Published

Michael Moran

Senior Currency Strategist at ACY

Loonie, AUD, GBP Outperform; US 10-Year Bond Yield Rebounds see more

Clifford Bennett

Chief Economist at ACY

Today, the top signs are everywhere. Stocks stalling, over, or another recovery. see more

- 08:00 am

Toplyne is pioneering technology that lets sales teams at PLG (product-led growth) companies increase conversions within their freemium user base

- Within just 3 months of product launch, Toplyne is used by 10+ leading SaaS companies across the spectrum of growth from early to pre IPO stage companies

Toplyne, a SaaS platform that enables product-led growth companies to increase their freemium user conversion rates, today announced US$2.5 million in funding by Sequoia Capital India’s Surge, Together Fund, and angel investors from Canva, Freshworks & Zoominfo.

The genesis of Toplyne happened at Sequoia India when 2 out of the 3 founding team members of former investment advisors noticed that there was a fundamental shift happening in how modern software was being bought. Software buying decisions were no longer happening in the corner offices of high-rise buildings but rather in the bustling trenches of sales, product, engineering, design, amongst others. The most exciting modern SaaS companies (Zoom, Canva, Slack) were riding this wave of bottom-up software adoption embodying a philosophy called product-led growth (PLG). Come early 2021, Toplyne’s founders noticed that eight in ten early-stage SaaS founders were building their companies for PLG. And to top it all off, June 2021 saw the world’s largest SaaS company (Salesforce) announce its plan to rebuild itself in the image of the world’s pioneering PLG company (Slack). PLG had officially arrived.

“Every decade, there has been a fundamental evolution in SaaS go-to-market strategy. The 2000s were the decade of the sales-led motion. The 2010s saw the evolution of inbound marketing as the default. We’re at the cusp of the third evolution in SaaS GTM strategy, and product-led growth (PLG) is going to be the default motion of the future” said Ruchin Kulkarni, Co-founder at Toplyne

The Toplyne team spent several months speaking with hundreds of revenue leaders at PLG companies across the spectrum - starting with early-stage companies and going all the way up to public market giants. The team discovered that sales in this environment is more difficult than ever before. While PLG opened the floodgates for new user signups, finding users who were likely to become paying customers was harder than ever. To sales teams, it almost felt like finding a needle in the haystack, since most PLG companies have a 1% to 5% free to paid user conversion rate.

“After speaking with hundreds of PLG companies, we realized most companies were flying blind. Moreover, even the very best had spent several quarters (if not years) & hundreds of thousands of dollars building complex internal tools which at the end of the day didn’t get the job done“ said Rishen Kapoor, Co-founder & CEO at Toplyne

It's been five months since the company was founded and the team has rolled out the closed beta version of the product to its first customers - a spectrum of early-stage SaaS companies to mature PLG companies like Canva (quote below). The product is a plug-and-play platform that enables sales teams at PLG companies to identify and focus on the users and accounts that are most likely to convert. Toplyne does so by analyzing user behaviors within a product and determining which users have shown high intent to buy. Most importantly to sales teams, Toplyne can go live within minutes, without the need for favors from their internal engineering teams! Early customers like InVideo have seen a 2x increase in sales conversion rates - case study.

“Millions of people around the world use Canva to achieve their goals – from high school students to small business owners and the Fortune 500, it’s important that we’re able to identify users where our premium subscriptions are the right fit and can add value to the way they’re using our platform. We’re looking forward to using Toplyne to effectively target and scale these efforts at our speed of growth while continuing to deliver value to our community of users across the globe.” said David Burson, Head of Product, Growth & Monetization at Canva

“Our product’s first version went live on Day 30 of the company’s existence when we onboarded our first customer - InVideo. When we saw their sales conversion rate double in just a few days, we knew we were onto something.” said Rohit Khanna, Co-founder at Toplyne and former VP-Product at Clevertap

With a mission to “help product-led companies bring delight to their users” Toplyne is committed to becoming a one-stop-shop for PLG businesses to solve their unique problems. Whether it’s bubbling up the most engaged users for sales calls or building plug-and-play features to help traditional companies transition to product-led, the company’s goal is to be in service of the end-users of software.

