Published

- 08:00 am

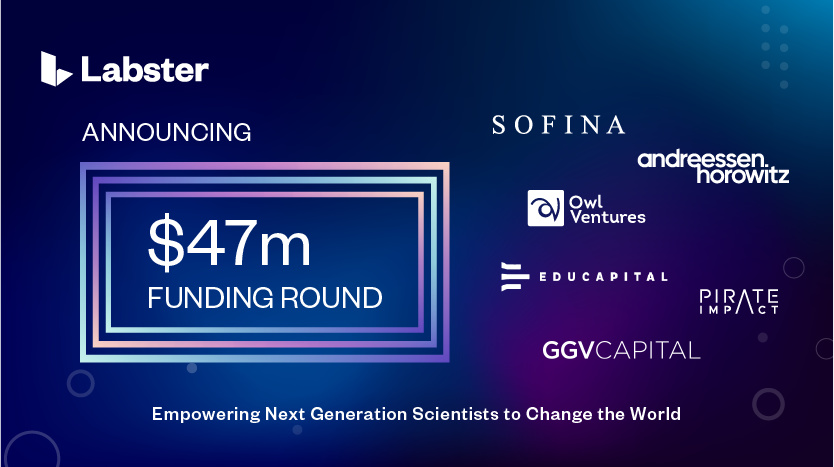

With new investors including Sofina Group, total investment hits $147 million

Labster, the world's leading platform for virtual labs and interactive science, has raised $47 million in additional funding to support massive growth opportunities worldwide. This new capital infusion will enable Labster to further develop in Europe and the United States and to establish itself within Asia and Latin America. By investing more funds into its library of science simulations and expanding its reach to younger students and adult workforce skills training, Labster will be able to serve 100 million students around the world through its institutional and government partnerships.

Total investment in Labster now stands at $147 million. This new financing tranche is sourced from new investors: Sofina Group and Pirate Impact, along with fresh infusions from existing investors: Owl Ventures, Andreessen Horowitz, EduCapital, NPF Technologies, and GGV Capital. They are joining the Series C round announced in 2021 led by Andreessen Horowitz. Additional investors included Balderton Capital, Northzone, Swisscom Ventures, and David Helgason, founder of Unity Technologies.

"As a contributor to sustainable development, Sofina is proud to support Labster's vision of empowering millions of students with an engaging STEM learning experience," said Bertrand Fawe, investment manager at Sofina Group. "The use of immersive virtual reality technology will continue to play a growing role in the delivery of education."

“Labster's mission is to provide all students, regardless of socioeconomic status or geographic location, with equitable access to high-quality engaging science education and virtual laboratories — an ongoing critical need accelerated by the pandemic and now rapidly growing globally as digitalization of the education sector with hybrid and remote learning continues,” said Michael Bodekaer Jensen, co-founder and CEO of Labster. “This additional funding will help us to continue growing our support for a broader group of students, teachers, and educational institutions around the world to make our mission a reality. There has been a fundamental change in the nature of education over the last two years that confirms the high value and impact on student engagement and learning outcomes of virtual educational simulations offered in tandem with in-person, teacher-led coursework in a post-pandemic world.”

Related News

- 05:00 am

Citi today announced that it has reached an agreement with Axis Bank Limited (Axis) for the sale of Citi’s consumer businesses in India. Axis was selected by Citi following an extensive and competitive auction process.

The transaction comprises the sale of the consumer banking businesses of Citibank India, which includes credit cards, retail banking, wealth management and consumer loans. The transaction also includes the sale of the consumer business of Citi’s non-banking financial company, Citicorp Finance (India) Limited, comprising the asset-backed financing business, which includes commercial vehicle and construction equipment loans, as well as the personal loans portfolio. It excludes Citi’s institutional client businesses in India; Citi remains committed and focused on serving institutional clients in India and globally.

The transaction will also include approximately 3,600 Citi employees supporting the consumer businesses in India, who will transfer to Axis upon completion of the proposed transaction. Axis will pay to Citi cash consideration of approximately US$1.6 billion for the acquisition of the consumer business, subject to customary closing adjustments.

