Published

- 05:00 am

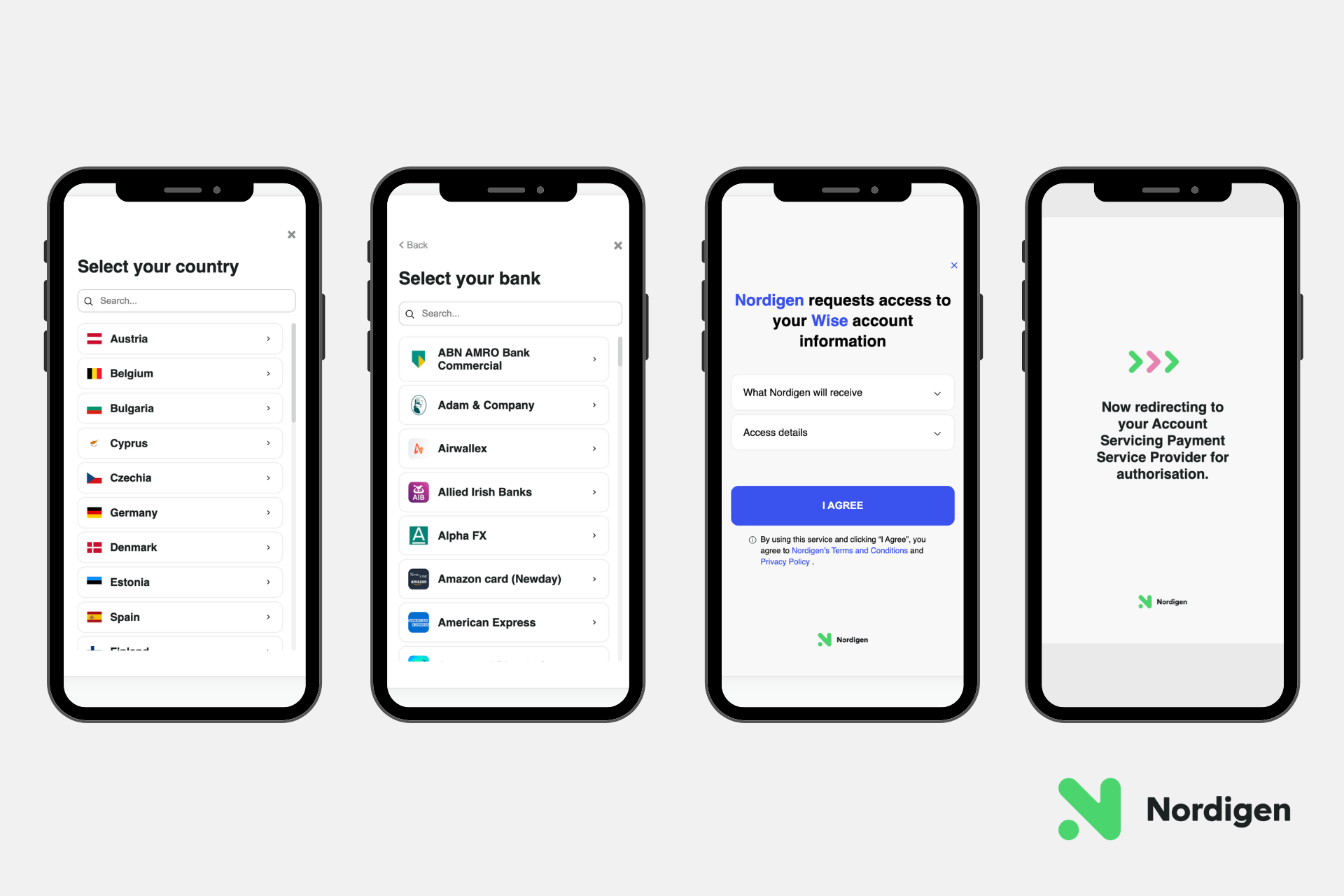

The world’s only freemium open banking platform, Nordigen, has further expanded their services to include a no-code feature, allowing users to access account information services without API integration.

With the new no-code feature, companies can go live with AIS in a day. Clients now have the option of a simplified integration method which eliminates the need to write code on the users’ side. Instead, clients can request the no-code solution during registration, and the sales team will assist with a tailored and personalised solution based on their needs and preferences.