"Founders and builders of product-led growth companies face the challenge of sales prioritization every day! Zeroing in on users who are most likely to pay is key to future-proofing your success. The Toplyne team’s experience in this sector, both as investors and entrepreneurs, convinced us that they’re the right team to solve this problem, and we're thrilled that Together Fund can help them scale." said Girish Mathrubootham, CEO & Founder, Freshworks (NASDAQ: FRSH)

Toplyne is also backed by several prominent angel investors including Arjun Pillai (SVP, Strategic Growth, ZoomInfo), Sahil Lavingia (Gumroad), Shashank Kumar & Harshil Mathur (Razorpay), Kunal Shah (CRED), and Gaurav Munjal (Unacademy).

Related News

- 09:00 am

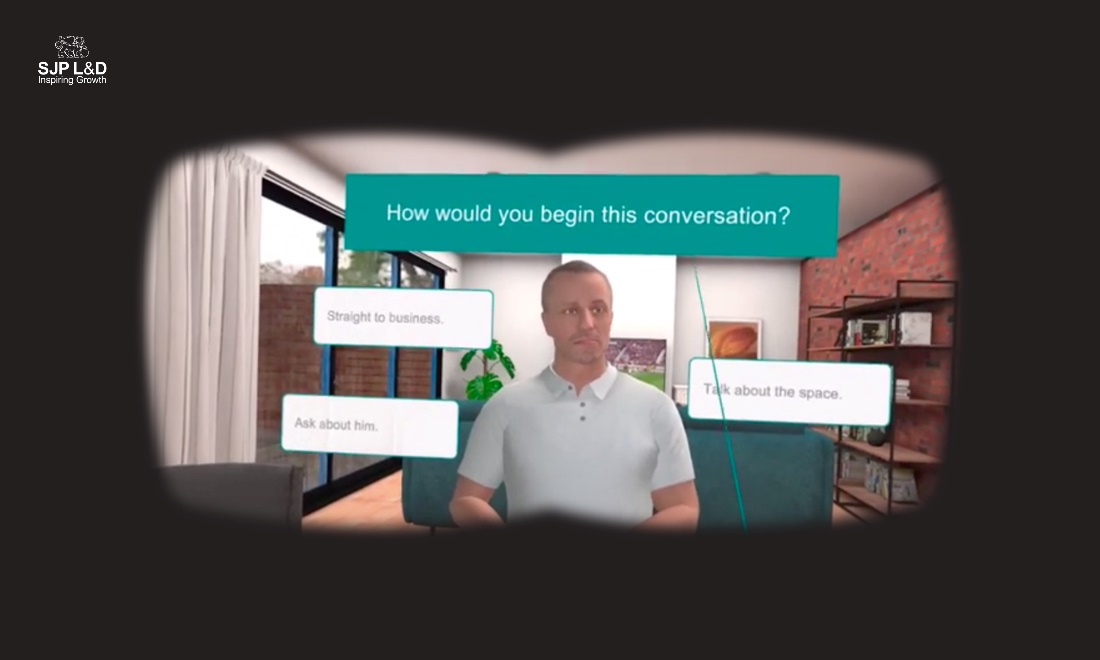

Wealth management group St. James’s Place has become the first financial services provider to roll out industry-leading Virtual Reality (VR) technology for training and role-playing across the business.

This is the first of its kind in Financial Services adviser and employee training, one of a number of planned launches from SJP’s Learning & Development Team using Virtual Reality (VR) and Augmented Reality (AR) technology. The aim is to develop and deliver a full programme based on these new technologies to accelerate learning throughout the business and improve overall performance.

SJP L&D have already begun to use the headsets for virtual presentations and workshops as well as social events, allowing users to meet and get to know each other in a virtual setting.

