and infrastructure.

“In today’s digital climate, organisations are encouraged to invest in automated regulatory technology, which can boost the effectiveness and efficiency of compliance programmes whilst keeping costs low.”

Related News

- 08:00 am

Validis, the provider of open accounting data and analytics, announces the appointment of Matt DeVoe as VP of Sales to spearhead its North American financial services growth.

Matt joins Validis from LendingFront and has previously held roles at EDR/LightBox where he helped drive strong expansion of SMB finance technology across the US. Matt’s appointment signals an increased focus by the global fintech to further expand its regional footprint and embed the Validis platform across the North American financial services sector.

Validis currently manages the acquisition and curation of SMB accounting data for several top-tier banks, lenders, and the largest global accounting firms – including the US and Canada, where it has had a long-standing operational presence.

“I’m delighted to join Validis in a key role that will help drive further success for the firm”, says Matt. “Validis are a well-established fintech with a wealth of experience, expertise, and an unrivalled level of sophistication in its technology. It’s a very exciting time in the financial services space where we are seeing a huge focus on digital transformation and a wide-spread appetite to improve connectivity and access data in a way that will better serve the SMB community. The Validis platform allows FI’s to seamlessly automate a very manual and time-consuming part of the underwriting and customer management process. I am looking forward to being part of a team that will help reshape the SMB lending experience and drive value for more banks and lenders across North America”.

Paul Thomas, CEO of Validis said, “We’re delighted to welcome Matt to our growing team as we continue to expand our coverage in an evolving US market. He has an impressive track record and brings a depth of knowledge and experience of the banking and SMB lending sector. With our continued focus on product innovation, increased data coverage, and the addition of high-calibre people like Matt, we have exceptional capability to serve our growing customer base.”

Related News

- 01:00 am

Credit card spend 3.5 percent higher compared to June 2019 suggests some households are benefitting from pandemic savings, but not everyone is experiencing post-COVID confidence with accounts missing two payments increasing 15 percent compared to May

Highlights

- Fourth consecutive monthly increase in credit card spend – 6 percent year on year – with spend now higher than June 2019 levels

- Further increase in percentage of payments to balance - 2.5 percent – although growth slowing

- 15 percent increase month-on-month in accounts missing two payments

- Cash usage continues to slowly grow, by 9 percent; but still 62 percent below pre-pandemic levels

Global analytics software provider FICO today released its analysis of UK card trends for June 2021. Maintaining the pattern for the year so far, average spend continued to increase compared to 2020. As the UK was only just coming out of lockdown in June 2020, this rise in spend is unsurprising, but the fact that average spending was 3.5 percent (£23) above 2019 levels suggests that, for those who have been able to save through the pandemic, there is confidence in their future financial stability.

However, the percentage of accounts missing payments reflected the fact that not everyone has been able to accrue savings during the last 18 months. With the end of lockdown across the UK and summer holidays prompting spending in the next months, and government support for furlough payments reducing from 1st July, lenders will need to be vigilant for those already facing financial pressure who could struggle further to stay on top of debts.

Spend on UK cards continued to increase, along with the percentage of payments

The average spend on UK credit cards increased year-on-year for the fourth consecutive month, by £40 to £691, a larger increase than seen in May. It also exceeds the June 2019 spend by £23 with the sunny weather and the Euro 2020 competition likely to have contributed to this uptick.

Average card balances marginally increased month on month. They are 4 percent lower than a year ago and 12 percent below June 2019 levels, suggesting that households are trying to manage their spend in the face of a still-uncertain future.

Mixed picture on payments

Whilst average spend increased year-on-year, the FICO data reveals mixed fortunes when it comes to payments.

The growth in the payments-to-balance ratio started to slow in June 2021, increasing by just 2.5 percent month on month. Year-on-year it is 45 percent higher, although that is unsurprising as some businesses were still arranging furlough and loan support in June 2020. However, it is 18 percent above June 2019 levels, suggesting the use of savings as well as continued government support.

The percentage of accounts paying the full balance stabilised in June and was 16 percent higher than June 2020. Despite the percentage of accounts paying the minimum payment increasing by 3 percent in June, the proportion is still 11 percent below that seen in June 2019.