The transaction is expected to close in the first half of calendar year 2023 subject to requisite regulatory approvals. This announcement is only the start of a process, and while there will be a transition, Citi will ensure that it is done in as seamless a manner as possible, with due notice. There will be no immediate impact on the services to the customers of Citi’s consumer businesses in India.

Upon closing, Citi expects the transaction to result in the release of approximately US$800 million of allocated tangible common equity. As was previously announced, Citi’s global exit from its consumer banking franchises in 13 markets across Asia and EMEA is expected to release approximately US$7 billion of allocated tangible common equity over time.

Peter Babej, Citi Asia Pacific CEO, said, “Our announced transaction with Axis, a leader in Indian financial services, represents an important milestone for our franchise and offers an excellent opportunity to our consumer banking colleagues in India. As we move forward with this transaction, India remains a key institutional market for Citi. In line with our broader strategic repositioning, we will continue to support our institutional clients in this core market and across APAC, delivering the full power of our global network to enable their growth.”

Citi has been present in India since 1902 and is a banker of choice for large and mid-sized corporates, financial institutions and multinational companies operating in the country. It has a market leading Corporate Bank in India that is the largest in APAC. Citi serves over 2000 international corporations in India and 300+ large domestic companies and financial institutions. It helps corporations raise capital (debt and equity) and provides financing solutions, besides working with them on risk management and transaction banking. Citi is actively engaged in various government initiatives, including working with our clients to channelize foreign capital through FDI investments under the PLI (Performance Linked Incentive) scheme of the Government of India, as well as FII / FPI flows into the country.

“We are extremely pleased with this outcome for our consumer colleagues and clients. Axis is committed to building its consumer banking business in India and is backed by a strong market presence. We believe Axis will provide our employees an excellent environment to build their careers and will meet all the financial needs of our consumer clients,” said Titi Cole, CEO of Legacy Franchises at Citi.

“This is a positive outcome for our staff and our priority has been on securing their future. We continue to remain committed to contributing to India’s growth and development as we deepen our presence through our institutional businesses and our community initiatives. Citi will also continue to harness India’s rich talent pool in the areas of Technology, Operations, Analytics, Finance and allied functional areas through its network of Citi Solution Centers that are located in five cities in India and support our global businesses,” said Citi India CEO Ashu Khullar.

With a physical presence in 95 countries, Citi works closely with global clients, attracting both FDI and FPI flows and showcasing India as a key global supply chain destination, while facilitating investments into the country across asset classes. Citi is a partner to its clients’ digital and ESG journeys with custom solutions, that in turn support inclusion and sustainability.

As a leading investment bank for over 15 years in India, in 2021 alone, Citi has helped raise over US$29 billion of capital across over 40 equity and debt transactions and provided strategic M&A advisory on seven announced transactions, amounting to over US$5 billion. Citi also handles 8% of India's trade flows and 5% of the country’s electronic payments flows. Citi supports foreign portfolio investors to get access to Indian markets – managing about a third of their activities in India as a custodian.

Citi’s Banking, Capital Markets and Advisory Group is acting as exclusive financial advisor to Citi in respect of the transaction.

Related News

- 03:00 am

Budget Insight raises $35 million in funding from PSG Equity to become one of Europe’s Open Finance leaders

- The management team and Crédit Mutuel Arkéa will remain shareholders alongside PSG Equity.

- A clear ambition: to emerge as Europe’s leader in Open Finance, a sector currently consolidating around a handful of big players.

- An ambitious business development strategy driven by inorganic growth and a sustained investment plan.

- Budget Insight plans to hire 50 people this year.

Budget Insight, the leading aggregator of banking and financial data in France and a pioneer of Open Finance in Europe, is pleased to announce $35m (€31m) in funding from PSG Equity (“PSG”), a leading growth equity firm partnering with software and technology-enabled services companies to help accelerate their growth and build scale across Europe and the US. PSG will be a shareholder alongside the management team and Crédit Mutuel Arkéa. Crédit Mutuel Arkéa invested in Budget Insight in 2019 due to Budget Insight’s strong growth potential and the natural synergies arising from the combination of the two players. The investment helped Budget Insight cement its technological edge and pave the way for its new stage of expansion on a European scale. Going forward, Crédit Mutuel Arkéa will continue to partner with Budget Insight to help drive innovation in the financial services industry.