Virtual Reality role-playing was first rolled out through the SJP Academy in September 2021, alongside in-person teaching, providing a blend of face-to-face and remote-based learning that was successfully adopted during the Covid pandemic. It is currently being used by Academy delegates, allowing them to practice client meetings, fact finding and building rapport with clients with a greater degree of realism. By reducing the need for solely classroom learning, the SJP Academy is determined to make financial planning training more accessible, allowing trainees to work from any location at their own pace.

Trainees are provided with headsets that allow them to experience the role of an adviser and engage in conversations with virtual clients through a series of multiple-choice questions. They can then watch the encounter back to increase their understanding from a client’s point of view and also receive feedback by hearing their clients’ thoughts played out.

The new programme has enabled the SJP Academy to double its intake this year to 400 delegates across 22 locations. The immersive learning experience, created with VR specialists Make Real and 55EFIVE in collaboration with experts within SJP, uses 200 Oculus Quest headsets, with 50 more being rolled out in the coming months.

With VR training continuously tested in the field, the team have developed new characters and experiences, with greater diversity of clients and scenarios to support all aspects of the business to drive commercial performance and operational efficiency.

Di Macdonald, Divisional Director of Learning & Development at St. James’s Place, comments: “The intention is to give people a safe space to practice in, so that they can gain confidence without the need for access to trainers, coaches or peers. It also enables us to utilise resources more effectively and train more people in a shorter space of time. We are able to enhance existing soft skills training and capture areas that may need more practice than others.

“This technology is improving rapidly, and is becoming more affordable, better quality and easier to use. Our continuing research and development programme is working to ensure that we can further enhance what is on offer. “

Related News

- 02:00 am

- City Possible network expands to over 300 members around the world

- New City Possible Advisory Board formed to guide a sustainable and inclusive future for cities

- Second annual City Possible Summit taking place in hybrid format, in partnership with Smart City Expo World Congress

Mastercard has continued to expand its support for addressing urban challenges and inequalities, working with city leaders and partners around the world, through the City Possible™ network and capabilities. The unique solutions now reach over 600 communities in more than 50 countries across six continents, helping to foster collaboration and co-creation, drive inclusive economic development, and build resilient communities.

City Possible, a partnership model pioneered by Mastercard, has grown from 16 founding members at launch three years ago to 310 city members and candidate cities. As well as welcoming new city members – such as Bogota, Colombia; the High Line in New York City; Nur-Sultan in Kazakhstan; the San Diego Cyber Center of Excellence; and The Smart City Association Italy formed of 38 cities across Italy – a number of industry and multilateral partners have also joined the network including the Inter-American Development Bank (IDB) and Citi.

Alongside this, 390 cities are leveraging Mastercard’s transit solutions, as the company takes an integrated approach to mobility to accelerate contactless payments on all forms of public transport. Mastercard is working with a range of partners across the ecosystem to deliver a consistent and seamless way to pay, whether it be buses, trains or micro-mobility such as bikes and scooters.

The newly launched City Possible Advisory Board are representatives from some of the world’s most innovative cities to provide guidance to the City Possible network and drive solution-oriented initiatives to solve the biggest challenges facing cities today. Founding Advisory Board members comprise representatives from City Possible members globally – including Curitiba and Novo Hamburgo in Brazil; Dublin City Council, Ireland; City of Hamilton, Canada; the North Texas Innovation Alliance; and The Smart City Association Italy - with the first meeting to be held later this year.

“Technology innovation has a vital role to play in solving big urban problems, in particular by bringing together the scale, expertise and reach of public and private organizations,” commented Carlos Menendez, President, Enterprise Partnerships at Mastercard. “Through City Possible, we’re focused on delivering innovation, flexibility and trust and, as the network continues to expand, we see increasing opportunities to support each other’s work to make our cities more sustainable and inclusive.”