Missed payment rates remain low

The percentage of accounts missing one payment increased in May. A proportion of these were unable to make a payment in June, which resulted in a 15 percent increase in the percentage of accounts missing two payments and 9 percent increase in their balance compared to total balance.

All average balances on accounts missing payments decreased month-on-month again in June. However, all balances are higher than a year ago, and 2, 3 and 4+ missed-payment accounts are higher than June 2019, prior to the pandemic with 3 and 4+ balances over 18 percent higher.

Cash usage continues to slowly grow but remains below pre-pandemic levels

Cash as a percentage of total spend fell month on month and is 8 percent lower than a year ago and 37 percent lower than June 2019, highlighting the change in attitudes towards cash.

Whilst the percentage of consumers using cash on their credit cards increased for the third consecutive month, it is 16 percent lower than June 2020 and 62 percent lower than June 2019.

Looking ahead

FICO July data will reflect the initial impact of the last stage of the re-opening of high-risk retail and entertainment sectors, as well as the start of the school holidays. It is expected that spend will continue to increase, although levels may not be as high as anticipated because of the ongoing confusion around foreign travel rules. Higher levels of savings may also continue to blur the picture of those negatively impacted by the winding down of the furlough scheme and further business closures.

Lenders will be keeping a watch on the impact all these factors have on their customers and any changes in payment trends as early indications of financial stress. Those that act quickly, offering the most appropriate options, will be viewed most positively by their customers and the regulators.

Related News

- 02:00 am

LHV Bank and European payment services provider Nets have extended their long-term partnership in Estonia, while adding new issuing services for LHV’s British subsidiary, LHV UK Limited.

The extended partnership will see Nets continue to deliver full acquiring services for LHV in Estonia, including terminal rental, payment authorisations and clearing, e-commerce capabilities, dispute management and fraud prevention. In the UK, Nets will support LHV with issuing services including CMS systems, issuer processing, tokenisation services, fraud prevention with AI, dispute and chargeback services, customer service and cards personalisation.

"LHV Bank aims to provide vendors and customers with truly innovative, tech-focused solutions to their financial needs,” said Andres Kitter, Member of the Management Board of LHV Bank. “We are looking forward to further extending our partnership with Nets in both Estonia and in the UK, enabling us to provide a range of additional digital services to our customers.”

Henrik Anker Jørgensen, CEO of Nets Estonia AS & Head of Baltic region in Nets, added, “We are pleased to extend our partnership with LHV Bank and for their continued trust in Nets, helping to enable financial services for nearly 300,000 customers. LHV inspires us to innovate and continue providing capabilities that meet their specific needs and we look forward to developing the partnership further in the future.”

The long-term agreement has already entered into force.

Related News

- 06:00 am

After launching in the UK in 2020, SurePay’s Confirmation of Payee (CoP) solution is now checking over 30 percent of all online payments in the British market

SurePay, the leading Confirmation of Payee provider, has announced that Triodos Bank UK, one of the leading players in ethical sustainable banking, will implement its full-service Confirmation of Payee solution.

Triodos Bank chose to partner with SurePay due to its best-in-class Confirmation of Payee solution. SurePay has a proven track record of implementing the technology quickly and without disruption with other leading financial institutions in the Netherlands and the UK. The company also supports the Dutch and UK governments with checking payments related to Covid-19 job retention schemes.

According to UK Finance, banks and consumers lost £479 million in 2020 to Authorised Push Payment (APP) fraud, as fraudsters took advantage of the Covid-19 induced rise in online payments. Confirmation of Payee enables consumers to avoid misdirected payments and protects them against certain types of APP fraud.

Confirmation of Payee was launched by Pay.UK in 2019 and allows users to check that the name and account indicators they give for a new payee are the same as the account name held by the payee’s PSP. The service aims to significantly reduce the number of payments made in error, prevent fraudulent transfers, and provide users with peace of mind when making a credit transfer online.

SurePay’s Confirmation of Payee solutions have been developed in compliance with all relevant UK rules and regulations. A key differentiator is that SurePay’s algorithm verifies transaction details instantly and does not interfere with correct payments, ensuring that the user experience is not hindered.

