Published

- 04:00 am

FinTech veteran will direct business development and client relationship management initiatives

Broadway Technology, a leading provider of high-performance front-office solutions, today announced it appointed Dan Romanelli as Head of Relationships. In his role, Romanelli is responsible for driving business development initiatives and client relationship management, overseeing a global team of sales and relationship managers. Romanelli’s appointment helps Broadway extend its global client success during a period of ongoing growth and strengthens its position as a premier technology partner focused on delivering exceptional client experiences.

Romanelli brings more than 25 years of international FinTech experience to his role at Broadway, including roles at exchanges, broker dealers, clearing firms and vendors. He joined Broadway from USAM Group Inc., a sales and marketing agency that helps startup and scaleup firms effectively better their business, where he served as co-founder and Chief Strategy Officer. Throughout his tenure he worked closely with clients to understand their needs and advise them how to quickly and cost effectively grow revenue and drive data strategy, policy and data management best practices. Prior to USAM Group Inc., Romanelli worked as a Senior Consultant at Delta Risk LLC, Vice President of NYSE Euronext and Vice President of Merrill Lynch. Throughout his career he has led turnaround projects for FinTech software startups and launched both data product business lines and multiple electronic execution products.

“Dan’s proven client focus and significant leadership experience, coupled with his vast industry and specific FinTech knowledge makes him the perfect addition to the Broadway team. Broadway continues to grow our global relationship management team as we focus on the client experience and success. Dan’s appointment as Head of Relationships demonstrates Broadway’s commitment to fostering deep client relationships and partnering with the FICC community,” said Bruce Boytim, Chief Operating Officer at Broadway.

“This is an exciting time in Broadway’s history as we continue to extend our global relationships and continuously help our clients meet their most complex fixed income workflow challenges,” said Dan Romanelli, Head of Relationships at Broadway. “Broadway has recorded significant momentum in the past year and added multiple FinTech experts to our relationship management team as we continue to grow and focus on delivering exceptional client experiences. This team’s commitment to its core values of transparency, fairness, teamwork and excellence defines Broadway’s culture and client approach, and I’m excited at the opportunity to help advance this tradition of excellence.”

Romanelli holds a master’s degree in Business Administration from the University of Chicago, Booth School of Business, and attended INSEAD, The Business School for the World, where he was a part of the Senior Leadership Program.