Budget Insight is a fintech company founded in 2012. It quickly established itself in the Open Finance sector as one of France’s leading aggregators of banking and financial data. The company provides tech solutions for an ecosystem of more than 200 businesses and institutions, including some of the largest French banks, insurers, and asset managers, along with several other leading names in fintech.

The Budget Insight API enables clients (banks, fintech firms, lenders, asset managers and software companies) and their end users to aggregate financial data and documents, and initiate payments. Thanks to its powerful technologies, its ability to offer a seamless user experience, and its expertise in European regulatory requirements, Budget Insight aims to give its clients the tools needed to unlock more value for users of financial services. Its solutions cover a wide array of services ranging from asset management and credit to corporate cash management, loyalty and payments.

This new partnership strives to allow Budget Insight to develop new products and significantly expand its European reach, thereby cementing its position amongst the leaders of Open Finance, an industry which is currently consolidating around a handful of big players. To support this phase of acceleration, Budget Insight plans to significantly increase its workforce by 2025. The company has already announced 50 positions to be filled in 2022, to grow its tech, product and sales teams.

Since its inception, PSG has worked with software companies to accelerate their growth and empowered them to gain significant market share with a view to market consolidation. PSG teams work hand in hand with business leaders and management teams to help them hone their strategy, drawing from their strength in M&A and international expansion, especially in Europe and the United States, while pursuing a sustained investment plan. Budget Insight is PSG’s 6th investment in France and its 16th investment in Europe.

“I’m more than pleased with the way this adventure has unfolded since it began, over a decade ago. Our past and future accomplishments are based on our technological prowess and our ability to offer one of the best Open Finance technologies on the market. And for that, we know we can count on our amazing, fast-growing team!” Romain Bignon, Founder, Budget Insight.

“PSG’s arrival marks a new milestone for Budget Insight, whose ambition is crystal clear: to become a European champion in Open Finance. We believe that we have everything we need to achieve this: a B2B model tried and tested over the past 10 years, cutting-edge technology and deep sectorial expertise that goes beyond Open Banking, a rich ecosystem of more than 200 partners, and shareholders who share our vision. I’m really thrilled to begin this new chapter in our story!” Bertrand Jeannet, CEO, Budget Insight.

“Budget Insight is, in our view, strategically positioned in a financial services market that is undergoing profound transformation with the development of Open Finance. We firmly believe that the market in Europe will consolidate around a limited number of key players, including Budget Insight. We were attracted by Budget Insight’s commitment and ambition to provide financial services companies and institutions with secure, comprehensive connectivity and strong added value. Our support should help the business to rapidly develop its presence in Europe and further expand its offering.” Romain Railhac, Managing Director, PSG.

“We’re proud of how far Budget Insight has come and are happy to support this new phase in its development. The partnership we began three years ago has enabled us to achieve strong, sustainable synergies to provide a richer, more seamless client experience. Budget Insight has consolidated its technological lead, accelerated its development in France and begun expanding in Europe. We believe it is now ready to tackle this new phase of growth on a European scale, with the goal of becoming a leading example of Open Finance services. Crédit Mutuel Arkéa will support this ambition, alongside PSG Equity, with the same conviction it has shown since investing in the company.” Frédéric Laurent, Executive Deputy Manager and head of the Retail Customer Division at Crédit Mutuel Arkéa.

The transaction is subject to the authorization of France’s Autorité de Contrôle Prudentiel et de Résolution (ACPR).

Related News

- 06:00 am

TransFICC, the specialist provider of low-latency connectivity and workflow services for Fixed Income and Derivatives Markets, has closed a Series A extension for $17 million. Led by AlbionVC, all existing institutional shareholders took part in this investment round, which follows the original Series A for $7.8 million, announced in April 2020.