The no-code solution allows companies to bring their ideas to life with ease and is a great tool to experiment and pilot with limited IT resources using open banking. This simplified approach breaks down the entry barrier standing between a business customer and a fully-fledged open banking integration, eliminating the need for the client to possess technical expertise or to employ in-house developers.

“The no-code feature is the ideal choice for business clients, created to combat issues and pain points that exist for non-developer customers. Despite the consistent growth of the phenomenon across Europe, open banking technology is still relatively unknown territory for many. Knowledge on the inner workings of open banking is limited to experts in the field and even enterprises wishing to participate may not fully understand how it works and what steps are needed to finalise implementation. Even with prior knowledge, the process requires many resources,” says Roberts Bernans, co-founder and Chief Product Officer at Nordigen.

Nordigen’s new no-code solution alleviates these issues, enabling a user-friendly approach to open banking and allowing more businesses to implement the technology to further innovate their applications, programs and services.

Related News

- 03:00 am

Fintech business HUB Group has appointed Rob Hudson into the new role of Chief Commercial Officer. Rob will start in June and report to Group Chief Executive David Cooper.

HUB Group is a part of the FTSE 250 retirement specialist Just Group and provides corporate solutions to some of the biggest UK companies; pension schemes and regulated advice and guidance services to employees and scheme members.

HUB Group’s innovative automated advice solution, Destination Retirement, started to be deployed in the worksite earlier this year and will have been installed into over 50 employers during the next few months.

Welcoming Rob to HUB Group, David Cooper, Group Chief Executive said; “I’m delighted Rob will be joining HUB Group to accelerate our investment and expansion of the Group’s innovative, retirement focussed digital solutions. This year we started to roll-out our financial wellness portfolio in the worksite channel to a wide range of employers and pension schemes, and Rob will spearhead the expansion of our propositions to help fulfil our purpose to help more people achieve a better later life.”

Rob Hudson said; “HUB Group’s Destination Retirement service is ground breaking, providing an entire solution to help people solve the challenges of navigating the financial aspects of life after work, with affordable regulated advice central to the service. I’m looking forward to helping the team extend the digitally focussed services and do our part to help close the UK financial advice gap so more people get the help they need.”

Rob joins HUB Group after spending over seven years at abrdn leading the development of new direct to customer distribution and partnerships, most notably the digital joint venture with Virgin Money. Previously Rob architected the successful launch and growth of the Charles Stanley Direct platform; and held senior customer focused roles at Hargreaves Lansdown, Egg plc and Close Brothers.

Related News

- 06:00 am

Clayton, Dubilier & Rice (CD&R), a global private investment firm, announced today that Amr Nosseir, who has spent the past 30 years working closely with sovereign wealth funds, pension funds, and other institutional and non-institutional investors across the Middle East, has become a Senior Advisor to the Firm.

CD&R, which enjoys a 44-year record of building value by driving operational excellence at its portfolio companies, is expanding its efforts to extend and expand its relationships with private markets investors in the Middle East. CD&R-managed funds currently count many prominent financial institutions and families from the region as investors.

Amr Nosseir will focus on reinforcing ties with existing limited partners and establishing new, trust-based relationships with investing organizations and families.

Most recently, Mr. Nosseir was Managing Director, Chairman, and Head of Middle East Business Development and Investor Relations at CVC Capital Partners. Previously, Mr. Nosseir was a Founding Partner and Chairman-Middle East at Perella Weinberg Partners, where he was responsible for the creation of their investment banking and alternative investment product capital-raising activities in the Middle East. Mr. Nosseir also spent 16 years at Morgan Stanley, including 12 years as head of Morgan Stanley's Middle East Group.

Mr. Nosseir earned an MBA from Columbia Business School and a BA from Colgate University. He currently serves as Chair of the Board of Directors of ABANA, the preeminent U.S. organization for finance professionals and institutions with interest in the Middle East & North Africa. He is also a member of the Board of Directors of NEF (Near East Foundation) Belgium.