Related News

- 03:00 am

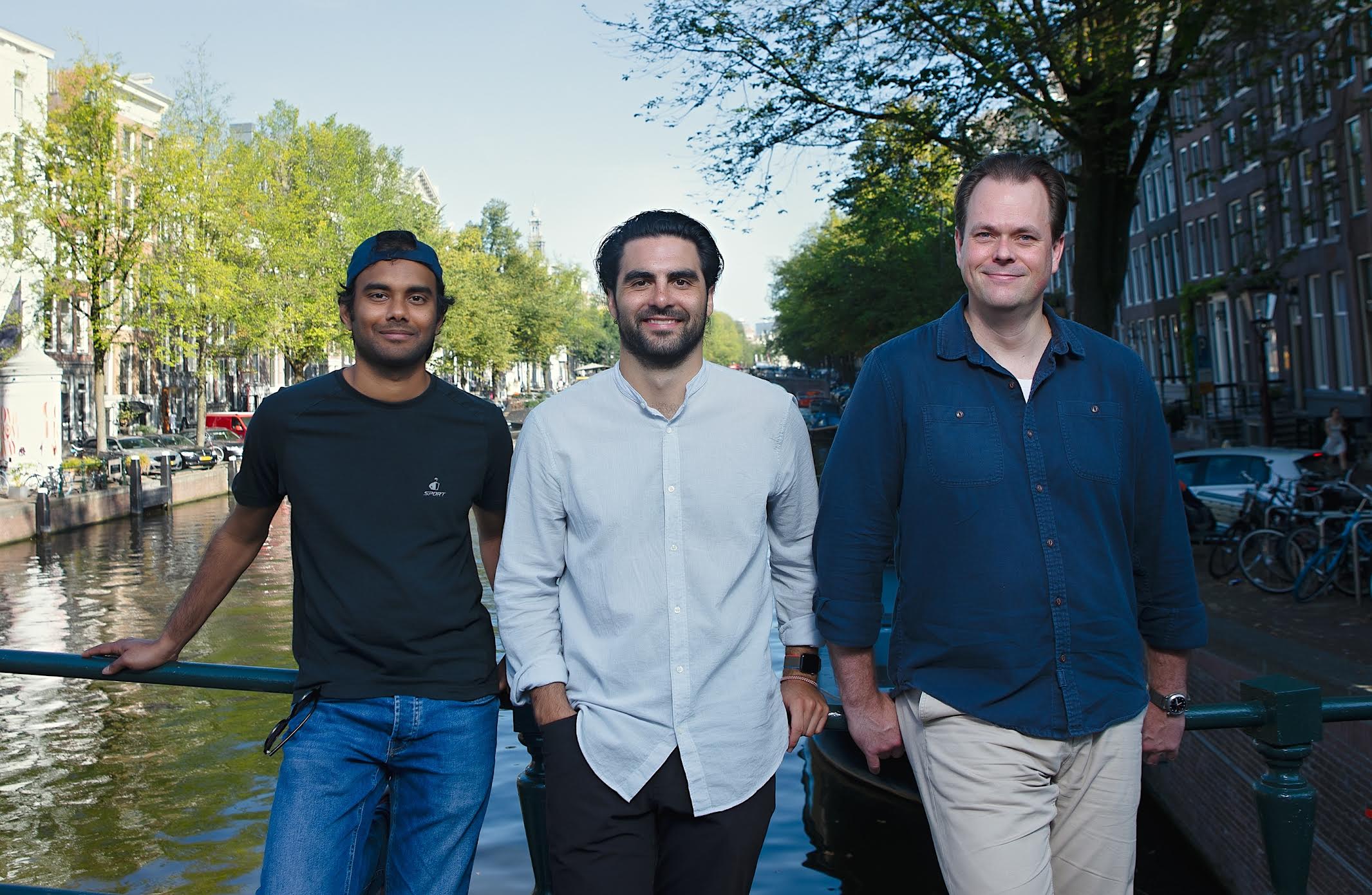

When consumers order something online, they expect a smooth, streamlined payment process. For online B2B purchases, that's not the case. Sprinque is set out to redefine online B2B payments. The Amsterdam-based checkout platform for B2B merchants and marketplaces offers a SaaS payment solution tailored to businesses' needs. Sprinque has raised €1,7 million in funding from Volta Ventures, Force Over Mass and a renowned group of angel investors and payments industry executives.

Smooth payment processes for businesses

Sprinque built a digital checkout infrastructure to make business transactions as frictionless as ordering something from a consumer webshop. Their SaaS solution only needs one single integration and offers a multitude of business-specific options. These include pay with net 30-, 60-, and 90-day terms, split payments, and pay on milestones. It also provides access to multiple payment methods, including Pay by Bank, allowing buyers to settle invoices using their online bank account or mobile bank app. Sprinque’s checkout platform automates all payment workflows and will offer merchants the option to get instantly paid.

“Frictionless checkout infrastructure”

The Amsterdam-based fintech is founded by Manoj Tutika (CTO), Mark Holleman (CPO), and Juan Espinosa (CEO), who all met at Antler Amsterdam, which subsequently invested in Sprinque. "We're experiencing the next tech wave, as B2B commerce is quickly migrating to digital channels, further accelerated by Covid19", says Espinosa. "There are now over 300 B2B marketplaces in Europe and the majority have been founded in the past five years. But when it comes to B2B payments, everything still happens offline. At Sprinque, we are out to build a frictionless checkout infrastructure for digital B2B commerce. Our goal is simple: we want to help B2B marketplaces and merchants grow their business while reducing costs."