TransFICC’s investors are AlbionVC, Citi, HSBC, Illuminate Financial, ING Ventures, and Main Incubator (the Early Stage CVC unit of Commerzbank Group).

The new investment will primarily be used to expand TransFICC’s Engineering teams, to support additional venue connectivity and automated workflows in US Rates and Credit markets, including US Treasuries, High Yield, Investment Grade, IRS, Repos, Munis, MBS and CDS products. Additionally, new products will be developed, which includes a complete e-trading system, incorporating a Trader desktop interface. The investment will also fund new sales and customer support teams, aligned with an ambitious growth strategy and geographical expansion through new data centres in North America and Continental Europe.

TransFICC resolves the issue of fragmentation in Fixed Income markets by providing banks and asset managers with a unified low-latency, robust and scalable API. Its ‘One API for eTrading’ platform provides connectivity to multiple electronic trading venues while supporting a variety of workflows across Fixed Income products. TransFICC enables financial institutions to access their required eTrading venues, while streamlining technology requirements and reducing operational costs.

TransFICC’s clients include eight top tier investment banks and two of the largest Exchange groups.

“As banks and asset managers focus on automating trading workflows to deliver increased efficiency, TransFICC’s ‘One API’ has been implemented at some of the largest Fixed Income trading banks and Exchanges,” said Steve Toland, co-Founder of TransFICC. “As we build on this success, we are very happy to have attracted additional investment from our existing shareholders, which will be used to expand our Engineering teams, develop new products, open new offices in New York and Brussels, and add to our salesforce.”

“We have already built a modern, robust and cost-effective alternative to legacy systems, but driven by client requirements we are expanding our product suite to deliver a full e-trading system, which will enable clients to also trade manually using our software,” said Tom McKee, co-Founder of TransFICC. “As we add more clients and automate more complex workflows it is also important that we continue to invest in our technology platform, to deliver fast and scalable technology, which keeps pace with microsecond price updates and provides an audit trail for Best Execution.”

“TransFICC’s one API for e-trading service has a huge opportunity to become the defacto standard API gateway between banks and trading venues. Our faith in the API’s superiority and future success is borne out by the eight banks and two Exchanges that are now using it, as well as the long pipeline of prospective clients,” said Cat McDonald, Investor at AlbionVC who joins TransFICC’s Board. “We expect TransFICC’s service to continue outperforming against expectations, thereby confirming the industry-changing nature of what Steve and the team have created.”

“The market structure in Fixed Income is evolving rapidly, and trading firms need modern, simple and innovative technology solutions to automate their trading workflows and quickly connect with numerous venues. TransFICC has been leading the way in API translation and continues to develop new products in response to client demand,” said Jonathan Lofthouse, Global Head of Markets Technology at Citi.

“This additional investment will let TransFICC further extend its connectivity reach and build additional components of the electronic trading stack. Having new UI’s and tools will make it even easier for TransFICC’s clients to adopt their technology and we are very excited to be working with them,” said Seth Osher, Global Head of Flow Fixed Income IT at HSBC.

Related News

- 03:00 am

The new, free service is available to all Qred VISA holders and will allow businesses to swiftly pay any invoice directly from the Qred app and benefit from up to 45 days interest free liquidity.

Qred is pleased to announce a brand new payments platform specifically designed to help small businesses free up short-term capital and save them time when paying bills.

The new service, which will be available via Qred’s app, will allow businesses to pay any invoice they have - whether it’s an electricity bill, to pay for supplies or inventory - with the Qred VISA card enjoying up to 45 days interest free credit. And best of all, there are zero additional fees charged.

“Tens of billions of dollars worth of invoices are issued each year and for most businesses the only way to pay them is to use cash directly from their account since most suppliers or vendors don’t accept card payments. With our new payment platform, small businesses can use their Qred VISA to pay any invoice they have with much more flexible payment terms. This frees up much needed, short-term cash which is the life blood of most entrepreneurs.” says Emil Sunvisson, CEO of Qred.

The new payment service is immediately available to all Qred VISA card holders and can be accessed via Qred’s App. Additional payment options will be added in the near future.