David-Jan Janse, CEO at SurePay commented: “The partnership with Triodos Bank UK will allow us to reach even more consumers, protecting them against the ever-growing threat of online payment fraud. We are the leading provider of Confirmation of Payee, with the highest matching percentage of 77%, close match of 18% and the lowest no match at 5%. Unlike conventional name matching algorithms, the SurePay algorithm has been specifically designed for Confirmation of Payee from scratch.”

Judy Rose, Chief Operating Officer at Triodos Bank UK, added: “Our mission is to help create a society that protects and promotes quality of life and human dignity for all. We are therefore committed to ensuring that our customers are fully protected against the increasing threat of APP fraud and have the best experience when using our services. SurePay is well established in the UK and Netherlands -– where we have our Group headquarters -– and has the most advanced offer, a strong Confirmation of Payee solution on the market and an incredibly devoted team. We are confident that this partnership will help us towards achieving our goals and further improve our resilience to fraud.”

Related News

- 05:00 am

Phillip McGriskin has an impressive portfolio of fintech successes, including TransferWise, SuperAwesome and YOTI.

His latest venture, Vitesse, was listed in the Deloitte 50 Fastest Growing Tech Companies 2019, contracting over 60% of the London insurance market.

- The fintech platform is set to revolutionise the insurance payment system, providing near real-time international payments and treasury management solutions for its extensive clientele across 116 domestic markets.

An Aussie born angel investor has swapped the surf for fintech innovation to launch Vitesse, a FCA and European (DNB) regulated provider of seamless international payments and innovative treasury management solutions for insurance.

Phillip McGriskin, 47, has over 20 years experience in fintech investments. He has built an extensive portfolio of investments across the fintech world. His ability to spot potential in businesses from as early as ideation has allowed him to be an angel investor for; TransferWise, SuperAwesome, YOTI and Griffin.io to name a few.

His later fintech venture, Vitesse, a payments platform that enables its insurance clientele to make reimbursements in a matter of minutes instead of weeks, launched in 2013 and currently boasts customers, including Brit Insurance, Mayfair Group, and CEGA Group. It has secured a £6.6 million Series A investment from Octopus Ventures and will be seeking Series B funding in 2022.

A former surfer may be the last person you’d expect to flourish in this field but Phillip puts his success down to his laidback and friendly approach towards the people he works with. He fondly mentions the entrepreneurs that he has invested in as being inspirational leaders in their respective fields and him having confidence in what was to come.

Fundamentally he really focuses on what he finds interesting. With such a diverse background in where he’s worked and his experience across a variety of business lines and roles, that has given him a broader range of interests and opened him up to more new concepts and ventures.

His career began at the young age of 20 working as an insurance broker in Australia. Over his two decades in the industry, he worked across commercial departments in London for companies such as; EarthPort, PaySafe and Envoy Services (that he founded and sold to WorldPay, where he worked as Chief Product and Marketing Officer before co-founding Vitesse).

His passion for fintech stems from the endless possibilities in this sector coupled with the extensive innovation that has been seen over the last years.

McGriskin says; “The fintech industry is only moving forward and the possibilities are growing. “There is a lot more growth to come from online payments. Cash payments have become a tiny percentage of payments made in the UK compared to how popular it was five years ago. Digitalisation is the one thing that will continue to grow and will speed up in the very near future.”

He sees financial technology as an enabler, encouraging companies and people to rethink outdated approaches. As he states “It is giving people the ability to solve legacy issues which have been around for a long time.”

For example, people can now have a claim approved and receive money back onto their debit card within a matter of minutes. It is effortless and that’s just one way fintech is transforming insurance.”

Phillip is currently the CEO of Vitesse: “After building a successful financial services business with Paul Townsend [Executive Chairman of Vitesse] which relied on creating international payment relationships for businesses to receive money; we realised that there were still multiple gaps on the other side of the transaction. The outward bound payment. There were some very specific use cases in the areas of insurance, payroll and corporate payments where service gaps were preventing these businesses from growing to their full potential.

This thinking created Vitesse, listed in the Deloitte 50 Fastest Growing Tech Companies. Vitesse is a dual-regulated provider of near real-time international payments and treasury management solutions for its extensive insurance clientele, supporting in-country payments to over 170 countries in 109 currencies around the world.