Related News

- 09:00 am

Temenos, the cloud banking platform, today announced that Saigon-Hanoi Bank (SHB) has selected Temenos to accelerate its digital transformation. SHB is one of the largest joint-stock commercial banks in Vietnam, serving more than five million individual and corporate customers. Adopting the digital banking capabilities on top of Temenos open platform for composable banking will enable SHB to reimagine how it engages with customers and deliver a consistent, seamless experience across multiple channels. For SHB, the move to Temenos digital banking platform is a crucial step toward its goal to rank first in efficiency and technology among Vietnam’s commercial banks by 2025.

Following the State Bank of Vietnam’s plan for digital transformation, Vietnam is witnessing an increased demand for online and mobile banking services. According to a McKinsey report, the adoption of digital banking in Vietnam has caught up with that in developed markets, with a large majority (73 percent) of Vietnamese consumers being multi-channel banking users. To meet the needs of Vietnamese consumers, SHB has identified digital transformation as one of its strategic pillars, with a focus on building a digital corporate culture and investing in IT systems.

The digital banking capabilities of Temenos open platform will enable SHB to deliver seamless state-of-the-art customer experiences with highly personalized and AI-supported user journeys. Additionally, SHB will leverage Temenos’ open architecture - with its combination of APIs, microservices and Micro Apps - to create a true omnichannel experience across all channels, including internet, mobile, branches and ATMs.

Do Quang Vinh, Deputy General Director and Director of SHB Digital Banking Division, said: “SHB aims to become a leading digital bank in Vietnam in the next five years. We are confident that choosing Temenos, the world leader in banking software, will enable us to complete the transformation project in the fastest and most effective way. With a modernized and secure system, we will be able to engage existing customers better and attract new customers through a digital banking experience that meets their current and future financial service needs.”

David Becker, Managing Director, Asia Pacific, Temenos, said: “SHB is a visionary bank with a clear digital transformation roadmap, and we are proud to support and partner with the bank on this journey. Temenos has nearly 30 years of experience in implementing core and front-office solutions for over 20 clients in Vietnam. This deep expertise together with the powerful capabilities of our open platform will help SHB accelerate the digital transformation initiatives that will differentiate its service and realize its growth ambitions.”

Related News

- 03:00 am

OTC Markets Group Inc., operator of financial markets for 12,000 U.S. and global securities, announced that Fearnley Securities, a leading independent full-service investment bank with offices in Oslo and New York, has been designated as an OTCQX sponsor.

Fearnley Securities is approved by OTC Markets Group to act as a sponsor for companies to be quoted on the OTCQX and OTCQB markets and the second FINRA-licensed investment bank to represent the Nordic region in this capacity.

“OTC Markets Group welcomes Fearnley Securities to our community of OTCQX sponsors,” said Joe Coveney, VP, International Corporate Services at OTC Markets Group. “As global issuers look to increase tradability of their securities in the U.S., qualified advisors continue to provide critical expertise and practical insight on navigating the guidelines set forth in our OTCQX and OTCQB Rules.”

“We look forward to working with the OTC Markets Group to assist companies listed in the Nordics in gaining even better access to U.S. investors and diversifying their shareholder base,” said Peter Wessel, CEO of Fearnley Securities. “The OTCQX Market offers an efficient and high-quality solution to this end, which we believe is very compelling.”

To qualify for the OTCQX market, all U.S. and International companies must engage an OTCQX Sponsor. To learn more about the OTCQX Market, contact Joe Coveney at jcoveney@otcmarkets.com.

Related News

- 03:00 am

MANGOPAY, a major European payment solutions provider for marketplaces and platforms, announced the appointment of Luke Trayfoot as Chief Revenue Officer. In this newly created position, Luke takes on a critical leadership role to help MANGOPAY accelerate its international expansion as well as improve revenue streams for this next phase of growth.

The appointment of Luke Trayfoot, who will report to CEO Romain Mazeries, is another step for MANGOPAY in becoming one of the key global payment solutions providers powering the platform economy.

With over a decade's experience in the payments and marketplace industry, Luke Trayfoot has a strong track record of scaling tech and payment companies with also a deep understanding of the top marketplaces challenges. With knowledge in digital marketplaces, cross-border trade and payment environments, Luke will focus on developing new markets, enabling MANGOPAY’s customers to expand their business globally, and deliver growth and profit objectives. This nomination follows a year of exceptional growth for the company and Advent International's acquisition of MANGOPAY.

