Running at the Speed of Data - Real-time Use Cases That Get Banks Moving

By Stacy Gorkoff, VP, Marketing at INETCO Systems Limited

Banks operate in a world of time-sensitive opportunities. From a customer perspective, instant notification and interaction with their financial institutions is becoming the expected norm, especially for millennials. From an operational and security perspective, the speed of reaction affects not only customer experience, but also reputation and profitability. This is why the notion of real-time is becoming more important.

We are generating and collecting more information about customers than ever before. If analysis of this information takes days, or even weeks, banks will find they lack a required level of responsiveness when it comes to building lasting customer relationships, dealing with security breaches and managing operational performance issues. With real-time data, financial organizations can move faster and smarter – exactly what every bank needs to boost financial performance, improve customer experiences, and manage risks.

Why real-time data now?

The adoption of real-time data within the banking industry is on the upswing as analytics skills and technologies advance and scale. There are more and more teams within a bank that claim to need real-time data to do their jobs – marketing, IT, channel operations, security, fraud prevention, customer experience and support to name a few. Use cases continue to expand as financial institutions invest in data streaming feeds and faster processing around functions such as high-volume customer transactions, fraud and risk management.

The ability to analyze increasingly massive (and increasingly diverse), datasets in real-time has become way more affordable with the Cloud and open source projects such as Apache Hadoop and Spark. A new generation of on-demand, vertical-specific data visualization solutions has made it possible for banks to develop intelligent “lenses” that deliver relevant data to each stakeholder or team involved in positioning the customer center stage. Behind the scenes of these user interfaces for “novice” analysts are advanced dynamic models and algorithms designed to continuously learn and predict customer behaviors. These advancements in storage, visualization and modeling capabilities are making real-time customer data more valuable than ever before. Here are some use case examples of where real-time data is making a difference today:

Offering the right products for customers, at the right time in their lives

Life events present fantastic opportunities for banks to customize their services to meet the customer’s needs. These could include getting married, retiring, buying a house, starting a new job, buying a car, having a child or securing a student loan. Real-time customer interaction data, perhaps gathered through a mixture of financial transactions (ie: transactions showing the purchase of an engagement ring and a honeymoon package), branch inquiries, online or mobile search queries and social media channels can help banks identify when these life decisions are being considered by their customers. The bank can react accordingly by preparing innovative offers and presenting targeted cross-selling opportunities in a timely manner.

Responding to ever-shifting customer habits and expectations

Continuing advancements in processing power have made is easier for banks to apply cognitive computing, predictive modelling and machine learning algorithms to their customer segmentation processes. Both structured and unstructured consumer data (such as emails or text messages) can now be combined together in real-time, and analyzed in a way that makes it possible to anticipate customer needs and get smarter about them over time.