City Insights: Data-driven insights, tools and solution

Since launch in November 2020, the City Insights digital marketplace has rapidly expanded with over 20 data-driven tools and solutions, including data insights, cybersecurity solutions, and small business resources that are designed specifically for the public sector, contributed by Mastercard and technology partners. More than 50 state and city governments are leveraging the applications from contributors such as Bright Cities, the Cyber Readiness Institute, the Global Cyber Alliance, Marketplace.city, Venture Forward by GoDaddy, UrbanFootprint, and Zencity.

City Key: Integrated access to services

Mastercard City Key™ is a digital-first payment and ID solution that enables residents and small businesses to access the economic, social, and cultural services they need, while at the same time making city operations more efficient. Today, over 2.7 million people in more than sixty locations worldwide have used Mastercard City Key cards to access financial aid and services, with 35 new city partnerships signed so far in 2021, including São Paulo, New Orleans and Egypt’s New Administrative Capital.

During this year, Mastercard has worked closely with cities and partners around the world to draw on the collective expertise and resources of all stakeholders to build innovative solutions which support the vulnerable communities that have been most impacted by the pandemic.

For example, in Los Angeles, Mastercard worked with the Mayor’s Office and Mobility Capital Finance, Inc (MoCaFi) on the launch of Angeleno Connect debit card and mobile app, which is being used to disburse financial assistance directly, connect residents to city services and offer free financial services to unbanked Angelenos.

City Possible Summit: Hybrid community engagement

At this year’s Smart City Expo World Congress in Barcelona, City Possible is showcasing how city leaders, private sector companies and many others are coming together to combine strengths and find solutions to enable innovation, accelerate digital access and foster an inclusive economic recovery.

Through a hybrid format, the City Possible Summit will engage the community in-person and virtually. Ten engaging live sessions, featuring a world-class speaker line-up and focused on near-term challenges as well as longer-term planning, will cover topics such as ensuring an inclusive economic recovery, enabling small businesses, future-proofing social infrastructure, and managing priorities such cybersecurity, environmental sustainability and urban mobility.

For those participating in the Smart City Expo World Congress in person, the City Possible Plaza will act as a meeting point for city leaders and partners from around the world as well as bringing to life the work being done by Mastercard and City Possible network participants.

Related News

- 03:00 am

Fujitsu Limited and BGN Technologies, the technology transfer company of Ben-Gurion University of the Negev (BGU), have signed a three-year comprehensive joint research agreement to develop technologies and solutions to contribute to the realization of safe, real-world applications of AI and machine learning technologies. The newly-established "Fujitsu Cybersecurity Center of Excellence in Israel" (Fujitsu CCoE IL) hosts a team of approximately 20 researchers including Prof. Yuval Elovici and Prof. Asaf Shabtai. The lab is headed by Prof. Elovici, Department of Information Systems Engineering and Head of BGU's Cyber Security Research Center located at the Cyber@BGU labs in the advanced technology park at the university's campus in Israel.

With this initiative, Fujitsu and Ben-Gurion University aim to accelerate joint research and development into technologies that offer solutions to threats posed to AI models and machine learning, improving the trustworthiness and security of AI-based systems and software that increasingly impact our daily lives.

Vivek Mahajan, Chief Technology Officer of Fujitsu Limited commented, "We are delighted to collaborate with Ben-Gurion University, which boasts world-class software development capabilities in the security field. I'm confident that the establishment of the Fujitsu CCoE IL will yield a variety of promising new security technologies for AI, and I look forward to a fruitful partnership with Ben-Gurion University as we work in tandem to resolve some of the challenges facing our increasingly digitized society."

Prof. Yuval Elovici, said, "We are excited to enhance our collaboration with Fujitsu, a world-leading information and communications technology company. Together we can make systems that are based on AI more robust to attacks that focus on the AI component."

"This joint strategic research collaboration is a testament to Ben-Gurion University's leadership in the cybersecurity space," added Josh Peleg, CEO, BGN Technologies. "The multi-year collaboration will improve AI security and help create a safer world while strengthening the University's positioning as a global player in the AI, machine learning and cybersecurity arenas."