Coupled with a regulated, industry audited solution which gives total control and transparency over funds, Vitesse is changing the game with claims payments and associated claims funds management by providing an efficient capital management solution. They also enable businesses to pay claims via a range of payment types globally such as bank transfer, Visa Direct, and USD eChecks.

“Vitesse brings the strength of the global banking network together with leading technology. We give our customers unparalleled control, transparency and efficiency for the holding and management of funds and liquidity.”

Related News

- 01:00 am

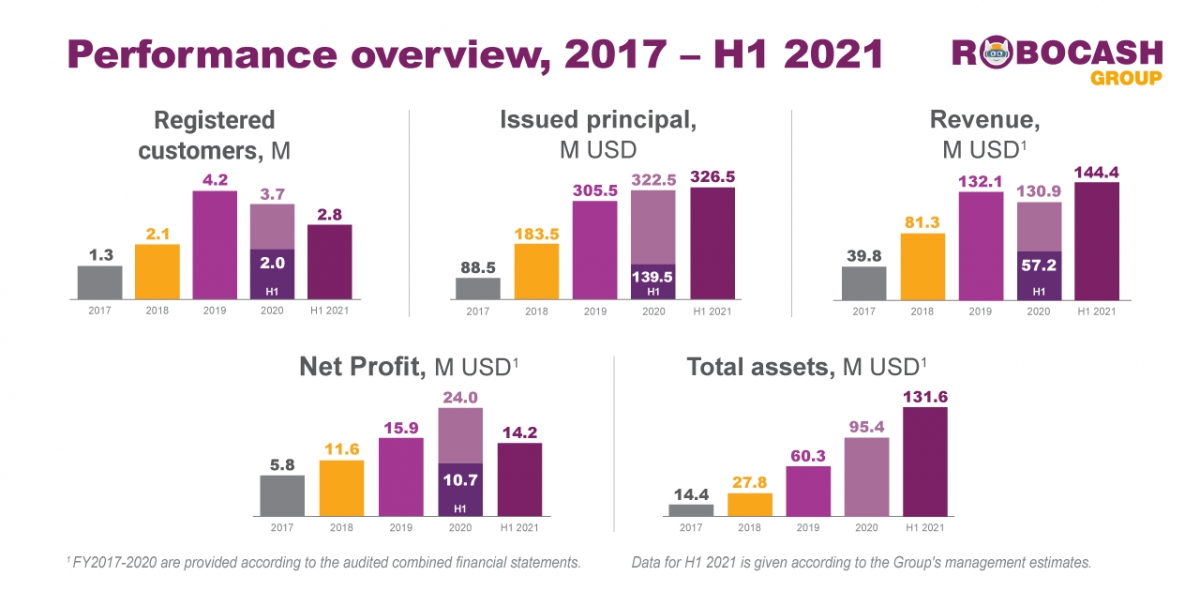

Robocash group, a global fintech holding, has published the results for the first half of 2021. The Group doubled the yearly loan disbursement volumes and managed to achieve commendable results.

In the first 6 months of 2021, Robocash Group issued loans worth 326.5 M USD - up by 134.1% of the H1 2020 performance, already exceeding the results for the entire last year. During the same period, the group revenue amounted to 144.4 M USD - 152.5% increase, yet again surpassing the results of 2020. The Group’s customer base is growing at a steadily increasing rate - up by 40%. In the past 6 months, there were 2.8 million registrations.

Commenting on the results, Sergey Sedov, Founder & CEO of Robocash Group said: “We are thrilled to accelerate the business development and reach new heights. In the next half of 2021, we plan to scale our current products, as well as access new markets and expand the product range. Currently, we are preparing to launch an online lending service in Sri-Lanka, and expect to launch new financial products in the Philippines.”

By the end of 2021, the Group aims to become the best player in each market of operation, growing its customer base and maintaining the quality of its portfolio.

Related News

- 08:00 am

TrueLayer, Europe’s leading open banking platform, has announced that Roberto Villani has joined the firm as its Head of iGaming.

A highly experienced commercial manager and payments specialist with deep expertise in the iGaming sector, Roberto will define and manage TrueLayer’s strategy for iGaming alongside Truelayer’s Chief Revenue Officer Max Emilson and UK Country Manager Jamie Morton.