Previously, Luke was EMEA Sales Director at Hyperwallet, where he contributed to creating a global payout company. He was at Hyperwallet when PayPal acquired the fintech company to enhance PayPal payout capabilities specifically for marketplaces and platforms. After joining PayPal, Luke led the EMEA marketplace strategy for the company. Prior to joining Hyperwallet, Luke spent 4 years at World First, where he held numerous leadership positions including Head of Partnership Sales EMEA and Partnerships Sales Manager.

Chief Revenue Officer, Luke Trayfoot said: ‘‘I am delighted to join MANGOPAY and bring my deep knowledge and experience to such an exciting pioneer in digital payment solutions. Marketplaces continue to be the paradigm shift in digital commerce which is connecting the planet. In fact, last year global marketplaces’ sales increased by 25% compared to global first party e-commerce sales which only grew by 12%. Unlike other marketplace payment solutions in the market, MANGOPAY's payment environment is tailored to meet the specific needs of growing global marketplaces. With the team in place and Advent’s position within the business, I’m certain we are well on our way to becoming the leading payment solution in this category.”

Romain Mazeries, Chief Executive Officer of MANGOPAY said:” I am pleased to welcome Luke to our team. His motivational leadership style and expertise in go-to-market strategy and execution will be a great addition as we continue our UK and global expansion plans. Luke is joining us at a very exciting time – fresh off our successful acquisition by Advent. He will help us as we enter another exciting hyper growth phase.”

Related News

- 03:00 am

As part of its drive to expand its financial services offering, global cloud-based payments provider Checkout.com today announced its intent to acquire digital identity verification (IDV) startup, ubble.

The deal—slated to close later this year pending regulatory approval—comes amid the continued growth of online transaction volumes around the world, and the concurrent increased risk of fraud and money laundering. It also supports Checkout.com’s mission to enable businesses and their communities to thrive in the digital economy.

The acquisition of ubble will enable Checkout.com to expand its current suite of financial products that allows fintechs and e-commerce merchants to accept and send payments to and from their customers while managing the financial risk involved.

The addition of IDV capabilities will support another important aspect of the payment journey: ensuring merchants and fintechs are compliant with local regulations, can verify that their customers are who they say they are, and can stay ahead of potential changes to the complex EU and global regulatory landscape in the future.

Co-founded in 2018 by CEO François Wyss, CRO Juliette Delanoe and CTO Nicolas Debernardi, ubble pioneered the technical foundations of real-time video-based identity verification, and today has almost 100 people employed in its French offices. The company’s flagship solution enables the automated verification of a user's identity for over 2000 types of documents from 214 countries and territories, using best-in-class machine learning models.

“ubble was founded with a mission to provide people with the convenience and security of using their personal identity in the digital world—and that is clearly becoming a growing need for e-commerce and crypto merchants, digital wallets, and other fintechs we serve,” explained Meron Colbeci, chief product officer at Checkout.com.

“We were impressed with the ubble team, their ability to rapidly drive machine-learning innovation in a complex and challenging space, and their market-leading engineering talent. By partnering more closely, we can significantly accelerate their already ambitious roadmap and bring the benefit of their cutting-edge technology to our thriving ecosystem of merchants.”

“For the past four years our team has worked to build a technology foundation that establishes trust between online services and their users, and respects and protects the privacy of identity data across the board,” added ubble CEO Wyss. “With today’s exciting news, we can increase the velocity of our IDV innovation journey, help to evolve the Checkout.com payments technology stack even further, and amplify and extend our collective reach and benefit to merchants around the world.”

To date, ubble—which was funded by Partech, Breega, Kima Ventures and other angel investors—has gained traction with many of the french fintechs, ride-hailing and delivery apps, as well as major banking networks and traditional financial institutions. Its success has been driven by an uncompromising approach to security and compliance and the development of its proprietary technology.

From here, the potential use cases remain far-ranging—especially considering the role that IDV can play in marketplaces, issuing or crypto trading, for example.

“We always put the needs of our merchants first,” added Colbeci. “By expanding our security and fraud detection capabilities, we can reduce the time, cost and friction those merchants experience with existing IDV solutions. And they can offer their end consumers a simple and compelling experience, which lends itself to increased conversion rates and faster growth.”