Growing Opportunities, Growing Threats

AI and machine learning technologies play a growing role in society, with promising applications emerging that will increasingly affect our daily lives, including the improvement of public safety through analysis of human behavior in surveillance video data, product quality control through the detection of abnormalities, product recommendations, as well as to improvement of autonomous driving.

With the growth and expansion of these technologies, however, the need to improve AI security represents an urgent priority. Hostile entities use increasingly sophisticated techniques to threaten critical infrastructure and systems by stealing and leaking confidential information contained in AI datasets. For instance, adding special noises to video data can cause the AI to misidentify people or misdetect actions. Fujitsu CCoE IL will address these issues through research on AI security to detect such attacks, protect against adversarial access to AI systems, and to make the models more robust against attacks.

As part of their new partnership, Fujitsu and BGU will focus on research that confronts these threats to make AI technologies safer and more trustworthy. For one of the Center's initial research projects, researchers from Fujitsu and Ben-Gurion University will apply an AI model (Out of Distribution detection model (1)) that can detect new, unknown types of threats, such as attacks on drones and fraud in network communications and develop technologies able to appropriately cope with the rapidly evolving attack methods. The Out of Distribution detection model will additionally be applied to detect product malfunctions in cases where unexpected data appears intentionally or accidently.

Outline of the Joint Research

1. Length of contract: Three years

2. Roles and responsibilities:

Fujitsu:

Development of security technologies for AI-based systems and software

Examination of scenarios for technology verification

Support for verification and evaluation

Ben-Gurion University:

Development of security technologies for AI-based systems and software

Research, verification, and evaluation of security technologies for AI-implemented systems and software

3. Research Contents:

The two partners will conduct trials at the Fujitsu CCoE IL in Israel simulating various cases of security threats to AI and will promote advanced research toward the establishment of technologies to defend against such threats.

Future Plans

Fujitsu and Ben-Gurion University will promote research and development activities at the Fujitsu CCoE IL in order to realize AI security technologies applicable to a wide range of fields with the ultimate objective of delivering advanced solutions for the global market that will contribute to the solution of various social issues.

(1) Out of Distribution detection model:

Generic term for a model to detect data that has not been expected at the time of AI learning. One of the methods to deal with unknown data and used to detect new methods of cyber attacks and abnormalities of products.

Related News

- 01:00 am

Hire of senior fixed income expert will support the US expansion of LedgerEdge

LedgerEdge is creating a new ecosystem for the corporate bond market with a trading model using distributed ledger technology

LedgerEdge, the next-generation ecosystem for corporate bond trading, today announced that it has appointed the senior fixed income leader Dom Holland to the role of Business Development for the US. In this role, Dom will report to Michelle Neal, who was appointed US CEO in July 2021.

This appointment will support the US expansion of the firm, which is rolling out a global corporate bond trading platform built on distributed ledger technology. LedgerEdge is launching a UK multi-lateral trading facility followed by a launch of a US alternative trading system in Q1 2022.

LedgerEdge was founded in 2020 to address historic market structure issues by creating a new ecosystem in which participants maintain control of their data, see the market more clearly, and unlock liquidity in the $41 trillion global corporate bond market.

Dom brings over 15 years of senior leadership to his new role. Dom was previously Head of Fixed Income Electronic Markets at BNY Mellon, and prior to that held senior roles at Deutsche Bank and RBC Capital Markets. He is currently an adviser to River Avenue, Bond 180 and Strategic Ratings.

David Nicol, CEO and Co-Founder of LedgerEdge, said: “Dom’s extensive network and reputation as an innovator in bond trading will prove invaluable to the firm as we build our US business.”

“Dom’s deep credibility in credit markets, coupled with a focus on client relationships are crucial to the next chapters of growth in the US,” said Michelle Neal, CEO, US LedgerEdge.

Related News

- 07:00 am

- One of the world’s fastest growing FinTechs having added 1.5 million customers in the last 6 months alone.

- Accelerating customer growth driven by strategic investment following landmark $125M Series B funding round in May 2021.

- Investment and innovation driving financial inclusion, set to unlock $5.4bn in annual savings for consumers and SMEs by 2025.