“Open banking is creating a huge opportunity for the industry to embrace innovation - from supporting responsible gambling initiatives through enhanced player identification and affordability checks, to faster payments that deliver a better player experience. TrueLayer is leading the way as a positive force in the industry with PayDirect, enabling players to receive instant payouts,” Villani commented. “I’m looking forward to working with operators across Europe, helping them to maximise the benefits of open banking with TrueLayer by providing a better end-to-end player experience, from setting up an account through to instantly receiving their winnings.”

Prior to TrueLayer, Roberto was responsible for business development and sales for Online and Retail Gaming at payment provider Trustly. With over a decade of experience in iGaming, he was also responsible for growth, revenue generation and relationship management of key accounts in Europe and emerging markets at Microgaming, an award-winning online gaming software provider.

“iGaming operators are experiencing increasing margin and regulatory pressures, especially those operating in the UK and mainland Europe. Increasingly, many see open banking as an answer to these issues, whether reducing payments processing fees, increasing conversion rates, or solving verification processes,” commented Jamie Morton, UK Country Manager. “As we continue to expand, we need people who understand the nuances of the different operators and the markets they play in. That is why we’re delighted that Roberto has joined us, bringing his expertise in iGaming and payments. With his strong track record of working with the biggest names in the industry throughout Europe, I have no doubt he will help take us to the next level.”

Related News

- 01:00 am

Digital AML provider launches campaign to highlight flaws in manual methods

Leading UK RegTech specialist SmartSearch has launched a new Electronic Verification Uncovered campaign, to raise awareness of the dangers of relying on outdated methods of identity verification for regulated businesses.

The campaign is part of the SmartSearch Index report which is being published to highlight the ongoing threat of money laundering in the UK.

New research* commissioned by the West-Yorkshire based AML solution provider, has found more than a third (34%) of regulated businesses across the financial services, legal and property sectors, still make manual checks when onboarding new customers.

In fact, the research highlighted that in the legal sector specifically manual methods of verification are still preferred by as much as 42% of the firms surveyed. Whereas a third (33%) of financial services, banks and estate agents confirmed they relied on manual checks.

The research, carried out among 500 UK regulated businesses in June, covered a range of topics related to how firms carry out their due diligence obligations. It found that almost one in ten (8.5%) firms in the property agency sector said they do not verify customer ID at all.

In addition, 10% of all firms in the survey said they carry out no checks on business customers with only 70% saying they check financial records as part of the business customer onboarding process – this dropped to 60% in the legal sector.

John Dobson, CEO at SmartSearch, which now operates in the US and the EU, said some of the findings were concerning as hard documents are so vulnerable to being forged.

He said: “It’s really important for regulated businesses to realise that when it comes to secure methods of customer ID verification, documents are high risk and should be at least supplemented with reliable low risk electronic verification.

“This is not only because of the increase in money laundering and financial crime we’ve seen since the start of the pandemic, but also the increasing cost of manually complying with regulations.

“Businesses need to make due diligence and Know Your Customer (KYC) obligations more efficient in terms of speed and cost, as well as remaining secure and accurate. That is not possible by relying on checking passports, driving licences and council tax bills.

“So, we asked businesses why they are still using manual methods of verification and a third said they felt hard copy documents gave them the reassurance that the customer was genuine.

“It’s that kind of belief that we are looking to overturn with our campaign, because increasingly when you’re inviting a customer to send copies of hard documents for verification, you’re actually inviting fraud in through the front door.”

Issues of compliance appear to be behind the decision by those firms to still use manual methods of verification, with a quarter overall (24%) saying it meets AML obligations and a further 30% claiming it’s the only way to guarantee a person’s identity.

However, Dobson is keen to point out that the use of electronic verification has been endorsed in UK law and is much more reliable and accurate.

He said: “When it comes to compliance, regulated businesses can be assured that electronic verification is approved in law. As part of our EU exit, changes to the Money Laundering and Terrorist Financing Regulations 2020 clarifies its support for the increased use of electronic verification.

“Moving away from manual ID checks to electronic verification, will provide regulated firms and their leaders with the confidence that the door is shut against the threat of fraud and money laundering.”