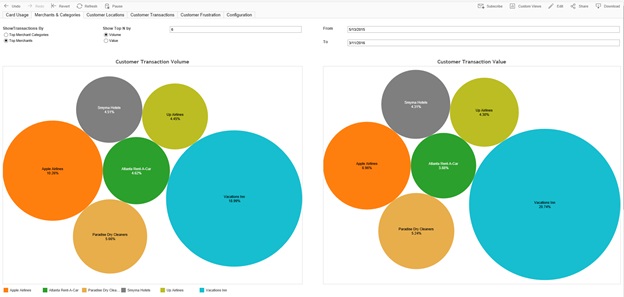

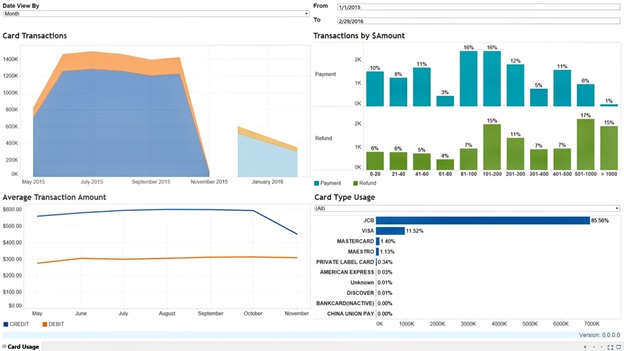

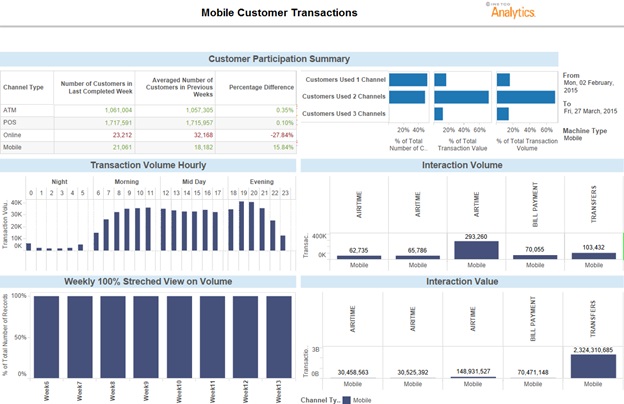

Based on real-time information involving demographics, life events and other relative things (such as payroll changes, shopping habits, cash flows, spending habits, channel usage and card preferences), marketing and customer experience teams can dynamically segment their customer base in more relevant ways and quickly respond to shifting customer habits and expectations. Take, for example, if a financial institution has just received real-time data that indicates a customer is thinking about defecting. They have noticed account closures, declining account balances, automated bill payment cancellations and direct pay check deposit cancellations. This type of real-time insight helps marketing and customer experience teams improve targeting, build out a successful retention program and identify ways to try and reverse the customer’s decision.

Guiding customers in the direction of actions that enhance investments and credit standings

Customers have come to expect short load times, personalization, and updates in real time. A real-time data pipeline enables banks to capture, process, analyze, and serve massive amounts of data to millions of users. Financial organizations can use this real-time data feed, and either team up with service providers or build out their own customer-facing mobile applications that help coach customers towards better financial habits. These money monitoring applications can deliver meaningful messages that increase interaction and help customers track where they are at with their banking. Examples include overdraft warning alerts, spending breakdown analysis, reminders to pay bills or transfer excess cash to savings. Applications that are built to accept real-time data can also be used to communicate targeted offers from merchant partners, encourage progress towards savings goals, or drive creative programs to save money such as a brown bag lunch week.

Assessing customer risk and speeding up credit card approval rates

A critical component of customer risk assessment, real-time data also improves the predictive power of risk models and system response times. The ability for banks to update customer risk profiles and risk scores in real-time, based on current behaviour, payments, investments and spending habits will help them identify, verify and respond to customer loan requests, overdraft increases and credit card applications faster.

Faster reaction to fraud and compliance issues

Security landscapes and compliance requirements are constantly evolving, as are the methods used to defraud banks and customers. Access to real-time data helps cyber security and fraud teams continuously screen and analyze aggregate patterns of transactions, combined with other important data sources such as geo-location data, merchant data, social media and authorization data. Security breaches and the operational costs associated with fraud investigations are reduced by keeping track of any traffic, credit card or behavioural anomalies that indicate a potential fraud hit or card compromise such as an advanced persistent attack, the same card being used in a number of locations in a short amount of time, or the velocity of transactions around cards used at one or multiple self-service locations. In addition to early warning systems and time series analysis, this data can also be used to set predictive alerts aimed at preventing fraud and addressing potential security or compliance issues before they cause problems.

Managing the cash flows of individual self-service devices in real-time

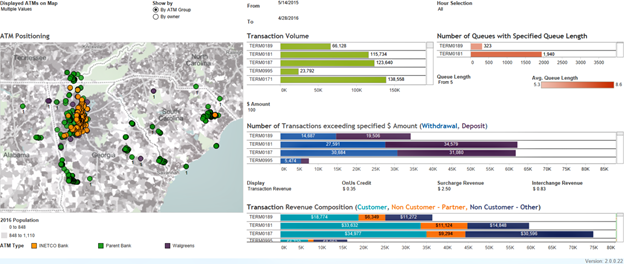

In the past, it has been a challenge for cash management systems to obtain core banking data such as open/close balances and withdrawals/deposits by denomination at each ATM. This information has traditionally been served up in more of a batch process, which made reaction times slower.