Paysend, the card-to-card pioneer and international payments platform, announces that it has reached five million customers, with one and a half million customers joining in the last six months alone. Founded less than five years ago, this makes Paysend one of the world’s fastest growing FinTechs.

Paysend’s platform is unique, owning the entire payment value chain. It removes the need for third-party acquirers or processors which increase cost and complexity, delivering savings and efficiency for consumers and SMEs. Accessible from any mobile device, customers can reach over 135 countries around the world for as little as 1 USD.

Paysend is committed to growing organically and has maintained positive unit economics since inception, with industry leading customer acquisition costs of less than $10 per customer. The five million customer milestone follows continued investment in technology, innovation and expansion that is increasing financial inclusion at scale.

Paysend has continually re-invested in people and proprietary technology to build capabilities that maximise customer value, with independent consumer review firm Trustpilot rating the company highly for convenience, speed and value. In 2021, the company has made significant progress in expanding and enhancing its global payment network with Plaid, Mastercard and Visa, and has significantly increased headcount to over 500 people across the globe, focussed on mobilising key target regions including North America, the Middle East and Asia-Pacific.

The international payments market today remains expensive and inefficient for users with significant barriers to entry for many people. 70% of international payments are currently still cash-to-cash, inflicting consumers and SMEs with high fees that average up to 5.2% per transaction and an hour spent by both the sender and recipient to complete each transfer.

Paysend’s next generation payments platform slashes fees by as much as 60%, with instant transfers through the Paysend app; unlocking up to $5.4bn in annual savings for consumers and SMEs by 2025 and saving millions of hours of process administration.

Paysend’s platform can reduce economic barriers to entry in the payments market by providing immediate access to transfer money to any card holder around the world, connecting 12bn consumers and businesses globally.

Ronnie Millar, CEO at Paysend, commented:

“Reaching five million customers in under five years is testament to the unique capabilities and customer value Paysend offers versus current payments alternatives. Our vision is to create the next generation integrated global payment ecosystem, enabling individuals and businesses to pay and send anywhere, anyhow and in any currency. Our platform helps to connect millions of ordinary people and businesses, increasing financial inclusion worldwide.

We are targeting the $133tn opportunity1 in cross-border payment flows through our vertically integrated platform and innovative card-to-card payments solution. We believe we have only scratched the surface of our potential scale and reach and are continuing to invest in bright and diverse talent, market-leading innovation and expansion into new markets. I am hugely excited by our potential to improve payments services for customers everywhere.”

Related News

- 02:00 am

Temenos cements its industry leadership position as one of the two companies in the Software and Services category in DJSI World, the world’s most influential ESG index

Temenos (SIX: TEMN), the banking software company, today announced that it has been recognized as a sustainability leader in the Software and Services Category for Dow Jones Sustainability World Index (DJSI) for the third year running and in the DJSI Europe Index for the second consecutive year.[1]

Temenos maintained its industry leadership as one of the two companies in the software category in DJSI World, which is considered a gold standard for measuring environmental, social and governance (ESG) corporate practices.

Temenos scored 76 (out of 100) in the 2021 S&P Global Corporate Sustainability Assessment (Score date: Nov 12, 2021). Temenos’ scorecard was in the top decile (96-100%) in 18 out of 20 criteria demonstrating the company’s leadership in environmental and social reporting (maintained full score for 100/100%) as well as a strong Y-o-Y increase in corporate governance, tax strategy and governance, privacy protection, operational eco-efficiency, climate change, labor practice indicators and human capital development. Overall, Temenos performed in the 99th percentile in the Software and Services industry of the 109 assessed companies in the S&P Global Corporate Sustainability assessment.