Related News

- 09:00 am

For the first time, THE INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS OF CYPRUS (ICPAC) held the ICPAC Mediterranean Finance Summit at the Parklane Hotel Limassol, Cyprus on the 5th - 6th of May 2022.

“ It is my pleasure to address today’s audience in what is considered to be the most prestigious gathering of finance leaders and key decision makers of the year.. Finance function was associated with an ocean-liner as opposed to a speedboat - notoriously inflexible and slow to react to change. The future of finance combines the emotional intelligence of experienced financial professionals with the right technology. Don’t forget, embrace technology and sustainability and be ready to make the difference” As quoted by Pieris Markou, President at INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANTS OF CYPRUS (ICPAC)

This prestigious Summit welcomed 200 local and global finance executives. The Opening Keynote Speech was delivered by Constantinos Herodotou, Governor at the Central Bank of Cyprus; Member at European Central Bank.

“ ..Our thoughts with those affected by the tragic events of the Russian invasion in Ukraine. Russia’s war against Ukraine has disrupted further the global supply chains and in-effect the growth and inflation patterns around the world.. Causing a new negative shock that is weakening the pace of the post-pandemic recovery. I call on continuing the discussion but more importantly to move from talking to doing..” as quoted by Constantinos Herodotou, Governor at the Central Bank of Cyprus; Member at European Central Bank

“The scale and pace of innovation in the financial services industry presents unique opportunities and challenges.. The trends we have seen are certainly more digitalization, more online, more mobile trading platforms and we have seen the growth of sophisticated technologies like AI, blockchain, big data technologies and so on.. These trends are impacting the way that the financial services industry is functioning” As quoted by Dr. George Theocharides, Chairman at Cyprus Securities and Exchange Commission (CySEC).

Joined by a prestigious Speaker line-up from leading global organizations, specifically: Aon, Microsoft, ING, UBS, Deloitte, NetU, PWC, FedEx Express, Novartis, Bridgestone, Exness, EcommBX, eBOS, Cyprus Central Bank, Cyprus Securities and Exchange Commission (CySEC), Marcolin, FCM, ICAEW, SOL Crowe who explored future visions and the latest market developments in finance, automation and digital transformation.

The ICPAC Mediterranean Finance Summit acted as a foundation for attendees to stay aligned and engaged with the future of the finance function.

“As ICPAC, we are delighted to eventually hold this Summit, as the covid restrictions

deprived us of the pleasure to do it earlier. The idea of our CFO’s team behind the event

served two principal purposes: To bring together finance professionals..To render Cyprus as the focal point for such a gathering in the wider Mediterranean area.. I believe that both of the above goals have been positively checked in our KPI checklist!” As quoted by Kyriakos Iordanou, General Manager of ICPAC.

The Summit was powered by Viva Wallet, the leading European cloud-based neobank with the largest footprint in Europe, delivering the future of payments, now. Among other C-level speakers, Yannis Larios, Senior VP / Strategy & Business Development at Viva Wallet, took delegates through the first Greek “unicorn’s” journey. From start-up to neobank, they followed a bottom-up business model, connecting with local payment systems in 24 countries, developing own breakthrough technologies and cloud-based infrastructure, owning the complete value chain. “Breaking into” the local financial “castles” as he remarked, allowed Viva Wallet to offer truly unifying, yet localized, advanced digital payments solutions and customised embedded banking services. Speaking of an innovation-focused company mindset, Yannis highlighted Viva Wallet’s latest breakthrough, the “tap-on-phone Viva Wallet POS app”, that turns any Android mobile to a card terminal.

Premium Sponsors: AON, Deloitte, eBOS, NETU, EcommBX, PWC

Supporting Sponsors: Char. PILAKOUTAS Group, Hellenic Bank

Powered by: Viva Wallet

Networking Technology Partner: Covve

Media Partners: CIBA, ACB, ICAEW, ITKeyMedia, FinTech Belgium, Malta Business, Financial IT, FINTECHNA, FinTech Futures, Coinpedia, CryptoNewsZ, FinTech Weekly,

ALPHA TV, ThePaypers

Learn more about future Summits: https://www.qubevents.com/forums or email us at: info@qubevents.com

Related News

- 02:00 am

Mitrade has been crowned the Most Innovative Broker 2022 and the Best Trading Platform 2022. The awards are given by FxDailyInfo, which rewards Forex brokers for consistent innovation and intuitive trading platforms. To declare winners, FxDailyInfo also takes into account several key factors including ground-breaking technology, cross-platform compatibility, responsive customer service, risk management, and fast growth.

