Bridging the Gap

An interview with Pamela Pecs Cytron, CEO – Pendo Systems, Inc.

Financial IT: Pendo extracts and orders unstructured information from PDFs and other documents, and then presents that information in a single, harmonized, way. Further, Pendo does this for large and complex financial institutions – which tend to hold key data in separated silos. Can you give specific examples of what you do, without exposing the sensitive details?

Pamela Pecs Cytron: In one instance, we extracted key financial data from 23 million investor statements. A part of the challenge was that the content and the format of the statements had changed over time. We then created just under 1.4 billion records of daily transactions and monthly positions. This enabled the bank’s risk team to create a detailed mode of how investors had behaved during 2008. The whole project took just three months.

In another instance, we extracted loan servicing information from more than 50 different loan servicer statements with varying content and formats. We had two objectives. The first was to create a no-touch process for gathering risk models. The second was to improve the efficiency and data accuracy of the bank’s risk model. The project took two months.

Financial IT: Pendo has had tremendous success in working with one of the world’s largest global banks. In general terms, who else are you talking to?

Pamela Pecs Cytron: The crucial point is that we are speaking with many divisions within that bank. The opportunity comes from working with numerous stakeholders within the organization. Looking forward, we hope to do a lot of work with the global insurance industry.

Financial IT: Presumably a huge opportunity for Pendo is that you can give managers the information that they need for matters requiring immediate attention (MRIA) – and far faster than Big Data projects. Does this mean that every bank with a Big Data project is a potential client?

Pamela Pecs Cytron: Absolutely. However, there are many other potential clients. The opportunities are unlimited, because we can handle any kind of data – which may or may not be central to a Big Data project. For instance, we can give an organization a good understanding of vendor contract risk – the exposure to a collapse of a key supplier.

Financial IT: Tell us about how you are working with legacy system providers? Surely Pendo’s platform can hugely increase the value of what you are offering, while their established relationships give you low cost distribution – and a win/win for everyone?

Pamela Pecs Cytron: That is basically true. However, the way that I would put it is that one opportunity stands out for organizations with legacy systems: we can help them to monetize the data that they have in relation to their customers. Merely providing the organizations with APIs is not – by itself – enough to achieve this.

Financial IT: Tell us about your progress with developing an on-demand self-service platform that is accessible by any financial institution?