€1,7 million funding

Sprinque has raised €1.7 million in funding from Volta Ventures and Force Over Mass. Both have invested in numerous fintech and B2B startups, such as Banxware, Cashforce, Blanco and Shieldpay. Sprinque's Mark Holleman says: "The complementary skill set, brought together by Antler, is what makes this team of founders a great match for investors. Volta understood the opportunity right from the start, and with Force Over Mass, we have partners experienced in the B2B and fintech field and with an international portfolio."

'Clear vision on B2B payments'

Filip Coen, Partner at Force Over Mass, says he is excited to invest in Sprinque. "Vendors are spending millions to build online platforms for B2B trading, but their payment processes are often lagging way behind. Sprinque not only offers a solution for these businesses, but they also have a team that can successfully deliver. There's a clear vision on how end-to-end business payments should work, and together, we can see them take their product international." Sander Vonk, Partner at Volta Ventures, adds: “B2B payments is a challenging problem to solve, we feel the experience the team brings and the early traction they have shown makes for a great combination able to tackle the problem.”

Renowned group of angels

Several angel investors with extensive experience in the B2B and finance industry also joined the round. The group includes Gaston Aussems (ex-CEO, Mollie), Matt Robinson (Founder, GoCardless), Charlie Delingpole (Founder & CEO, ComplyAdvantage), Rainer Majcen (ex-CEO, Finance BPO at Arvato Financial Solutions), Chris Adelsbach, and Great Stuff Ventures.

“Speed is of the essence”

The funding allows Sprinque to build out their product and onboard the first clients on the ever-growing waiting list. Espinosa: "We're aiming to grow to process €100 million in payment transactions next year." Holleman adds: "Speed is of the essence now. We're facing a blue ocean full of opportunity. With this funding, we can conquer a large part of the vast open space ahead of us."

Related News

- 04:00 am

Caitlin Woodward will oversee Trulioo’s corporate governance and execution of financial transactions

Trulioo, the leader in global identity verification, today announced the appointment of Caitlin Woodward as General Counsel. Caitlin brings more than 15 years of expertise in overseeing strategic acquisitions and cross-border transactions and advising executive leadership teams on corporate governance requirements.

“We’re thrilled to welcome Caitlin to Trulioo and look forward to her knowledge and legal expertise surrounding technology, complex financial transactions and regulatory compliance. She will be instrumental in supporting strategic opportunities that will enable us to expand and continue our growth trajectory,” said Steve Munford, Trulioo CEO.

Prior to joining Trulioo, Caitlin served as Associate General Counsel with TELUS Corporation leading internal M&A teams and advising on strategic acquisitions. She also advised the TELUS Ventures team in its investment program execution. Previously Caitlin was Associate General Counsel and Corporate Secretary at Atlas Corporation, an NYSE-listed global asset management company. Caitlin led the completion of multiple public and private financing transactions and advised on corporate governance and securities regulatory requirements. Caitlin is a member of the Bar of the State of California and she holds a JD from Stanford Law School.

“I’m excited to join Trulioo in a period of hypergrowth and I look forward to contributing to Trulioo’s mission of advancing financial inclusion globally,” said Caitlin Woodward, Trulioo General Counsel.

Related News

- 08:00 am

The customer conference will highlight best practices and the latest innovations in the banking and lending customer journey

Total Expert, the customer experience platform purpose-built for modern financial institutions, today announced its 2021 Accelerate customer conference, an annual event highlighting customer experience innovation in financial institutions and the game changers who make it happen.

Taking place Oct. 3-5 at the Fairmont Scottsdale Princess in Scottsdale, AZ, Accelerate will bring together Total Expert customers, partners, and industry thought leaders for inspiring keynotes, breakout sessions, and in-depth conversations about the connected customer journey and strategies to drive growth and customer loyalty. Attendees will take away key learnings from industry speakers and panelists, including Guy Kawasaki, Author and Marketing Evangelist, Brittany Hodak, Chief Experience Officer at Experience.com, James Robert Lay of the Digital Growth Institute, Hunter Young of HIFI Agency, Julian Hebron of The Basis Point, and Amanda Swanson of Cornerstone Advisors.

