Open Finance and Open Banking – the Main Difference and Takeaway Points

- Sabrina Akramova, Editor & Content Manager at Financial IT

- 11.03.2022 09:00 am #openfinance #openbanking #defi #FCA

Although it hasn’t been long since open banking became a popular topic of debate, a new confusing term emerged – open finance. What is open finance and how is it different from open banking? Is open finance regulated by a legal framework? Let’s dive deeper into this concept and see how open finance can benefit individuals in the long run.

What is open finance?

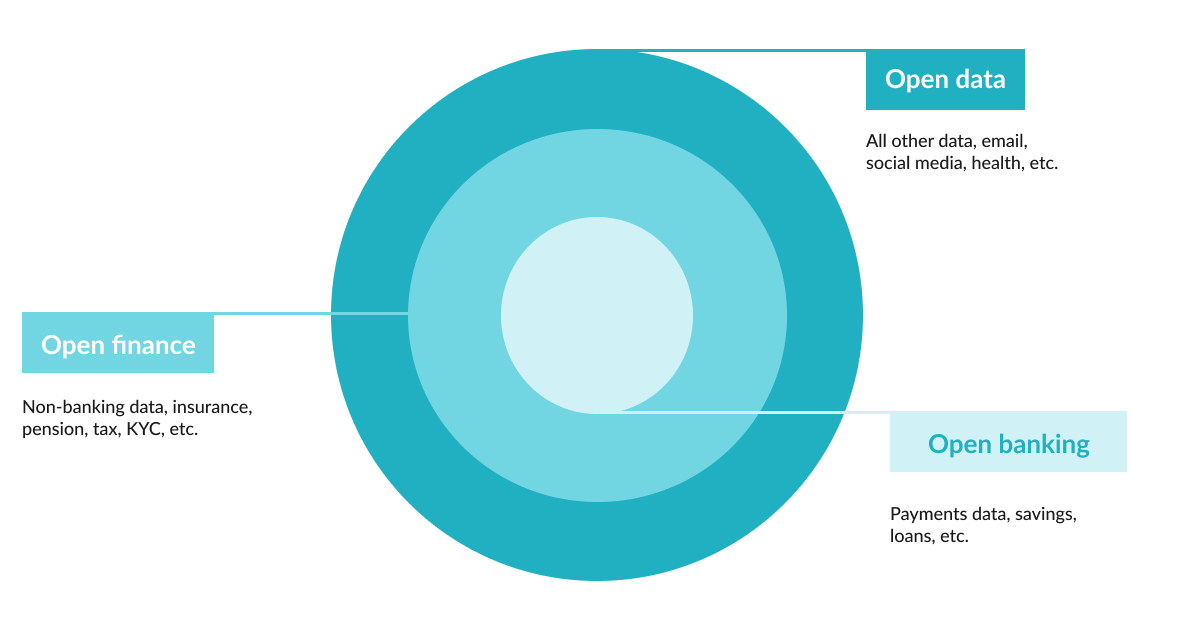

Open finance is believed to be an extension of open banking, allowing third-party data exchange to affect a broader variety of financial goods and services. Unlike open banking, open finance is a much broader concept of data, products, and services, which cover the entire financial sector. A trustworthy third party might access your pension, tax, and insurance data with the user’s consent, which reveals greater customer services, payments, and financial goods.

A year ago, the UK’s Financial Conduct Authority published a Call of Input with a conclusion stating that open finance could be beneficial for firms in the constantly changing environment due to COVID-19. As financial data basically includes information about mortgages, insurance, savings, pensions, open finance aims to improve the individuals’ financial well-being in the era of market innovation and increased competition levels.

As open banking has democratized and revolutionized finance, open finance will foster collaboration between third-party suppliers and the traditionally closed financial sector. Consequently, customers will get access to their financial data in a more simplified way and know every detail about their money savings.

How open finance is beneficial?

Both financial service providers and consumers benefit from a comprehensive network of banks and other parties.

1. Lender Transparency: Currently, third-party lenders must evaluate each consumer's finances to determine their creditworthiness. However, without access to several banks' data, this procedure is slow and prone to human mistakes. Lenders can better comprehend a consumer's financial status via transparent finance. Lenders can better assess potential borrowers' creditworthiness, audit documents, and provide personalized solutions by securely collecting customer data. Machine learning algorithms may be used to derive deeper insights from raw data.

2. Transparency for Consumers: Just as open finance helps lenders, it helps consumers. A full picture of personal finances is attainable by combining data from banks and third sources. For people with less financial literacy, the findings allow them to optimize their financial situation utilizing personal finance management (PFM) tools.

Any challenges?

Despite the many advantages of open finance, there are still certain obstacles to overcome.

1. Cross-platform friction. Consumers, regulators, governments, data providers, and third-party providers are all part of the open financial ecosystem. Because there are so many parties involved, misunderstandings are inevitable. The number of API connectors required might lead to data asymmetry when not everyone has access to the same information.

2. Bank compliance. The pressure on fintech businesses to comply with rapidly evolving rules is already starting to build. If any stakeholder violates these or similar restrictions, the open banking ecosystem may suffer financial or reputational loss.

How open finance affects individuals?

Open finance has various personal and commercial repercussions.

Personal finance management platforms (PFM) might evolve to provide cheaper and more comprehensive debt counseling, product suggestions, and enhanced financial involvement. However, open finance isn't just about suggestions and dashboards. Open finance may also have “write” permissions, saving you money. For instance, savings account or mortgage overpayment with the additional £100.

For consumers and businesses, the FCA believes open finance has the potential to change financial services. Open finance should be implemented gradually, considering how consumers will use and interact with it. The essential building elements for open finance in the consumer's interest are generally agreed upon. The legislative and regulatory framework, standards, and an implementation entity.

The future of open finance

Integrating traditional banking with technology is a big task. The benefits to consumers and financial institutions are apparent. The decentralized finance (DeFi) sector is expanding its use of blockchain technology to create the most autonomous financial services ever.

Smart contracts can empower customers by enabling trustless transactions using blockchain-based digital money. Despite the advantages of fintech and DeFi, there remain obstacles to overcome. But if emergent ventures collaborate with established financial institutions, open finance can alter global financial services delivery.

So, open finance is a natural extension of open banking. It will continue what open banking started: leveling the playing field so customers enjoy better-tailored financial journeys. Businesses get access to more relevant data, faster client onboarding, and scalable financial solutions.