dLocal and Open English Roll Out Bre-B Instant...

- 20.02.2026 12:25 pm

Nearly 3 Bn BLIK Transactions in 2025 and Over 2 M New...

- 20.02.2026 12:25 pm

Fluz Launches Embedded Payment Platform to Bring...

- 20.02.2026 09:05 am

Mastercard Cardholders Can Now Use Google Pay in Saudi...

- 20.02.2026 08:45 am

Rakuten Card Launches AI Agent On Rakuten Card Lite App

- 19.02.2026 12:25 pm

TransferGo Enters New Stage Of Growth As Bank Of...

- 19.02.2026 10:45 am

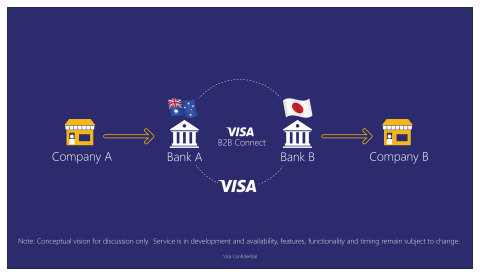

Visa And CarCloud Partner To Redefine Business...

- 19.02.2026 10:05 am

Volt Becomes An NPP Identified Institution In...

- 19.02.2026 09:55 am

eBay Partners With TrueLayer To Offer Pay By Bank At...

- 19.02.2026 09:55 am

Zūm Rails to Become a Payments Facilitator in the US...

- 18.02.2026 01:20 pm

UK Banks Explore Domestic Alternative to Visa and...

- 18.02.2026 12:45 pm

Nexi Launches Nexi Ready to Bring Agile Innovation to...

- 18.02.2026 11:45 am