When everything is free, how do we make money?

- Chris Skinner, Chairman at The Financial Services Club

- 23.07.2015 01:00 am P2P , payments

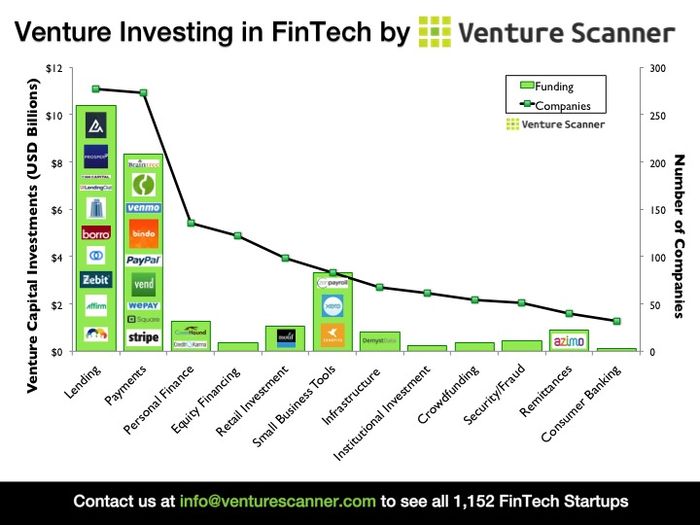

I have this mantra in my presentations about payments. Payments is being attacked by Fintech startups like Klarna, Square, Stripe, Alipay, PayPal (Venmo, Braintree) and more. In fact, according to VentureScanner, it’s the second most active area for investors after lending (P2P and crowdfunding) ...

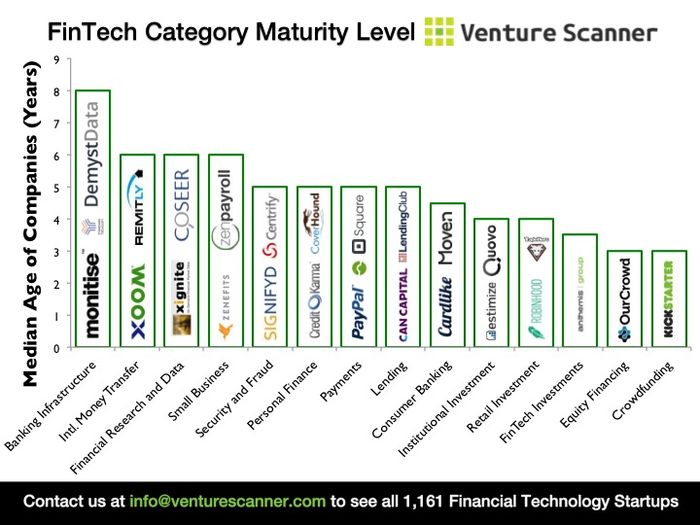

… and the most mature http://insights.venturescanner.com/2015/07/02/which-financial-technology-category-is-most-mature/ sector for new competition to traditional bank processors.

My mantra is not about payments as a sector though, but the failed structure of how we pay in the 21st Century. If I send a payment from London to Sao Paulo today, it takes 7-10 working days to process. How completely ridiculous is that? If I telephone my friend in Sao Paulo, it’s immediate, real-time and free via Skype. If he picked up the Skype call a week later, I wouldn’t bother talking to him. So why does it take days to process a payment from UK to Brazil?

The answer is that old counterparty transfer system between sending and receiving banks via SWIFT networks and low and high value clearing systems. Now that’s slowly being solved by companies like Ripple. The idea is to create a banking shared ledger, or blockchain if you prefer, that would allow counterparties to share a trusted exchange system in real-time on the internet, for almost free.

And that is my mantra: that everything in banking should be real-time and almost free. You cannot run a 21st Century financial system on old technologies that are slow and expensive when everything else around us is fast and free.

Blogging, sharing, storing, calling, watching, consuming, buying, selling … everything around us has moved to a fast and free model of exchange. How come it’s still so expensive to bank? Because it’s so expensive and slow to bank is why peer-to-peer lenders and payments start-ups are thriving and flourishing. Not all of them get rid of the expense – only Klarna gets around the challenge of the old fee-based structures of the card schemes – but they’re all focused upon simple, real-time exchange.

Now here’s the real question: if everything is almost free, how do we make money?

Most people haven’t answered this question. That’s why Square, Stripe, PayPal and co add an extra little fee for usage on top of the card scheme fees. That’s one way to make money. I prefer another way though. We make money by informing, augmenting, supporting and managing money. By informing, augmenting, supporting and managing money, our users are willing to pay for this.

In what ways can we inform, augment, support and manage?

Well, I haven’t found many examples, but two stand-outs were alerted to me in my recent travels.

One is a bank that has created a restaurant app. The restaurant app provides reviews and ratings of all the restaurants in the country. Like a TripAdvisor, you can find restaurants near you, book a table, write a review and, most importantly, pay through the app. The way you pay is using a QR code on the bill or, even easier, just create your wallet in the app and payments are taken automatically with bills provided electronically.

The thing I like about this bank’s app, is that it’s succeeding in becoming the country’s main app for foodies and blocked out the other banks. The block is that the other banks are not part of the app, so you can only pay for your meal through the wallet or QR code if you are a customer of this bank. As a result, their competitors are now asking to be part of the app and the bank is charging a fee to the other banks to include them in the wallet.

I love this as it showed early mover creative thinking and a way to gain loyalty and attraction through design.

Another great example is a bank that is looking to social media to create loyalty. You‘ve probably heard the crowdfunders idea of gathering enough people who want a particular product to get discount on that product. If you can find 100 mates who all want to buy the new BMW 5-series, then BMW will give you a discount if you order 100 BMW 5-series this week. Well, there’s another bank that is taking this idea to leverage value for their customers.

The idea is that the bank will monitor their customers’ Facebook likes. If they find a large group of customers who have all liked the announcement of the new BMW 5-series for example, then they would approach BMW to negotiate a deal. The bank might then commit to buy 100 cars in the first week of release and, by doing so, would contact all the customers who like the new BMW 5-series and let them know that if they want one, not only would they get a whopping discount (let’s say BMW gave the bank 20% discount, so the bank gives their customers that whole discount, 20%) but a nice loan from the bank too.

In other words, the bank is purely seeking increased loyalty from their customers by giving them value. The bank cross-sells a loan to the customer at a discount rate and, most importantly, gains 100 loans in a week for a three- to five- year period from 100 customers. The customers are locked in and the bank is happy. The customer is happy too, as they have a new BMW 5-series ordered at a 20% discount (far more than they could have negotiated) AND a discounted loan and a three- to five- year term.

This is a win : win for both sides, and that’s how future banks will have to behave to differentiate in the internet of value. The future bank will make money by creating and unlocking new ways to deliver value through data.

So, when asking the question: if everything is free, how do we make money? the real answer is: by thinking differently and creating additional value through design. A tough ask for an old bank, but not an impossible one as illustrated by the two examples above.

Source: http://thefinanser.co.uk