Regulatory Algebra

- Christian Voigt, Senior Regulatory Adviser at Fidessa

- 13.06.2016 08:15 am undisclosed

Algorithmic trading and market access are under increased pressure from regulators everywhere, adding new layers of complexity in the quest for a single, global, normalised trading experience. Buy-sides often use Sponsored Access (SA), Direct Market Access (DMA) or Direct Electronic Access (DEA) via brokers across different regions. With MiFID II andRegAT each defining those terms, differences in meaning can quickly escalate from a simple semantic annoyance to a more serious compliance and business issue.

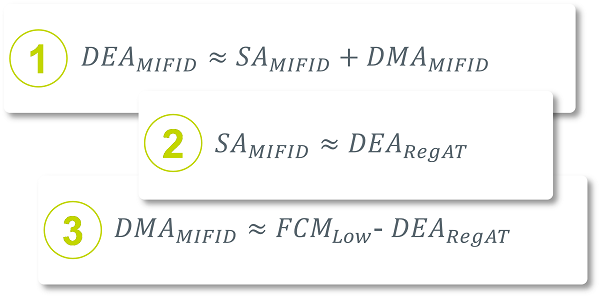

MiFID uses DEA as an umbrella term to capture both SA and DMA (eq. 1). However, under RegAT, DEA looks more like SA under MiFID II (eq. 2). Finally, DMA under MiFID II effectively corresponds to US FCMs’ low touch flow without their DEA activity (eq. 3).

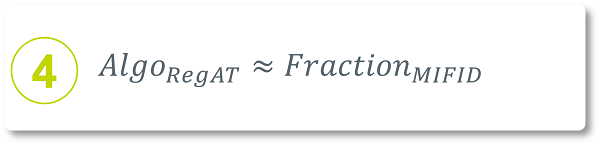

So it appears that legislators in the EU and the US both intended to exclude order flow generated by humans. Under RegAT only algorithmic orders are in scope. Under MiFID II, however, to be in scope the DEA user must have the capability to determine the fraction of a second of order entry and the lifetime of orders within that time frame. Since MiFID II doesn’t stipulate which fraction of a second is needed, the interpretation is still open. If we assume that only algorithms are able to work in fractions of seconds (eq. 4), then the respective EU and US regulatory definitions could become comparable.

That said, with a human’s average reaction time of 0.25 seconds and an algorithmic trade’s in the realms of milli or microseconds, maybe only a quant can estimate how to achieve true global equivalence.