Read more at: https://en.qred.se/pay-invoices-with-creditcard

To help power the launch of this platform and Qred's continued overall growth, we are pleased to announce that Nordic Capital is investing a further €10m of capital as part of its ongoing support and commitment. This additional investment will allow Qred to continue to deliver innovative products and services to small businesses throughout Northern Europe.

The Board of Directors of Qred Holding AB (publ), Reg. No. 559031-0685, has resolved to recommend a directed issue, raising a total of EUR 10m for Qred. The issue is directed to, and will be fully subscribed by, Nordic Capital Evolution.

The issue is subject to shareholder approval at an extraordinary general meeting on 19 April, 2022.

Related News

- 03:00 am

Payment fraud is a nightmare scenario for any business. Irrespective of size, companies face substantial financial and reputational harm resulting from fraudulent activity. Depending on the severity of the crime and the losses incurred, the very survival of the business may be at stake.

Ryan Mer, CEO at eftsure Africa, a Know Your Payee™ (KYP) platform provider, says banking and payment fraud remains a serious concern as fraudsters use increasingly sophisticated methods to exploit process vulnerabilities and take advantage of human error.

A 2021 TransUnion report noted a significant surge in fraud and criminal activity related to financial services in South Africa, with fraud in this sector surging over 187% in the last year. An Accenture report from the previous year confirms South Africa had the third most cybercrime victims globally, resulting in losses topping R2.2 billion.

“The risk of payment fraud is not limited to any one sector or industry. Any business that makes use of internet banking or EFT facilities is vulnerable. Fake invoices, Business Email Compromise (BEC), and even insider scams have become worryingly commonplace,” says Mer.

What to do when the worst happens

Payment fraud happens most frequently when companies are paying invoices or doing payment runs. Mer says it’s important to remember banks require only the account number and branch code to process an EFT payment. This means the onus of making sure all payment details are correct, and haven’t been altered or manipulated, is on the payer.

When payment fraud is discovered it’s vital to act quickly and methodically:

- Contact the bank immediately to freeze payments and/or accounts to prevent further monies from being stolen.

- Gather as much paperwork and bookkeeping relating to the theft as possible.

- In the event of internal fraud, ensure any laptops, tablets and mobile phones of employees are recovered and safely stored.

- Open a police docket as soon as possible.

- Contact the Southern African Fraud Prevention Service (SAFPS).

Prevention is better than cure

While there is a small possibility stolen money can be recovered, it is mostly not the case as the stolen funds are withdrawn very quickly. In any event, Mer says the process is likely to be time-consuming and costly. “Strict banking terms and conditions place responsibility on the account holder making EFT payments to ensure the accuracy and integrity of payee details. An additional challenge is the unfortunate reality of the South African Police Service (SAPS) being understaffed and under-resourced to deal with crimes of this nature.”

“Creating a fraud prevention ecosystem is the most effective way to mitigate risk and stop payment scams in their tracks. Even the best ERP systems cannot protect you from a malicious employee while a platform like eftsure can help limit the risks of internal fraud and BEC attacks by quickly and easily cross-referencing the payments an organisation makes with verified bank account details, before every payment is released,” he adds.

“Given the potential losses and the onerous process with no guarantees of recovering stolen funds, real-time prevention at the point of compromise just makes good business sense,” says Mer.

Related News

- 08:00 am

Digital identity and possession factor APIs provide powerful new authentication tools to help companies fight the growing threat of cybercrime

tru.ID exists to help companies solve the $1trillion threat of cybercrime attacks on customers and employees. In today’s post-COVID hybrid world, legacy authentication methods, using passwords and PIN codes sent by email or SMS, are no longer fit for purpose – they are vulnerable to criminal attacks such as phishing and provide a poor user experience. Businesses have been trying to replace passwords for years, but have failed to find a secure and scalable solution. Now, the answer is here, combining the ubiquity of the mobile phone with the cryptographic security of the SIM card.