"We are profoundly humbled to receive these distinguished awards. We take this double win as a recognition of our hard work and commitment to make trading easy for all. This milestone is an inspirational motivation for our team, that we are on the right track. This achievement has encouraged our team to bring even more innovation to our trading system and make Mitrade a leading Forex trading platform. Our team strives to make our trading platform more intuitive in the future," said a representative of Mitrade.

Mitrade went through a massive structural overhaul of its team and resources in 2019. It introduced a proprietary web trading platform, which immediately started gaining worldwide attention and engagement due to its simple user interface and smooth function. Later on, the innovative WebTrader was complemented by mobile apps for Google Play and iOS. The mobile apps brought cross-platform compatibility to Mitrade, making trading on the go possible for everyone.

Earlier this year, Mitrade also bagged four 2022 awards from International Business Magazine -- Most Trusted Broker Asia, Best Forex Educational Resources Global, Most Transparent Forex Broker Global and Best Trading Platform Australia.

Continuing its innovation streak, Mitrade has recently upgraded its mobile app with cutting edge features. The app now comes with a built-in economic event calendar that lets traders forecast market trends and craft a winning trading strategy ahead of potential market movements. The mobile app also has a tiered trading educational portal, which guides both beginners and experts.

This innovative spirit has won Mitrade many prestigious awards and added to its immense popularity among the global trading community. Mitrade's evolving technology, dynamic research tools, and instant-response 24/7 customer service fueled its growth to over 1,100,000 customers in a short span of three years. The Mitrade app on Google Play has surpassed 1 million downloads.

In addition, Mitrade has also won the Most Innovative Forex Fintech Broker 2021 by Global Brands Magazine and Best Mobile Trading Platform 2020 by Forex Awards. More information can be found at www.mitrade.com/about-us/awards.

Related News

- 09:00 am

Total Expert, the CRM and customer engagement platform purpose-built for modern financial institutions, is rolling out new features for lenders, banks, and credit unions to help them better navigate customer relationships in the coming year. With a mortgage market that’s gone from 70% refinance loans in 1Q21 to 70% purchase loans in 2Q21, capitalizing on every loan application is more important than ever.

In this competitive environment, lenders require easy access to consumer data from across the financial ecosystem. To enable this, Total Expert has built new or enhanced partnerships with third-party data integration, social marketing, lead conversion, and lending broker brands. The ability to access and leverage consumer data and sales inputs from systems including Salesforce, BankingBridge, and FreeRateUpdate, gives lenders a broader view of customer behavior in order to optimize and fill the pipeline.

A new integration with Denim Social will allow loan officers to create compelling, personal landing pages that give consumers detailed information on lending services, integrate with social media lead gen campaigns, and funnel new leads into the Total Expert platform. The BankingBridge integration allows lenders to easily embed lending and rate calculators into landing pages and profiles to further customize the consumer experience and encourage action.

Additionally, Zapier will allow financial institutions to connect Total Expert to more than 4,000 third-party software platforms that are generating potential leads and consumer insights. It is now possible to automate the movement of lead data from existing sources such as Zillow, Google, LendingTree, and more, directly into Total Expert, giving loan officers a singular database of potential new customers to target with automated, personalized campaigns.

“With the mortgage market flipping to 70% purchase loans and rates rising 2% this year, loan officers need real-time insights and leads to win and close customers fast,” said Julian Hebron, founder of The Basis Point, a sales and strategy consultancy for consumer finance and real estate companies. “Higher rates don’t derail homebuyers as much as headlines suggest, and loan officers must be armed with the right customer, rate market, and local housing market data to help customers understand long-term home affordability and win bidding wars in a competitive market.”

“To compete today, financial institutions must go beyond transactional banking and lending, and build comprehensive customer profiles to power more relevant customer communications,” said Joe Welu, founder and CEO of Total Expert. “With the exceptional new integrations and capabilities included in our latest release, we’re providing customers with the data, insights, and intelligent automation they need to understand behaviors and preferences, and deliver the perfect customer journey.”

For more information about Total Expert visit www.totalexpert.com.