Stocks are down around the world and still heavy

- Clifford Bennett, at ACY Chief Economist

- 17.09.2021 12:00 pm #trading

The past week has seen sharp swings on a daily basis, but the overall drift has been largely sideways. Economic data has been less than reassuring.

US500

There are price action resistance levels developing in markets, which could see resumption of some significant upside if breached. That is worth keeping an eye on.

Nevertheless, one would have to say that the major correction potential is still very much in play, and the view which I personally remain concerned with.

The overwhelming market sentiment in New York, Australia and elsewhere, is to buy the dip. That equities are bullet proof.

Certainly, earnings are strong, and as previously discussed this is due to freedom of pricing as well as economic recovery from the depths of 2020.

We do have, the 'how long is a piece of string problem' with valuations as they continue to stretch.

We also have the phenomenon I spoke of months ago, of an increasingly segregated society. One that leaves far more, post the Covid upheaval, left behind. For instance, people point to the improving un-employment level in the US, but forget there are still 5 million jobs lost. The majority of those people have been so severely marginalised, they no longer try. Meanwhile, many others are enjoying high pay, low interest rates and bigger homes. This has always been the case, but Covid has changed the world from the wealth gap growing through the rich getting rich faster, but the poor still getting richer too, to one of a growing wealth gap as the poor get poorer.

Stretches and strains on systems will always be present. It is only when they become extreme that something breaks. Triggering a snow ball effect. As we witness in the GFC. This was purely a product of rather dumb investment bank mathematics ignoring the realities of what was happening on the ground in society. The stretch of stock pricing, based on artificially low interest rates, while price gouging the world over drives earnings, is not something that is sustainable.

This is why, any significant correction period, such as the one we are currently experiencing, should be viewed very seriously and acutely indeed.

The party can only go on for as long as the broad economic base is stable and productive. The disruption at that level at the moment, around the world, is on-going.

Alliances and Submarines

Still seeing a broad sell Australia sentiment around the world, that was already in place due to our Covid isolation and declining relationship with China.

Certainly, the new military alliance will have a further diminishing impact on exports to China. There can be no doubt about that. It may also mean increased trade with UK and the USA, though this remains to be seen.

Going nuclear with submarine propulsion is helpful regarding the significant oceanic distances that Australia has to deal with, but it will be a significant expense. The submarine deal cancellation with France, cooling relations with Paris, will have a few heads turning on the continent. France was helping Australia, and has significant interests in the region, but was completely left out of this latest defence alliance.

Attempts to rally on every mention of NSW and Victoria opening up, but still looks like a bounce that is tiring.

AUDUSD

The down-trend is likely to be reliable.

US Retail Sales

Bouncing around a lot on Delta impact, schools re-opening and weather events. The trend at this time however, is relatively flat and firmly below pre-Covid normal levels.

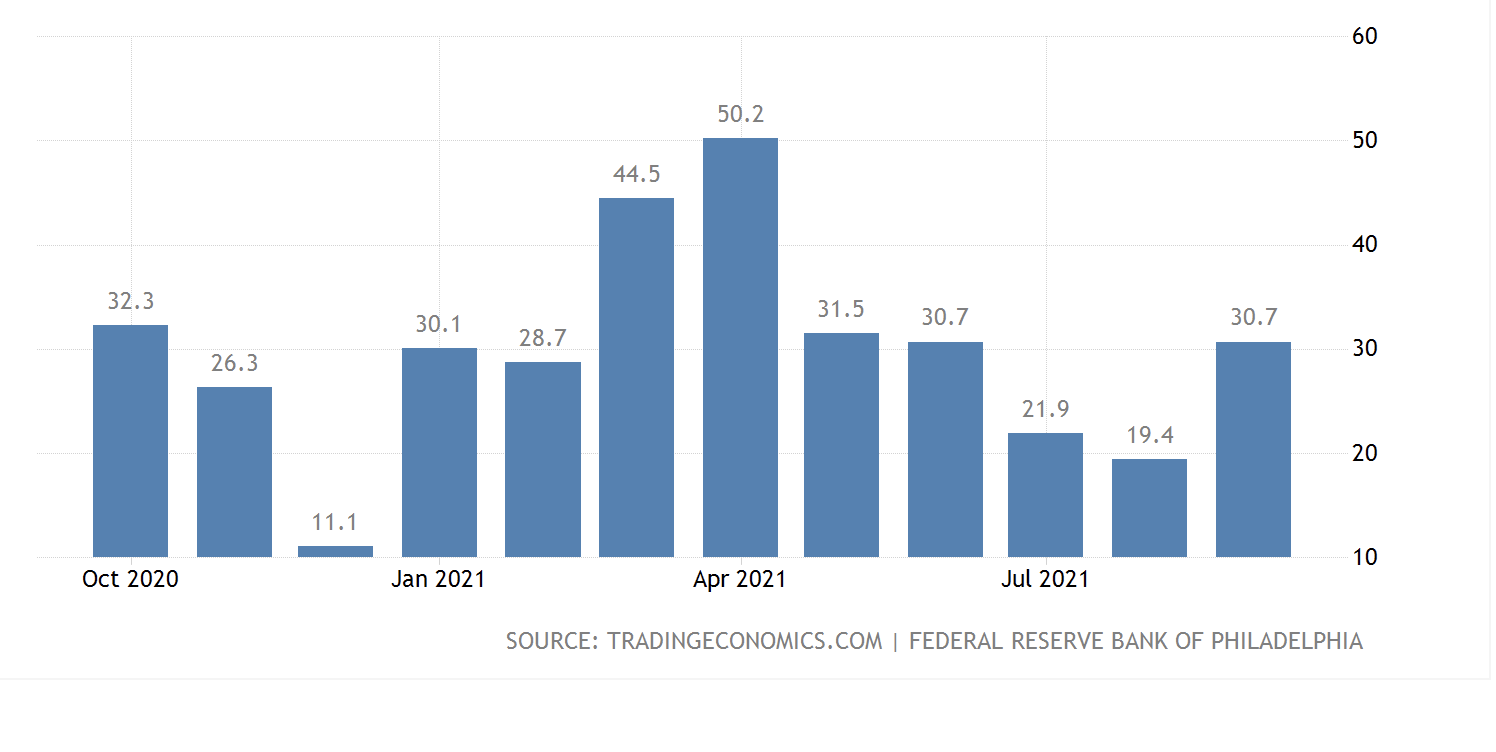

Philadelphia Fed Manufacturing Index

Seeing that boost on school re-openings. Still down on pre-Covid norms.

US Capital Inflow

A major factor in the holding up of US stocks at extreme valuations. Could prove quite fickle, should the Delta and inflation surges continue unabated.