Tapering rate hike race is on

- Michael Moran , Senior Currency Strategist at ACY Securities

- 09.08.2021 09:15 am undisclosed

Despite some real concerns in Friday's data too.

EURUSD slide can turn into an avalanche.

This is the Grand Stadium of who will hike first.

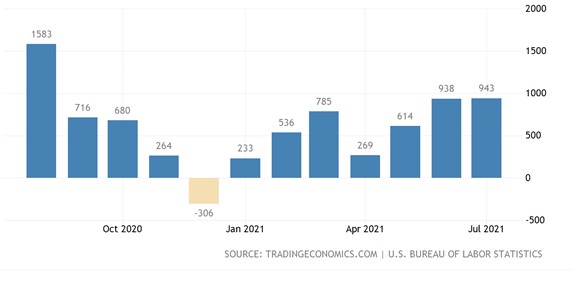

Job creation in the US is finally firming more reasonably, as schools have opened up and hospitality too.

At the same time, the Delta crisis in the US is intensifying.

While vaccination is lower in Texas, it is still at 50%. 40% of new cases are in California and Texas, but that means 60% are across the US where vaccination rates are up at 70% or better.

Fauci is now saying what I have been saying for a long time, being vaccinated, you still need to wear masks and social distance. There is also the new variant out of Peru, which is more resistant to vaccines. I am not being a pessimist. Getting a handle on the future reality paths for the economies of the world is still influenced by cover.

The outlook, is that the US economy is about to slow, move down another gear, from that already seen. It should hold there. This is the light at the end of the tunnel, but there is a bit of a tunnel we are just entering yet again. The US will get through this, and businesses remain profitable. The initial surge in earnings now being seen however, a function of pricing freedom inflation, will also begin to fall back.

Nevertheless, the Federal Reserve will see less and less purpose in its massive bond buying program. Tapering will happen sooner, as will rate hikes, than the market or even the Fed had imagined. This has been our central theme on US rates all along. Very different to our competitors. We see a US rate hike in 2022.

There is no doubt the US will win the race to tapering and hikes, whenever they occur, over the European Central Bank. Hence, the move by the US dollar broadly against other currencies and commodities on Friday. All, as we have been forecasting. Except for Gold. I have been a bull on Gold and remain so, but clearly, there is more short term pain here first. Gold will eventually stabilise in a way I do not expect the Euro, Aussie or Oil to do.

What about Oil?

Oil can continue to fall approaching a mini-crash

The world economy will slow, as all nations are now experiencing on-going Delta challenges. We should not see widespread lockdowns, but there will be a strong up-tick in supply chain disruption just the same. Oil pricing could survive this, were it not for the tremendous rally already seen. Again, it has been a case of a market pricing in a Nirvana economy that is just not going to happen. Hence, Oil was already vulnerable, and all the more so now.

US infrastructure bill is possible

This is actually not a certainly, though it is a probability. It may contain new tax measures on crypto currency transactions. As a boost for the US economy, this is a long overdue initiative of some 10-20 years, and will be a ten year plan. The immediate impact to the economy is almost non-existent. Some big plans will simply never eventuate. Nevertheless, the market will again believe what it wants to believe. This sentiment response could see a temporary boost in the equity market, but I would not expect that boost to last beyond a week. Especially if, as expected, the Delta stretching of hospital resources continues.

US Jobs creation firming.

Un-employment fell to 5.4 %, while participation remained around the same. This is a positive performance and hence the increased pressure toward tapering rather immediately.

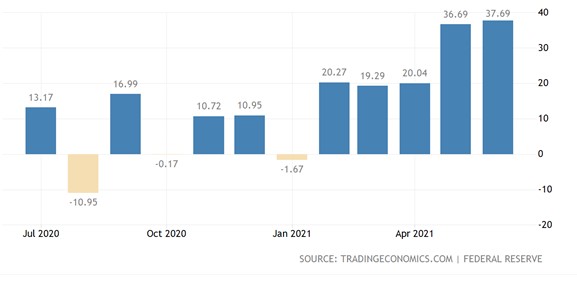

US Credit Binge in play.

Many Americans are clearly coping by resorting to credit, and/or were confident for a while and went on a spending surge. Either way, these are historically high numbers. Government and personal debt moving to higher levels.

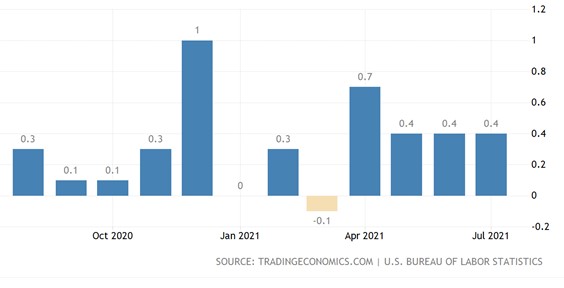

US Inventories are very high now.

Suppliers may now choose to wind these levels down a little. Again, a braking force on the economy going forward.

Latest Video report.