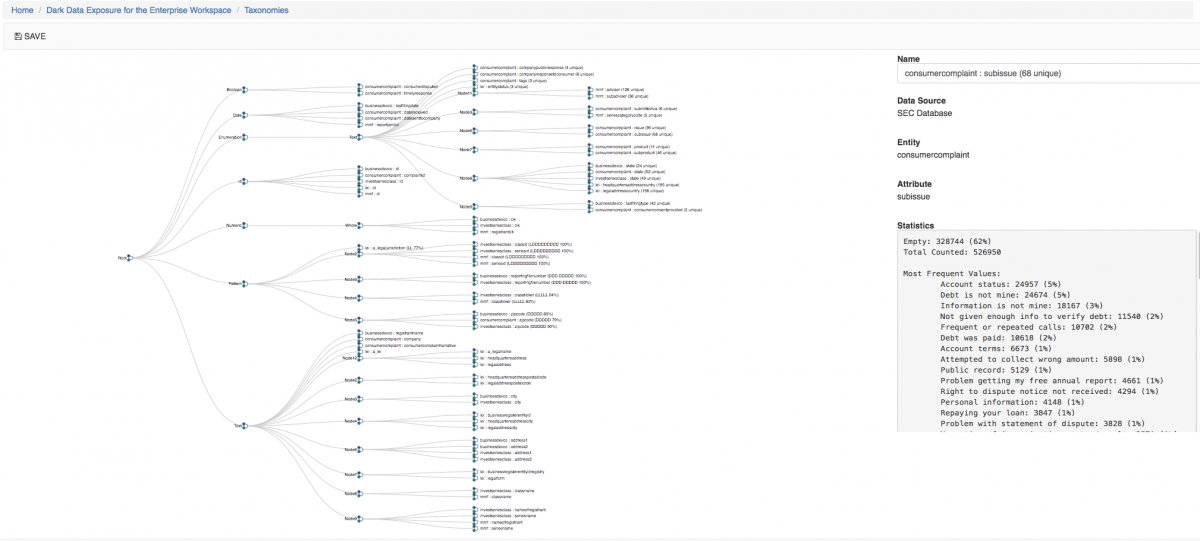

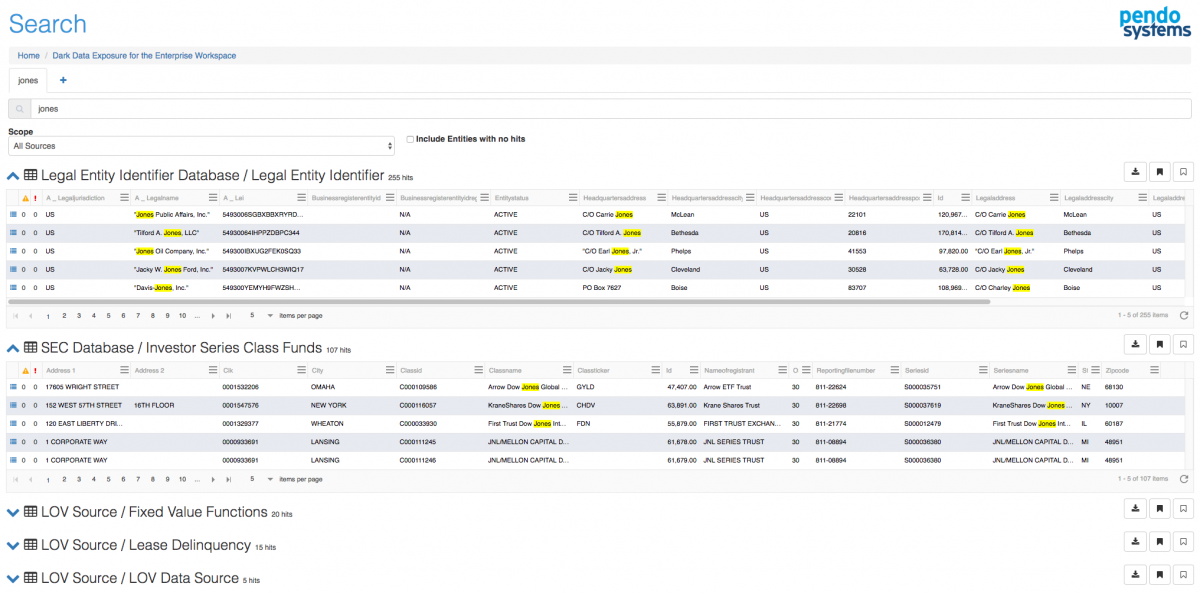

Pamela Pecs Cytron: There are various reasons why we are excited about 2017. One is our self-service Platform, which should become available. Another is the series of improvements that we have made to our existing Platform. Risk modelers can now combine internally-sourced information with data that they have have collated from outside the organization – through FileNet or Sharepoint, for instance. It is also possible to use geometry-based queries to find data in specific locations in documents that have been scanned.

Financial IT: That’s great. What are the really big changes that you expect for 2017?

Pamela Pecs Cytron: I think that 2017 will be the year of true insight. True insight is much more than Big Data. True insight occurs when decision-makers can immediately see what data is missing and what data needs to be enriched. A catalyst for the change will be Artificial Intelligence (AI) and machine learning. However, AI will only really have an impact when two conditions are met. The first is that we are efficiently extracting data from documents that are contained in legacy systems. The second is that we are efficiently finding the data that is not contained in legacy systems. Many of the legacy systems were invented before anyone understood properly what form fields were needed. Our Platform helps organizations to meet these conditions. In doing so, we are bridging the gap.

Pamela Pecs Cytron is the Founder and CEO of Pendo Systems, Inc., which was established in 2006. She had previously served in executive roles with DST International, Sungard, BlackRock and Netiq.

Pendo Systems’ PD³P product is a data management and intelligence platform that provides exploration, discovery and analysis capabilities across multiple, disparate sources of both structured and unstructured data. Probabilistic algorithms are leveraged for searching, matching and classifying data to create a superior understanding of an organization’s data. This new-found understanding is used to quickly solve an organization’s most difficult data problems.