Max Chuard, Chief Executive Officer, Temenos, said: “We are honored that our ESG leadership has been recognized for a third year in a row in the S&P Dow Jones Sustainability World and Europe Indices. Sustainability is a strategic priority for Temenos. Apart from our solid commitment to operate sustainably and responsibly, we innovate to develop solutions to new business and social challenges and help our clients transform into smart, sustainable organizations. Banking and technology are powerful forces for change and can advance sustainable development. We are committed to supporting this, by reducing our own carbon footprint, and by creating environmental and financial inclusion benefits for our clients by leveraging our green cloud technology. For example, with The Temenos Banking Cloud we help banks become more operationally efficient and sustainable by reducing their carbon footprint, improving their operational and environmental performance, reaching their sustainability targets and addressing global social and environmental issues.”

For the results published November 12, 2021, more than 10,000 publicly traded companies across 61 industries were invited to participate in the S&P Global Corporate Sustainability Assessment (CSA), with the top 10% to be included as DJSI members.

Manjit Jus, Global Head of ESG Research, S&P Global: "We congratulate Temenos for being included in the DJSI World and DJSI Europe. DJSI distinction is a reflection of being a sustainability leader in your industry. The record number of companies participating in the 2021 S&P Global Corporate Sustainability Assessment is testament to the growing movement for ESG disclosure and transparency."

Temenos is included in the SXI Switzerland Sustainability 25® Index, among the 25 Swiss stocks from the SMI® Expanded Index with the best sustainability scores. Temenos has also been included in the FTSE4Good Index Series and been rated as PRIME by ISS ESG Corporate Rating for its sustainability performance. Temenos also obtained a platinum recognition by EcoVadis for its CSR performance.

Related News

- 07:00 am

Simplilearn, a global digital skills training provider, today launched its Professional Certificate in Cloud Computing in collaboration with the University Of California Irvine (UCI), Division of Continuing Education (DCE). The program is designed for professionals who want to upskill in emerging cloud technologies and is best suited for middle and top management professionals with over eight years of work experience. This comprehensive program offers learners the benefit of UCI's academic excellence and Simplilearn's award-winning curriculum to develop a set of in-demand cloud-related skills and accelerate their career trajectory.

With 100+ hours of core learning, this six-month intensive Professional Certificate in Cloud Computing is delivered via Simplilearn's high-engagement bootcamp-style learning delivery model. This model provides learners with an effective combination of self-paced videos, instructor-led live virtual classrooms, and interactive labs. The course is divided into four components: prerequisite courses, mandatory courses, and a capstone project that offers students an opportunity to solve real-world challenges in cloud architecture. The learners will also benefit from the exclusive master classes conducted by the UCI's faculty.

Speaking about the program, Anand Narayanan, Chief Product Officer, Simplilearn, said, "Cloud has been a critical topic among CIOs and IT decision-makers for the past decade. The global pandemic has only served to further drive organizations of all sizes across all sectors to adopt digital and cloud-based technologies in a secure and scalable manner. To address this need, we are happy to collaborate with the UCI DCE to offer a comprehensive Professional Certificate in Cloud Computing. This in-depth program will provide extensive knowledge to learners and open new growth opportunities for them."

Upon completion, program graduates will receive a Professional Certificate in Cloud Computing from the University of California Irvine, Division of Continuing Education along with Alumni Status in the DCE chapter to enable interaction amongst the UC Irvine community. Learners will get continuing education credits on program completion which will demonstrate their commitment to ongoing learning. Learners in India will be enrolled in Simplilearn's Job Assistance service.

Speaking on the partnership with Simplilearn, Stephane Muller, Directory of Business and Technology Programs at the UCI DCE said, "Owing to the current scenario, Cloud has become a critical technology domain. From allowing online learning to supporting remote work, Cloud has emerged as indispensable in the pandemic and post-pandemic for business survival. Seeing the surge in demand for Cloud services, it's clear that graduates and young professionals should understand and pursue careers in this domain. We are delighted to partner with Simplilearn to deliver the most updated industry-relevant curriculum to learners and create a job-ready workforce in this field."

Simplilearn conducts more than 1,500 live classes, with an average of 70,000 learners who together spend more than 500,000 hours each month on the platform. Programs offered by Simplilearn give learners the opportunity to upskill and get certified in popular domains.