Seizing the mPOS opportunity

- Christian Damour, Head of Marketing – Security at FIME

- 26.04.2016 11:15 am mPOS

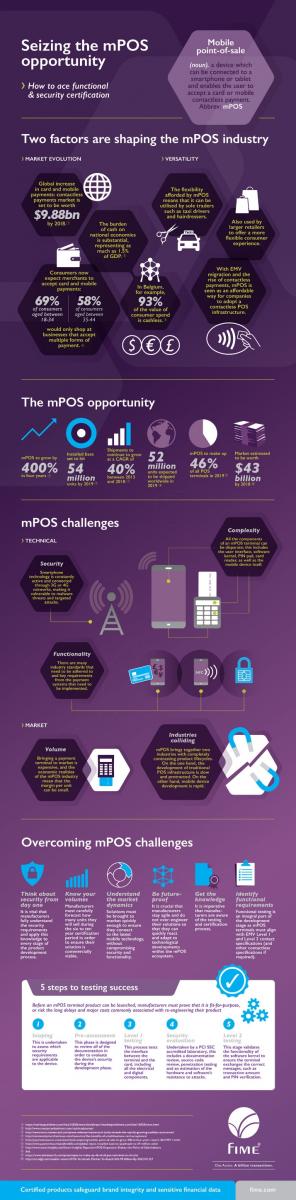

Mobile point-of-sale (mPOS) is revolutionising the POS terminal industry. Taxi drivers, plumbers and hairdressers can now accept payments on the move, armed with their smartphones. And larger merchants are also benefitting from a cost-effective, wireless and flexible alternative to the traditional POS infrastructure. Because of this, the market is poised to grow by 400% over the next four years, 46% of all POS terminals in 2019 are expected to be mPOS and the market will be worth an estimated $43 billion by 2018.

As well as presenting opportunities, however, mPOS solutions also pose various security and functional challenges. These must be addressed in the development phase to ensure the technology reaches its full potential. This blog and infographic explain how manufacturers can overcome these challenges to successfully bring their solution to market and seize the mPOS opportunity.

Before an mPOS product can be launched, manufacturers must first prove that it is fit-for-purpose, or risk the long delays and major costs of re-engineering. To this end, addressing the functional and security requirements when the product is in early-stage development is imperative.

Security testing is an essential stage in the product development process as mPOS terminals arguably need to meet even more rigorous standards than traditional POS terminals. This is because smartphone technology is constantly active and connected through 3G and 4G and is therefore vulnerable to malware attacks. mPOS payments also require the presence of a dedicated hardware card reader, entirely independent from the mobile device, as well as an mPOS application on the mobile device. Both of these elements must be subjected to stringent security testing and certification.

Functional testing is also an integral part of the development stage as mPOS terminals must align with EMV Level 1 and Level 2 contact (and contactless if required) specifications. This process, however, can present challenges. In traditional POS terminals, all of the components are standardized, which makes the testing process relatively simple. In contrast, the complex nature of mPOS means that the user interface, software kernel, PIN pad, card reader and the mobile device itself, are often disparate. This lack of standardization can lead to delays in times to market and can generate unforeseen development costs.

The infographic walks you through the factors shaping the mPOS industry, the opportunity for manufacturers, the challenges the technology presents and how they can be overcome.