Prodigy Finance Establishes another $350 Million Facility for International Masters Students with Citi, Schroders Capital, and SCIO Capital

- 2 years 4 months ago

- Lending

Prodigy Finance, a social impact-driven FinTech and a leading international student loan lender, is proud to announce a $350 million facility with Citi, Schroders Capital and SCIO Capital. This is the first transaction that Prodigy has closed under their new multi-issuance special purpose vehicle structure.

16 Million Brits Still Don’t Know You Can Get into Debt Using BNPL Services

- 2 years 4 months ago

- Lending

16 million people in the UK are still unaware you can get into debt using ‘Buy Now Pay Later’ (BNPL) services*, according to research from responsible lender, Creditspring. A third of people (31%) still don’t think that BNPL purchases can lead to debt, however, this jumps to over half (51%) for those aged 18-24 who are 29% more likely to use BNPL than then UK average.

Core10 Joins the Jack Henry™ Vendor Integration Program (VIP)

- 2 years 4 months ago

- Lending

Core10, Inc. (Core10), a U.S.-based financial technology company that provides lending, account opening, and BaaS products, as well as software development services, today announced that it is expanding its participation in the Jack Henry™ Vendor Integration Program (VIP).

Decentro Makes its First Acquisition with Neowise to Strengthen Itself in the Lending Infrastructure Space

- 2 years 4 months ago

- Lending

Decentro, a leading fintech infrastructure company, has announced its expansion in the lending infrastructure space through its first-ever acquisition of Neowise. The acquisition, executed in a combination of cash and stock, includes acquiring all assets, mainly its advanced collection suite, and integrating the acquired company as a wholly owned subsidiary of Decentro's India arm. This strategic move strengthens Decentro's position in India's... more

Modulus Launches Technology to Enable Borrowing and Lending in Digital Asset Exchanges

- 2 years 4 months ago

- Lending

Today, Modulus, a US-based developer of ultra-high-performance trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges, announced the launch of its crypto lending and borrowing technologies, which will be available to all clients of the company’s white label exchange solution by the end of the quarter. With this technology, exchanges will be able to offer traders an easy way to earn interest on... more

A Third of Lenders Report Increasing Numbers of Defaulted Loans Over the Last 12 Months

- 2 years 4 months ago

- Lending

A third (32%) of lenders have seen an increase in borrower defaults over the last 12 months, according to new research from AI-powered transaction analytics firm, Fuse.

Extraco Banks Partners with Teslar Software to Modernize Commercial Lending

- 2 years 4 months ago

- Lending

Extraco Banks and Teslar Software today announced their partnership to streamline the bank’s commercial lending process and more effectively balance their portfolio.

Baker Hill Announces its Latest Solution, Baker Hill NextGen® Accelerate

- 2 years 4 months ago

- Lending

Baker Hill, a leading financial technology provider in delivering solutions for loan origination, risk management, and analytics, has launched its newest offering, Baker Hill NextGen® Accelerate, a preconfigured version of their award-winning Baker Hill NextGen® commercial loan origination system (LOS), which features robust and scalable digital capabilities designed for rapi

Capalona Unveils New Business Loan Comparison Platform

- 2 years 4 months ago

- Lending

Capalona.co.uk is excited to announce its new and improved business loan comparison service, which now includes example costs of lender products, rates, monthly loan cost, and total repayable. There’s also now a ‘more details’ expandable panel to give borrowers more product information.

Egypt Post Signs a Partnership Agreement with Qardy to Give SMEs Access to Financing

- 2 years 4 months ago

- Lending

Dr. Sherif Farouk, Egypt Post Chairman, witnessed the agreement between Egypt Post and Qardy, which enables Qardy to provide its services to Small and Medium-Sized Enterprises (SMEs) in Egypt through Egypt Post's network over 4,300 post offices across the Egypt. This partnership agreement was signed by Mr. Khaled Emam, Egypt Post Vice Chairman for Financial Inclusion, and Mr. Abdel Aziz Abdel Nabi, Qardy’s founder, in presence of all executive... more

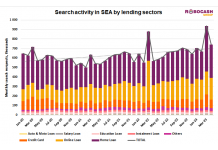

Interest in Lending Products in SEA Has Risen by 15% Since 2020

- 2 years 5 months ago

- Lending

These are the findings of analysts from Robocash Group who have studied search requests for lending products.

Dock Launches Responsible Credit Solutions to Empower Financial Inclusion

- 2 years 5 months ago

- Lending

Dock, an innovator in payments and digital finance infrastructure across Latin America, announced the launch of Responsible Credit Solutions on its proprietary Dock One platform. These solutions enable businesses to offer an array of flexible, customizable credit and loan products to their customers in a way that encourages responsible financial decision-making.

Almost Two-thirds of UK Consumers Have Used Buy Now, Pay Later Services, Finds Kearney

- 2 years 5 months ago

- Lending

Leading global consultancy Kearney has today announced the latest findings of its European Banking Radar, which includes a survey on the use of BNPL, conducted annually in 12+ European countries since 2020.

One-fifth of Teachers Reliant on BNPL to Pay for the Weekly Shop Risking Long-term Debt as Key Worker Finances Reach Breaking Point

- 2 years 5 months ago

- Lending

One-fifth (18%) of teachers have been forced to rely on buy now, pay later (BNPL) payment options to afford their weekly shop, according to new research from responsible lender, Creditspring. More than a quarter of teachers (26%) say they wish they’d never used BNPL options, with 14% admitting they’d were unable to meet repayments and that this pushed them into debt.

Experian Launches 4D Credit to Help Lenders Better Support Small Businesses Thrive and Survive

- 2 years 5 months ago

- Lending

Experian has today announced the launch of 4D Credit - a new suite of services designed to help lenders better manage their commercial lending portfolio and provide valuable support for small businesses as they look to battle economic uncertainty.