Paul McGuire, co-founder and CEO of tru.ID, says: “Cybercrime threatens all online businesses. The annual cost is estimated to be over $1trillion and increasing. One of the biggest vulnerabilities is the password. But finding a more secure alternative that is easy to use and widely available has proved impossible – until now. tru.ID brings a new solution that the world urgently needs: strong online security that is easy to use and already in everyone’s pocket.”

The SIM card is the same highly secure technology that is in every credit card, and there are already 5bn+ SIM cards deployed. That means every customer and every employee already has a cryptographically secure digital identity token in their pocket. tru.ID makes this revolutionary new security solution available through an API-based SaaS platform.

tru.ID is already live in 20 markets and continues to build out its network.

Rob Rueckert, Partner at Sorenson Ventures, comments: “Today, doing business online or working remotely means a constant threat of cyberattacks. Finding a solution that is effective and usable for customers and employees is an urgent and unsolved problem for businesses of every size. tru.ID brings a new and potentially transformative approach, leveraging the security & ubiquity of the SIM card through a modern, API platform. We are delighted to be backing this experienced team and to already see the significant traction they have achieved since we made our investment.”

Related News

- 07:00 am

- Acquisition built on a successful existing partnership

- Demonstrates SAP Fioneer’s commitment to innovation in financial services

- okadis brings expertise in financial accounting, regulatory reporting and analytical banking within the German financial services industry

SAP Fioneer, the leading global provider of financial services software solutions and platforms, has acquired a majority stake in okadis Consulting GmbH, the consulting company and SAP software house based near Frankfurt, Germany.

The acquisition is built on an already successful and proven partnership and demonstrates SAP Fioneer’s commitment to innovation and developing state-of-the-art software solutions for financial services. Since 2003, okadis has provided SAP consulting, application services, additional products and solutions to customers that run on SAP’s financial software. With this addition to the SAP Fioneer family comes a team of highly skilled employees specialized in SAP Fioneer’s product portfolio.

Dirk Kruse, CEO at SAP Fioneer, said: “This acquisition is highly strategic and sends a positive message to the market that underlines our commitment to constantly innovating and enriching our portfolio of solutions. The okadis team brings deep expertise in the areas of financial accounting, regulatory reporting and analytical banking within the German financial services industry along with longstanding experience of our products. Our goal is to respond to the market’s need for innovation in areas such as Environmental Social and Governance (ESG) reporting, by accelerating the development of new products and solutions.”

Björn Jonas, Managing Director at okadis Consulting, commented: “After founding okadis Consulting more than 20 years ago, this is an exciting strategic step for our customers, employees and the business. Being part of SAP Fioneer, our customers will benefit from deeper market expertise, access to a wider portfolio of products and innovative solutions which we’ll develop with our new colleagues. We look forward to the next chapter of continuing to deliver the first-class service and solutions that our customers expect from us.”

For customers, partners, and employees, there will be no immediate change as the okadis brand and company will remain in place for the time being.

The announcement comes after SAP Fioneer’s acquisition of Hedwell, a software and IT company specialized in insurance, in November 2021.

Related News

- 08:00 am

Amman, Jordan:

Al Rajhi Bank – Jordan, one of Al Rajhi Bank’s international branches, has selected ICS BANKS Islamic and ICS BANKS Digital Banking software solutions from ICS Financial Systems (ICSFS), the global software and services provider for banks and financial institutions.

Founded in 1957, Al Rajhi Bank is the largest Islamic bank in the world. Al Rajhi Bank has overseas branches in Kuwait, Jordan, and Malaysia. The bank has been operating in Jordan since 2011, with a network of 10 branches, and over 46 ATMs.

ICSFS’ differentiation in Islamic and digital banking software solutions will pave the way to provide our customers with fully digital shari’a-compliant products and services. In line with Al Rajhi Bank’s strategy, and with our new strategic technology partner, we will be able to leverage emerging technologies and infrastructure through providing the most sophisticated and customised solutions, and expand customer-centricity through providing the best customer experience with a differentiated and focused digital marketing approach supported by digital-ready platforms and touchpoints.