With today’s real-time transactional data feeds, financial organizations can now get an up to date status on cash-in and cash-out at each ATM and self-service kiosk location. The timeliness of this information helps financial organizations react faster to ATM usage, and understand important details such as preferred withdrawal denominations, interactions and service locations. This data also enables more accurate cash forecasting and timely cash flow handling at individual self-service locations. A reduction in emergency replenishment scenarios and a better understanding of when cash drops really need to be made will have a positive impact on overall channel profitability and customer experience.

Reducing the risk of operational performance

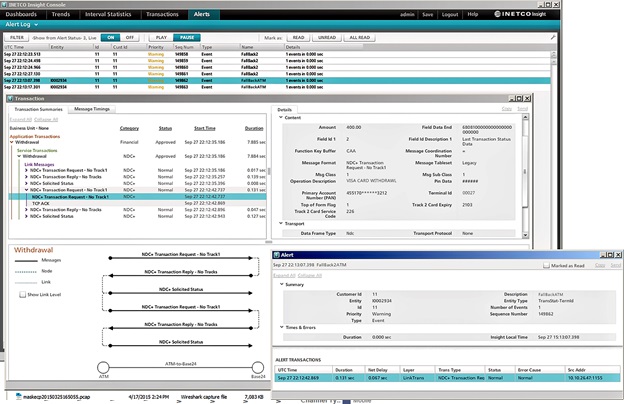

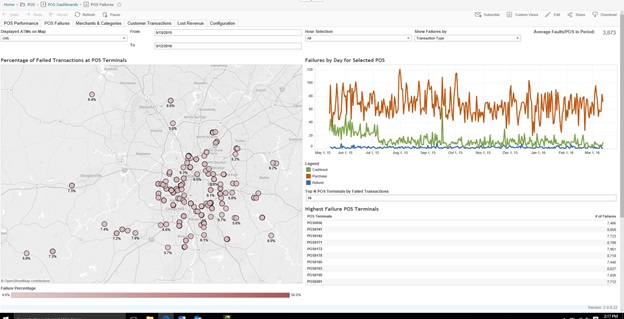

When it comes to managing the operations of core banking and self-service channel systems, real-time data plays a key role in minimizing downtime, identifying abnormal behavior within systems, and isolating the root cause of performance issues. IT and channel operations teams can manage their end-to-end transaction environments, drive a consistent user experience across all technology touchpoints and channels, and isolate transaction failures and slowdowns related to applications, networks, host authorization and third party services on average 75% faster.

Real-time data also helps IT and channel operations teams become more proactive. For example, if properly monitored and visualized, real-time transaction data has been proven to help IT and channel operations teams proactively identify when the transactional response time of a system is degrading – before they fail completely. Monitoring transactions by type and completion status also helps identify patterns in specific response code errors or when EMV fallbacks are occurring. Teams can act quickly, before the end customer has experienced a problem, liability has shifted or service level agreements are impacted.

Are you ready to run at the speed of data?

In summary, harnessing real-time data greatly increases a bank’s ability to deliver amazing customer experiences, make timely decisions, and expand customer wallet share. But advancing to real-time cannot be done without investment in people, business processes and analytics technology. The good news is that all the skills, use cases and technology components you need are out there, and ripe for the picking. By building out an advanced analytics strategy that involves real-time data collection, cleansing, combining, calculating and visualization, CIO’s and other IT leaders will get their financial organizations moving in a direction that can boost financial performance, improve customer experiences, and manage risks.

About Stacy Gorkoff:

Stacy has spent 15+ years working with leading edge technology companies such as INETCO. She is passionate about fintech innovation, and loves helping customers uncover new revenue streams and deliver an amazing customer experience.