Meet Banking Customers’ Digital Expectations - Before Your Competitors Do

- Zeev Avidan, Chief Product Officer at OpenLegacy

- 19.12.2018 10:15 am undisclosed , Zeev Avidan is Chief Product Officer at OpenLegacy, which delivers microservices-based API integration and management for companies who want to replace older legacy systems, including proprietary mainframe and midrange systems, applications, and databases.www.OpenLegacy.com

Today, more than 7.5 billion people - almost 52 percent of the world’s population - use the Internet. That includes digital customers - especially the tech-savvy Millennials - who want to interact with banks and financial services online or via mobile, securely.

To get the lion’s share of new, younger customers and keep their existing customers, well-established financial institutions must innovate like nimble newcomers and leverage their lumbering legacy systems into lithe digital experiences. They must decide whether to compete by adding their own innovations or collaborate with the emerging tsunami of fintech technology options. Either way, to drive new revenue and prevent customer defection, they simply must find a better, faster approach to extending their proprietary systems - and do it speedily, safely, seamlessly, and inexpensively.

The Need for APIs: Why No Bank Can Afford to Be Left Behind

Tomorrow’s outlook makes this digital demand even more urgent. According to a recent PWC Global FinTech Report, large financial institutions across the world could lose 24 percent of their revenues to financial companies harnessing new technologies. They need to fully utilize their existing assets through digital transformation and rethink their business models to self-disrupt and ensure continued sustainable growth.

The banking and financial services landscape has been dramatically changing. Thanks to venture capital money, increasing consumer appetite for cutting-edge digital experiences, inexpensive cloud infrastructure, and mix-and-match APIs, startups are building revolutionary financial products and experiences.

Innovations like online-only banks, fully automated financial advisory and investment sites, peer-to-peer lending services, and web applications that present a 360-degree customer view for faster, more efficient banking services are fast becoming commonplace.

Financial innovation competitions worldwide show that some banks are going even further - an AI-based tool that helps users improve their financial habits and save money, time, and effort; blockchain technology that creates a seamless car loan experience that includes not just the car loan and insurance but also license plate acquisition and even breakdown assistance. All these are pushing traditional banks to wake up from their lethargy and bring their enterprises into the digital age, and fast.

Why Transformation Is So Difficult - and Why Past Methods Have Failed

No transformation is pain-free. New digital imperatives all require legacy transformation; and the choice is between integrating data, processes, and business functionality from legacy systems of record to newer, modern technologies or developing newer systems.

Integration is complex - involving critical business functions like account management, payments, loan management, credit cards, as well as CRM, finance, and accounting applications. Additionally, more and more enterprise applications are becoming cloud based - further complicating the process due to the technological differences between on-premise and cloud-centric integration approaches.

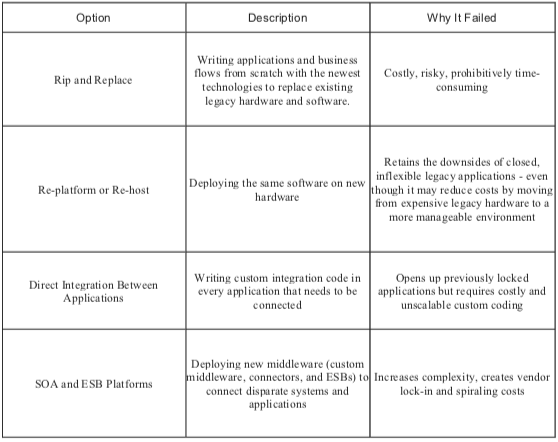

Of course, organizations have tried various transformation options in the past, only to see them fail, including:

The Future Is Here: Why APIs and Microservices Are the Best Way Forward

What do financial institutions need to succeed? Three things:

● Customer-centricity - a seamless, personalized customer experience via integration of an

intuitive user interface containing data and processes from multiple, disparate systems and applications across the organization.

● Mobile centricity - anytime, anywhere access by consumers and employees to the information and services they require across devices, locations, and applications.

● Agility - The ability to quickly deploy new business functionality and user interfaces and quickly introduce new consumer products like service bundles, payment apps, and digital banking.

Microservice-based APIs can make this “evolution rather than revolution” happen. Simply put, APIs are a software intermediary that allows two applications to talk to each other. Microservices is a way of developing software systems that focuses on building single-function modules with well-defined interfaces and operations.

By bringing APIs and microservices together, financial institutions can:

● Extend the tried and true environment using standard, open API technology

● Create fully functional digital services within days instead of months

● Get speed of implementation, low cost, and open standards in one API integration and management software platform

● Connect enterprises’ core applications to mobile, web and cloud solutions

● Provide end-users with an improved experience via access to systems through web or mobile devices–or their device of choice–within days or weeks

● Give customers an improved experience in addition to information and new services they did not have available previously

● Create microservices as an API that has the application, rules and security built-in or, in one step, create a legacy API and deliver business processes as microservices.

Bridging the Legacy Gap

To enable the flexibility banking enterprises need to meet today’s digital imperative, they need to transform existing systems as services and then integrate those services as needed. The API and microservices approach lets them customize their strategy – providing options such as which business processes and data elements to expose and which functions to keep internal. Features and functions from legacy applications can be easily pulled out and combined into processes that authorized users and other applications can access from anywhere.

It’s imperative that established financial services organizations do what it takes to stay in business. With the agility of microservices and APIs, delighting your customers is more within your reach than ever.