Total Expert customers CIVIC Financial Services, Horicon Bank, Paramount Residential Mortgage Group, (PRMG, Inc.), Prosperity Home Mortgage, Fidelity Bank, United Community Bank, Motto Mortgage, American Pacific Mortgage, and Finance of America will also take the stage, sharing their strategies for building stronger customer relationships.

“Accelerate 2021 unlocks the opportunity for the industry’s greatest innovators to connect and share best practices for driving growth, earning customer loyalty, and turning data into action and impact in today’s dynamic market,” said Joe Welu, founder and CEO of Total Expert. “After a long pause, we’re excited to get back together with our customers and partners for a few days to continue learning and mapping modern customer journeys that hit the mark.”

For the first year, Accelerate will welcome sponsors from key technology partners, including Adwerx, Blend, Experience.com, Denim Social, Mortgage Coach, Optimal Blue, Sales Boomerang, SimpleNexus, HouseCanary, and 6 Solutions.

For more about Accelerate 2021, visit info.totalexpert.com/accelerate2021 or reach out to events@totalexpert.com.

Related News

- 04:00 am

● 34% say their organisation is at risk of security threats due to skills gaps

● Only a third (33%) conducted a cyber security risk assessment in past year

● Increased DDoS attacks (35%), phishing and scam attacks (35%), and employees downloading unapproved apps (33%) listed as main IT security threats

New research from Europe’s leading provider of cloud infrastructure and cloud services, IONOS Cloud, has found that over 40% of IT decision makers (IT DMs) surveyed admit to their business having a cyber security skills gap, with a third (34%) saying this is putting their organisation at risk of security threats. Additionally, four in 10 of those surveyed say they are facing a skills gap in data protection or cloud knowledge and understanding.

Worryingly, a quarter of those surveyed also state that the business they work for isn’t as secure as it needs to be (25%) and that their organisation is not adhering to necessary legislation (25%).

When stating what they feel are the biggest threats to a business’s IT security at this time, respondents said increased DDoS attacks (35%), phishing and scam attacks (35%), employees downloading unapproved apps (33%) and employees not storing data correctly (32%).

The research, which was conducted by Censuswide on behalf of IONOS Cloud, polled 609 IT decision makers. The aim was to better understand the current challenges businesses are facing in the wake of the pandemic, and where cyber security and data protection standards are sitting on business IT priority lists.

While the skills gap is a clear issue, encouragingly, many businesses do in fact recognise the importance of cyber security, with more than three quarters of those asked (76%) saying it is either the top priority (34%) for their business or within the top three (42%).

However, when asked about cyber security risk assessments, there was a real disparity in responses. Remarkably, only one third of those surveyed have conducted one in the past 12 months. A further 16% have conducted one more than five years ago and have no plans to do one in the future, and 12% have never conducted one and don’t plan to. These findings demonstrate a lack of understanding regarding the importance of risk monitoring – which can often highlight new security issues teams may not be aware of.

“What’s clear from the new insights is that businesses understand the importance of both cyber security and data protection, but missing skillsets are leaving organisations extremely vulnerable. That’s why it’s vital companies put measures in place to plug these gaps, and don’t hesitate to work with external expertise to ensure businesses are protected,” commented Achim Weiss, CEO of IONOS.

Weiss added: “When it comes to withstanding a cyber-attack, fortunately the pandemic has put this front of mind. Eight in 10 businesses say they feel prepared to handle one, despite any skills gaps they have, with the main reasoning being greater investment in secure cloud services (37%). While internal procedures like staff training are an important step in preventing attacks, seeking external support and services and working with designated providers can provide an extra layer of defence and much needed peace of mind.”

In addition, almost six in 10 businesses (58%) surveyed say they are putting more focus on adhering to data protection compared to before the pandemic. However, 13% are actually giving it less attention, with almost half (48%) selecting the main reason as time pressures and job workload meaning insufficient time to ensure the business is up-to-date with the latest protection legislation.

