Global Research from NTT DATA Finds Half of Corporates want More Investment in Sustainable Banking Products and Services

- 2 years 7 months ago

- Digital banking, Investment, IT Innovations

NTT DATA, a digital business and IT services leader, today announced the results of its annual global banking research report. The report compared the latest demands from the largest corporate businesses with current investment priorities of global banks. It found a shift in post-pandemic corporate banking towards more integrated, digitized, sustainable banking aligned to the new generation of millennials taking up senior positions in corporate... more

Plinqit Integrates with Banno’s Digital Banking Platform

- 2 years 7 months ago

- Digital banking, Personal Finance

Community and regional financial institutions can offer accountholders a platform with a non-traditional tool that helps with the first step of the financial wellness journey – saving money Plinqit, the only savings platform of its kind that pays users for learning about personal finances, announced today that its platform is now accessible through Jack Henry’s Banno Digital Platform.

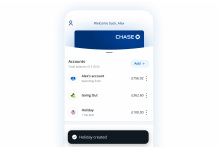

Chase Launches New Saver Account with Market-leading 1.5% Rate

- 2 years 7 months ago

- Digital banking

• Saver account combines a market-leading rate with a flexible and straightforward way to save • Customers can open multiple saver accounts to help reach their savings goals

25/03 – Weekly Fintech Recap

- 2 years 8 months ago

- Digital banking, E-Commerce, Open Banking, RegTech, Security, M&A Deals, People Moves

Partnerships Yapily Partners with NayaOne to Offer Open Banking Connectivity

Intellect Global Transaction Banking’s (iGTB) Virtual Accounts 2022 set to revolutionize Digital Banking at a major private Qatari bank

- 2 years 8 months ago

- Digital banking, Transaction Banking, Banking

iGTB’s fully integrated, front-to-back, contextual Virtual Accounts to enhance corporate and SME user experience, to bring operational efficiency and to generate new revenue streams for the bank in line with Qatar National Vision 2030

New Digital First Bank – Monument – Launches a Range of Savings Products With Market Topping Rates

- 2 years 8 months ago

- Digital banking

12-month, 2 year and 5 year Fixed-Term deposits at 1.80%, 2.05% and 2.40% AER respectively, with a minimum balance of £25,000 Accessible via its app, Monument has launched new 12-month, 2 year and 5 year Fixed-Term Deposit savings products which will offer an AER of 1.80%, 2.05% and 2.40% respectively, the highest interest rates in these categories at present. This launch follows the release of its app and entry into the savings market in... more

Vilja recognized as a New School vendor in Now Tech: Digital Banking Processing Platforms (Retail Banking), Q1 2022

- 2 years 8 months ago

- Digital banking

The leading global market research company Forrester has included Vilja, as the only Nordic digital banking platform vendor, in their newly published report: Now Tech: Digital Banking Processing Platforms (Retail Banking), Q1 2022, authored by Forrester vice president and principal analyst Jost Hoppermann. The overview is based on market presence and functionality. Vilja’s core banking platform is identified in the New School vendor... more

9 Out of 10 Uk SMEs Don’t Know Their Business Carbon Emissions

- 2 years 8 months ago

- Digital banking, Banking

NATWEST LAUNCHES CARBON TRACKER PILOT TO HELP SMES GO AND GROW GREENER ● New research from NatWest reveals 87% of UK SMEs are unaware of their businesses carbon emissions ● Almost half (45%) say it’s important to lower carbon emissions in the next five years

18/03 – Weekly Fintech Recap

- 2 years 8 months ago

- Artificial Intelligence, Blockchain, Digital banking, Digital Identity, SWIFT, Cryptocurrencies, Banking, FinTech StartUps, M&A Deals, People Moves

Partnerships Bank of Canada and MIT Partnering on CBDC research

Bank of Canada and MIT Partnering on CBDC research

- 2 years 8 months ago

- Digital banking, Banking

The Bank of Canada has teamed up with the Massachusetts Institute of Technology on a twelve-month research project on central bank digital currency. The project will see the central bank and the MIT Media Lab’s digital currency initiative team experiment with potential technology options to establish how a CBDC could work.

Digital Banking in Africa Report by BPC Highlights Challenges and Opportunities in Sub-Saharan Region Where Over 50% are Unbanked

- 2 years 8 months ago

- Digital banking

Leading fintech BPC today announced the launch of a new report that focuses on the regional market environment of Sub-Saharan Africa and relevant implications for key digital banking players.

Prizeout Announces Integration with Q2’s Digital Banking Platform

- 2 years 8 months ago

- Digital banking

Prizeout’s integration brings benefits directly to the local communities of Q2’s banking partners.

How to Encourage Ethical AI in Financial Services

- 2 years 8 months ago

- Digital banking

Following publication of the Bank of England and FCA’s Artificial Intelligence Public-Private Forum (AIPPF) final report on AI in financial services, Gery Zollinger, Head of Data Science & Analytics at Avaloq, assesses the best ways to support ethical use of AI by financial firms.

Mauritius Commercial Bank Ltd Partners With Mobiquity to Strengthen Its Online Banking Offering

- 2 years 8 months ago

- Digital banking

MCB and Mobiquity improves customer experience for digital banking with the implementation of Backbase platform and launch of mobile banking application The digital transformation partnership will enable MCB to appeal to younger age groups Mobiquity, a full-service digital transformation enabler, announces its partnership with Mauritius Commercial Bank (MCB) to transform MCB’s digital banking offering for its one million client base.

Spanish Neobank Rebellion Pay Strengthens AML Compliance with Sentinels

- 2 years 8 months ago

- Digital banking, Transaction Banking, AML and KYC, Risk Management

Sentinels signs first digital bank and expands client footprint into Southern Europe Sentinels, Europe’s leading intelligent transaction monitoring and client risk management platform, has been selected by Rebellion Pay to enhance and streamline the leading Spanish neobank’s anti-money laundering (AML) compliance monitoring and risk profiling functions.