Transitioning from the MLA to the LCR regime

- Shivani Venkatesh, Senior Banking Technology Consultant at Fintellix

- 16.09.2015 01:00 am undisclosed , Shivani is a Managing Consultant at Fintellix and comes with rich experience in Consumer Banking (Channel Management, Proposition Development, Customer Portfolio Management and Segment Strategy). She has worked on multiple cross-functional projects at a bank level to enhance performance on critical metrics like customer loyalty and sales productivity. She currently works with Fintellix’s Banking Compliance solutions team for building nextgen products and solutions in Analytics, Risk and Compliance. Shivani is an alumnus of ISB-Hyderabad with a Post Graduate diploma in Rural Management from IRMA and a Computer Science Engineering degree from Anna University.

Globally, the inclusion of Liquidity Risk as the fourth dimension in Basel reporting has resulted in an increased focus on Liquidity Reporting and its alignment to the LCR framework. The Basel Committee for Banking Supervision (BCBS) has specified two key metrics to measure the health of financial institutions from a liquidity perspective – LCR (Liquidity Coverage Ratio) and NSFR (Net Stable Funding Ratio).

As per MAS 649 guidelines –“A bank incorporated and headquartered in Singapore needs to maintain a Singapore Dollar LCR of at least 100% and an all currency LCR of at least 60% by 1 January 2015, with the all currency LCR requirement increasing by 10% each year to 100% by 2019”.

Moreover, any other bank that has been notified that it is D-SIB or a bank that elects to comply with the LCR framework, shall maintain at all times, a Singapore Dollar LCR requirement of 100% and an all currency LCR requirement of 50% by 1 January 2016. MAS is yet to publish the guidelines on reporting and tracking of NSFR.

MAS has been collecting liquidity related information from banks for over a decade now. The information sought in Return 613, covers lists of Top 20 individual depositors, corporate depositors and inter bank lenders to identify areas of concentration risk. These reports have been retained as-is in section 1 of MAS 649. However, a new entrant has been the introduction of reporting assets and liabilities by currency.

Also, all currencies to which the bank has exposure, needs to be covered irrespective of the quantum. Some validation checks and coding norms have also been introduced. For example, all currencies in the Asset Liability Report have to be represented as per the ISO 4217 format. All list reports (such as Top 20 Corporate and Retail deposits etc.) need to be populated in descending order.

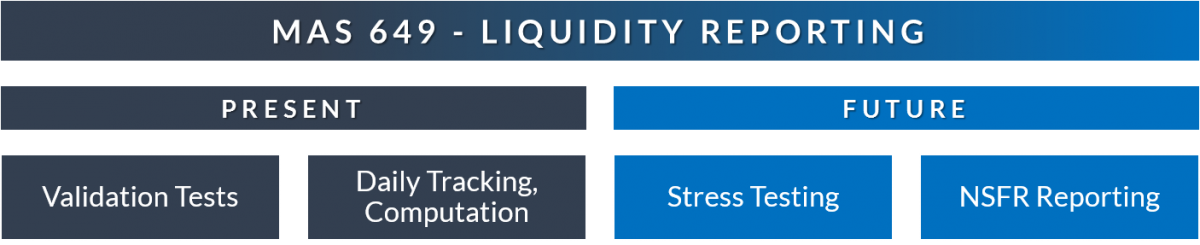

Section 2 of MAS 649 also retains the reports on inflows and outflows based on contractual and residual maturity as well as the behavioural inflow-outflow report. In addition, sections have been introduced to capture the step-by-step computation of the LCR. With the introduction of LCR reporting, automatic validation checks such as -

- Level 2B (II) - can comprise a maximum of 5% of total HQLA.

- Level 2B - can comprise a total of 15% of total HQLA.

- Level 2 - can comprise a total of 40% of total HQLA

In addition, some more validation checks have been prescribed by MAS, for example –

- Amount of central bank reserves that can be used in stress (as reported in Section Level 1 Assets) must be less than or equal to the total amount of central bank reserves.

- All subsections referring to eligible liquid assets in the context of the different classes of assets should be less than or equal to the total amount of that asset.

- All cash flows reported in the LCR section must be positive.

LCR reporting requires to be performed on a monthly basis. However, each monthly report will show the LCR value for the last 30 days. Banks therefore need to put in place the framework to perform LCR computations on a daily basis, store the results and report them as required.

While in the MLA regime appropriate haircuts were proposed for different kinds of instruments (basis which the MLA was finally computed), in the LCR framework exhaustive guidance has been provided on assignment of haircuts to inflows, outflows and HQLA based on the tenure, details of the contract, nature of the underlying of the asset/liability and counterparty involved

However, the liquidity reporting prescribed in MAS 649 is likely to evolve to include performance of and reporting on stress tests. Basel guidelines emphasize the importance of performing stress tests to evaluate the impact of various macroeconomic shocks on the health of the bank from a liquidity perspective. The MAS 649 guidelines at the moment are yet to cover this aspect of Liquidity Reporting. In addition, NSFR-related reporting is also expected to become a part of regular Liquidity Reporting for banks soon.

Transitioning from the MLA to the LCR reporting regime requires greater focus on creating the right framework to automate the calculation, since the complexity of computations involved and the frequency of reporting are both increasing. More importantly, creating the right data infrastructure is vital for banks for having the flexibility to cater to more reporting asks in the future, as well as perform stress testing.