With the Information Commissioner's Office setting significant monetary fines for breaches to GDPR law, businesses must ensure they are fully aware of compliance procedures and the latest legislative requirements to follow when handling personal data.

“When it comes to data protection, action must be taken to bridge knowledge gaps. IT teams are under great pressure to adhere to the latest legislation, but one way to help minimise risk when it comes to data is to work with European-based cloud providers that adhere to GDPR – rather than those that must also work under laws such as the US CLOUD act” Weiss concluded.

For more information on IONOS Cloud, visit: https://cloud.ionos.co.uk/

Related News

- 03:00 am

NCR Corporation, a global enterprise technology provider, today announced that it has placed in the top ten of the 2021 IDC FinTech Rankings, a comprehensive list of the financial services industry’s leading global hardware, software, and service providers.

The IDC FinTech Rankings evaluates the top IT vendors based on revenues and the percentage of revenues exclusively attributed to financial services, including banks, capital markets firms and insurers. The data is gathered from vendor surveys, as well as from original research and market analysis conducted by IDC Financial Insights.

“Recognition in the top 10 of IDC FinTech Rankings demonstrates NCR’s commitment to the success of its financial institution clients,” said Marc DeCastro, research director at IDC Financial Insights. “We congratulate NCR for being ranked 8th in the 2021 IDC FinTech Rankings Top 100 list, and for ranking in the top 10 for a solid decade.”

“NCR remains dedicated to providing the software and services to help financial institutions run, connect and extend digital, self-directed and branch channels,” said Frank Hauck, president and general manager, NCR Banking. “We deliver the flexible, innovative and efficient technology needed to power excellent banking experiences and strengthen their competitive positions. We are proud to once again be acknowledged by IDC Financial Insights for these efforts.”

For more on the 2021 IDC FinTech Rankings, visit https://www.idc.com/prodserv/insights/#financial-fintech_rankings.

Related News

- 06:00 am

Signicat will strengthen If’s customer operations in the Baltic states through its market-leading customer authentication solution

Signicat, the Trusted Digital Identity Company™, has been a trust service provider for If Insurance for over 10 years in Finland, Sweden, Norway, and Denmark. Now, the cooperation has been expanded to include new markets in Estonia, Lithuania, and Latvia.

If has around 3,8 million corporate and consumer customers in Nordic countries and Baltics and is one of the biggest insurance companies in the region. If handles over 1,4 million claims annually, where the success of If’s cross-border activities is based on the continuous innovation of its operations. If has invested heavily in digital customer journeys and more secure channels, as a result of the increasing consumer and compliance demands.

"Year 2020 was a turning point for us where the use of electronic customer channels grew significantly in all customer segments. This made the importance of being able to engage with our customer digitally even more vital for our business” states Mihails Galuška, Identity and Access Management Global Product Manager from If Insurance. “Signicat has been our trust service provider since 2009 and it was a natural choice for us to choose Signicat’s solution for the Baltics since the reliability and coverage of services are important for us and our customers.”

Signicat has supplied If with secure customer authentication solutions for years. One of the key advantages of Signicat’s technology is, unlike its competitors, its internationally scalable, secure, single solution. Signicat’s platform provides a broad coverage of digital identity and electronic signing services across Europe, adhering to strict regulatory requirements. The use of digital identities for secure customer logins supports businesses such as If to manage risk, reduce fraud, and build trust with customers online.

“Since using Signicat’s authentication services in the Nordics, we have increased our customer engagement and satisfaction score” Galuška continues. “We also have millions of digital touchpoints, which enables us to gain better data and insights into our customers’ needs.”

