Why Accountants Can’t Afford to Ignore AI

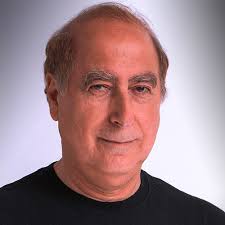

- Eli Fathi, CEO at MindBridge AI

- 12.11.2018 09:45 am undisclosed

Artificial intelligence (AI) is triggering a major inflection point across all industries, and none will escape the influence of this tidal wave of change. While not yet deeply ingrained into the fabric of society, PwC predicts“AI to drive GDP gains of $15.7 trillion,” derived by productivity gains and new product and service offerings. The same report also identifies the perils of not adopting AI-based solutions, “Businesses that fail to apply AI, could quickly find themselves being undercut on turnaround times as well as costs and experience, and may lose a significant amount of their market share as a result.”

The accounting world is not immune to this transformation. But while leaders in accounting are cognizant of the potential impact of not adopting AI in their practices, it’s not happening at a rapid enough pace or occurring uniformly across all firms. According to Forbes Insights, “nearly 90% of executives say AI is either important or very important to the future of their company, yet just 25% have adopted AI into their business plans and processes.”

With the impact big data is having on the ability for accountants to do their work, and increasing global scrutiny of auditing practices, the industry must embrace the advantages that AI provides. AI offers a strategic differentiator for firms and they must understand that the most-commonly cited fears of not adopting it are misplaced.

The most common arguments by firms who are hesitant to adopt AI are the perceived “black-box” nature of AI, the lack of a data strategy due to the size and complexity of client records, the lack of available skills and data scientists to carry out the work, and the inability to define a good business case to articulate clear reasoning and goals for adoption.

The data avalanche

Big Data is no longer a future dream, it’s the new normal for accounting, and as datasets grow in size and complexity, firms must strengthen their infrastructure to manage data confidently, and their tools to analyse it effectively. Due to the overwhelming amount and complexity, data tends to stay stuck where it is within organisations, in older systems and processes. This is known as data inertia and firms struggle to overcome it, by not knowing where to start.

AI offers the unique opportunity to ingest, process, and derive meaningful results from existing infrastructure and tools, and is able to analyse all transactions nearly instantaneously, shining a light on risks across the entire data set. This means firms can rely on AI to report on unknowns lurking anywhere in the data and accountants are freed up to focus on the actual problems, rather than spend days processing and checking samples.

Accounting and audit are not dead

The biggest fear around AI is that accountants will lose their jobs. This entire premise is fundamentally incorrect for the simple reason that AI cannot replace the context, critical thinking, and intuition of a human. A common myth is that an AI-based chess player will always beat a human one, but the reality is that a human and AI in combination will always beat AI alone.

The strength of AI is that it empowers accounting professionals to process larger sets of data faster and make decisions quicker and more effectively. As a way of simplifying tasks, AI can assess risk across all transactions and report any anomalies but it’s still up to the accountant to apply critical thinking and their knowledge of the client to take action. In combination, an accountant fuelled by AI is turbo-charged to make faster, more accurate decisions, while having more time to focus on providing guidance, value, and insights.

A related fear is the perceived black-box nature of AI, with trust in the analysis at risk if the details under the hood aren’t known. Or worse, a lack of evidence available to provide confidence to the client. This is where human-centric and explainable AI comes into play, where the tool is conceived, designed, and built with the person, such as an auditor, at the centre of the loop. Explainable AI exposes the exact what and why of every transaction, and allows for the intuitive investigation into deeper details.

Finding the business case

Despite some movement towards AI, many firms struggle to articulate clear reasoning and goals for adopting the technology. In large part, this is due to anxiety over AI requiring significant shifts in tools and culture, and that firms are too busy to make the change. There is a misconception that AI-enhanced tools require specialised knowledge to use, as highlighted by Gartner’s survey, stating that 47% of CIOs think they need new skills for AI projects. This is based on the assumption that AI isn’t built for human use.

The concept of human-centric AI eliminates the need for people to train on the technology itself, by offering a user experience that is compatible with the way things are traditionally done, while allowing for a natural evolution into newer capabilities. By eliminating the need to spend days or weeks poring through samples, an AI-powered auditor can jump right into the analysis and decision-making, using the insights reported by the platform.

Without the need for AI-specific training, and the benefits of adopting an AI platform as a strategic differentiator, the business case is similar to any technology selection: cost, integration effort, and timelines for adoption.

The move towards AI should not be limited by fears and innuendo, instead we should all recognise that itsredefining the very definition of reasonable assurance and empowering finance teams to deliver added value, leaving the data ingestion and number crunching to computer-sized brains. If you’re not planning a roadmap to AI within the next 12 months, you may find yourself leaving a very powerful - and visible - differentiator on the table. The truth is that AI will not replace accounting professionals, but those who use AI will replace those who don’t.