– Mr. Eyad Jarrar; CEO, Al Rajhi Bank – Jordan

Al Rajhi Bank – Jordan initiated its Universal & Digital Banking study and replacement project a couple of years ago, and opted for a fully-fledged Islamic banking platform and a holistic digital banking platform from ICSFS, to elevate financial services offerings to their valued customers. The study covered many international systems that participated in the international tender process. The bank will be utilising ICS BANKS’ open banking and financial software products that are built on a fully-fledged digital ecosystem with; international standards, real-time business processing, and value-added capabilities of tailoring products, on-premises, cloud, or hybrid.

We are proud to be chosen by Al Rajhi Bank – Jordan as their strategic technology partner. We are committed to delivering innovative products that are constructed on a secured and agile integration. We assure Al Rajhi Bank – Jordan to have an enriched customer journey experience, through leveraging ICS BANKS’ fully integrated, end-to-end, future-proofed financial and banking software suites. The bank will also be able to utilise ICS BANKS to reduce costs and drive productivity and efficiency. We are looking forward to a successful and solid partnership with Al Rajhi Bank – Jordan

– Mr. Robert Hazboun; Managing Director, ICS Financial System

ICSFS invests in its software suites by utilising modern technology in launching new products, constructing a secured and agile integration, and keeping pace with new standards and regulations worldwide. ICS BANKS software suites future-proof banking activities by providing a broad range of features and capabilities with more agility and flexibility, to enrich customers’ journey experience, hence improving the trust and confidentiality between the customer and the bank. ICS BANKS has always been a pioneer in utilising the latest technology to serve financial institutions. In addition to its embedded Service-Oriented-Architecture (SOA), the system can be deployed on-premises, hybrid or cloud.

Related News

- 02:00 am

TrustQuay has today announced the launch of TrustQuay Online, the first complete end to end cloud-native SaaS platform for corporate services and trust administration providers. TrustQuay Online is a fully digital entity management, client accounting, general ledger and practice management SaaS platform, enabling providers to meet their corporate and private wealth clients’ regulatory requirements as well as manage their own business in a simple to use, highly automated way at a significantly reduced total cost of ownership.

Available on demand 24/7 from any device with a browser and internet connection, TrustQuay Online requires no need to purchase and manage infrastructure, install or upgrade pre-requisite or specialist software components. Leveraging industry best practice based on TrustQuay’s 20+ years of experience with out of the box core configuration and sample data, it reduces the complexity, cost and risk of migrating data from legacy sources, and ongoing operational system usage. In addition, TrustQuay Online reduces both cybersecurity and platform availability risks by leveraging the highly secure and reliable infrastructure of Microsoft Dynamics 365 Business Central Online, in addition to being seamlessly interoperable with Office 365.

The total cost of ownership is significantly reduced compared to traditional on-premise or managed service software offerings, where infrastructure, installation, and upgrades are managed individually on a customer by customer basis. TrustQuay Online will therefore enable firms to deploy their sparse IT resources on more value-added initiatives such as automation and digital client engagement to increase margin and drive growth rather than ‘keeping-the-lights-on’ management of infrastructure and software updates.

Research by TrustQuay has found that the corporate services and trust administration sector lags way behind other areas of financial services, with firms currently ranking themselves just 5 out of 10 in terms of how far they have progressed on the digitalisation journey, but with 92% of the industry citing the need to accelerate innovation. TrustQuay Online will enable corporate services and trust administration providers to leapfrog ahead of competitors by leveraging digitalisation to create reduced cost and differentiation in the market.

Keith Hale, Executive Chairman of TrustQuay, comments:

“We are very excited about this game-changing launch. TrustQuay Online will enable corporate services and trust administration providers to significantly reduce complexity, reduce the total cost of ownership and reduce risks such as cybersecurity, as well as future proof their technology.

“It offers a one-stop-shop solution that just needs a browser and internet connection, with no installation and no need to separately purchase or manage infrastructure and software. This will enable providers to focus on managing their client’s and their own data for regulatory and operational purposes in an increasingly automated and digital basis, leveraging this new SaaS solution to increase margin and drive growth.”