Signicat is one of Europe’s 1000 fastest growing companies recognised by the Financial Times and supports small to large enterprises to engage with their customers securely in the digital realm. Signicat recently acquired Norwegian Strong Customer Authentication (SCA) specialist Encap Security, the Spanish digital identity pioneer, Electronic IDentification and Lithuanian electronic signing provider Dokobit, to further enhance the company’s leadership position in the European RegTech market. With Signicat’s geographic coverage and rapid expansion ambitions, businesses have an accelerated time to market where they can acquire customers faster than ever before. In addition, customers can get access to a business’ products and services through secure and user-friendly channels.

"Over the last years Signicat has invested in expanding geographical coverage in services and If is a great example of a customer to which we provide authentication in several countries with a single contract” says Asger Hattel, CEO of Signicat. “We are grateful that our long-standing cooperation with If will now expands to the Baltic countries.”

Related News

- 05:00 am

Consumers and brands alike are gearing up for what’s anticipated to be the most wonderful holiday retail season on record. According to Mastercard SpendingPulse™, which measures overall retail sales across all payment types including cash and check, U.S. retail sales are anticipated to grow 7.4% excluding automotive and gas. Consumers are expected to spend online at even higher rates (+7.6%) than last year, while in-store sales are also expected to see a rebound—growing 6.6%** compared to 2020.

With early holiday shopping slated to begin in October again this year, retail sales for the “75 Days of Christmas,” are anticipated to grow 6.8% excluding automotive and gas, and e-commerce sales to grow by 7.5% compared to the same time period last year.

While this holiday season will continue to look different –due to geographical, economic, and household differences – there are a number of overarching trends to watch:

- Early season’s greetings: With potential supply chain and labor supply issues impacting the season, retailers are expected to offer omnichannel promotions early on – particularly in the heavily gifted Electronics, Apparel and Department Store sectors. Technologies like contactless and buy online, pick up in store will continue to be embraced by consumers and retailers who desire a quick and seamless experience.

- ‘Tis the season for splurging: Fueled in part by pent-up savings and government stimulus, consumers have the desire and the means to spend. Over the last six months, the Luxury retail and Jewelry sectors have been experiencing some of the strongest YOY and YO2Y growth; that is anticipated to continue through the holidays.

- Shoppers return to stores, though shift to e-commerce is here to “sleigh”: Nothing says holiday cheer like busy malls and bustling Main Streets. While we anticipate that the return to in-store browsing and shopping will continue, e-commerce retail sales are not going anywhere. For the extended holiday season, e-commerce sales are expected to grow 7.5% YOY and 59.3% YO2Y - a record high for the channel.

“This holiday season will be defined by early shopping, bigger price tags and digital experiences. Over the past two years, retailers have learned a lot about what shoppers want and need, bringing us into an exciting new age of retail resilience,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “Retailers have been preparing for this moment and will find innovative ways to deliver on what’s bound to be the biggest holiday shopping season yet.”

Mastercard SpendingPulse: August Actuals - Sustaining Retail Momentum

The holiday season will be a fitting end to a year marked by strong retail performance. In August, for instance, U.S. retail sales excluding automotive and gasoline increased 8.1% year-over-year, and 7.7% compared to August 2019. Online sales in August grew 8.1% and 82% respectively, compared to the same periods. This momentum was particularly evident in key gifting categories, which have experienced strong year-over-year growth, including: Apparel (+75.2%), Electronics (+12.4%) and Department Stores (+28.7%). View the full August SpendingPulse figures here.

*excluding auto and gas sales

** 6.6% excludes auto and gas. When looking at in-store retail sales excluding auto, sales are expected to grow 8.9%

Related News

- 08:00 am

According to a recent survey by Capital.com, the high-growth European investment trading platform, 61% of its traders make decisions based on research and technical analysis. This is compared to 16% of clients who said their trading decisions are affected by social media influencers. A further 22.3% said the media is a strong influence when making trading decisions.

These findings, which were revealed as part of a survey of 1677 Capital.com clients polled between 14 and 20 June 2021, run contrary to the growing significance of social media influencers and ‘copy-cat trading’ on retail traders.

Jonathan Squires, Group Chief Executive Officer at Capital.com said:

“Despite the rise of social media influencers in the retail trading space, our clients do not seem to be significantly swayed by them when it comes to making all-important trading decisions. Instead, most traders on Capital.com prioritise greater education and independent research when it comes to making trading and investing decisions.”

“At Capital.com, we are committed to supporting our clients with cutting-edge technology, exhaustive education resources and in-depth analysis to help them access markets responsibly. We support our clients with free education apps and advanced charting and analysis tools to help them make informed trading and investment decisions.”

The survey also found that most traders prefer to hold a position in stocks for a month or more, suggesting that retail investors are currently embracing a buy-and-hold strategy when it comes to investing in stocks.

When asked how long they would typically hold a stock position, 38% of survey respondents said a month or more while 28% said a week or more. This compares to just 16% who said they’d hold a position for two to three days, while a minority (10%) said they would hold a position for 24 hours or less.

Half of all respondents also said they usually select value stocks (50%) while 37.7% said they favour growth stocks. When asked if they had a preference for stocks based on market capitalisation, 27.6% said they would usually pick small-cap stocks while 25.9% favour mid-cap and 22.6% said they would typically select large cap stocks.

“Our data clearly demonstrate that retail investors are currently taking a longer-term view when it comes to stock investments. As more day-traders diversify their portfolio and turn to longer term investment strategies, retail platforms like ours must be quick to respond to changing investment patterns with a wide range of products and services. To enable our clients to diversify beyond derivatives trading and to allow them to take a more long-term investment view, we enabled commission-free stock dealing on Capital.com, ” added Squires.

Capital.com enables clients to trade derivatives on more than 3,000 of the world’s most popular markets through its web and mobile platforms. The platform recently launched commission-free stock dealing with tight spreads. With no hidden costs or mark-ups and with no fees to pay on deposits or withdrawals, clients can invest directly in an underlying stock without incurring any additional costs or expenses.

Capital.com offers clients a convenient educational app that they can use on the go. Investmate is an all-in-one app to learn finance. It provides clients with a rich and free toolkit that includes varied learning materials, 30+ courses including short lessons that take as little as 3 minutes to complete. The Capital.com platform is also fitted with a demo site, regular news feed, as well as more than 5,000 pages of intelligent financial content and analysis available on its website and through its Youtube trading channel, Capital.com TV.

Related News

- 01:00 am

Allied Bitcoin Wallet, available through Finastra’s FusionStore, enables community financial institutions to offer their customers the ability to buy, sell and hold bitcoin

Allied Payment Network (Allied) and Finastra today announced Allied Bitcoin Wallet, a new app to be launched on Finastra’s FusionStore. The service, created by Allied, in partnership with NYDIG, will enable financial institutions to offer their customers and members the ability to buy, sell and hold bitcoin via a compliant, secure and turnkey platform. Allied is the first bill pay provider in the industry to embed this service into a payment platform and offer it to financial institutions.

“Allied’s primary focus is to make it easier for financial institutions to provide value-based technology that differentiates them in the marketplace, attracts new depositors, retains through high engagement, and generates revenue,” said Ralph Marcuccilli, Founder and CEO of Allied. “Providing access to bitcoin does just that and is a game-changer for many community institutions.”

Allied Bitcoin Wallet—built on Finastra’s open developer platform, FusionFabric.cloud—will consolidate bitcoin transactions, digital payments and account balances into one easy-to-access location for enhanced financial management. The financial institution will not have to hold bitcoin on balance sheet or transact in bitcoin to offer this service. However, by giving their customers the ability to buy, sell and hold bitcoin, financial institutions can attract new accountholders, better serve existing ones and create a new source of potential non-interest income.

“Bitcoin adoption has increased dramatically over the past 10 years, and financial institutions need to be able to service their customers across currency classes,” said Vincent Pugliese, SVP and General Manager, Platform, Finastra. “Finastra is excited to launch the first bitcoin wallet in its app store with Allied Payment Network. Through Finastra’s FusionStore, financial institutions are able to access innovation and claim a leadership position regarding the latest banking trends and technologies.”