Manage FX Risk: Find the Right Stress Test as Pandemic Disruption Continues

- John Clarson, Director – Quantitative Services at GTreasury

- 16.10.2020 10:30 am FX

Global supply and demand remain unsettled as pandemic recovery struggles forward with a still-uncertain future. Disruption continues to stoke FX volatility, further clouding the future as treasurers and other corporate finance professionals navigate uncertain cashflow and dangerous liquidity risks.

The foresight that corporate treasurers provide their organizations through careful liquidity and risk metric tracking offers tremendous strategic value even under normal circumstances. Our current global uncertainty now makes them unequivocally crucial. Corporate leadership rely on treasurers to accurately forecast cash liquidity, and to use that data to make informed risk management decisions while steering their businesses forward.

For those forecasts to be complete and predictive, they must account for exposures stemming from FX volatility. This means leveraging powerful, analytical techniques that enable precise and effective policies to curtail market risk. Once an organization fully recognizes the effects of FX shifts on their cashflow and earnings, leadership can adapt hedging strategies to optimize risk tolerance and be better positioned amidst ongoing turbulence.

Where is your exposure?

The first steps toward achieving effective FX risk management are finding and scrutinizing exposures and their impact on risk. In order to properly model risk management, the exposure forecasts that provide the baseline for these models need to be as accurate as possible.

Forecasts should be made on a moderate time horizon – one that’s long enough to capture the full threat of risks, but brief enough to preserve accuracy. It’s critical to surface intercompany and external exposures to complete a comprehensive risk profile. Forecasts should account for natural hedging and seasonal business cycle movements as well. Those businesses affected by interrelated risk factors must also account for these dynamics in their forecasts.

What is your FX risk model?

With baseline forecasts prepared, next select the most appropriate methodology for FX risk measurements. Options include earnings/cashflow modeling and economic value modeling. For instance, cashflow modeling is ideal for a foreign exchange book, since currency pair movements result in upward and downward earnings shifts. Alternatively, economic value modeling is an apt fit for a fixed-income securities investment portfolio, since its current value will decline as interest rates rise.

1) Scenario (deterministic) modeling

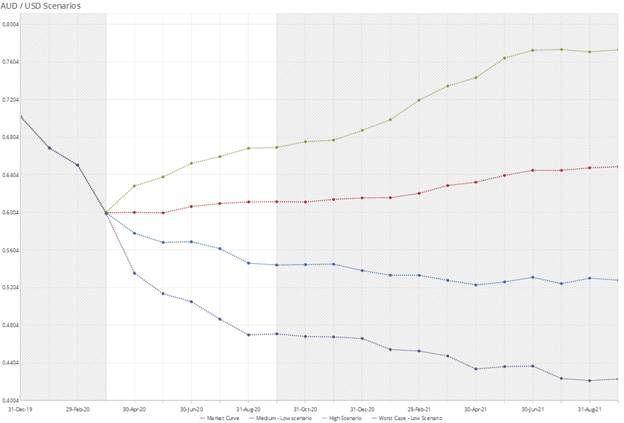

As the simplest method for stress testing, scenario modeling doesn’t try to predict how FX rates will change in the future, but instead provides a clear view of the company’s risk exposure across a range of likely/worst-case/best-case scenarios and their quantified impacts on cashflow.

Scenario modeling enables treasurers to communicate risk as the span between likely and worst-case scenarios, or between the best- and worst-case scenarios. Importantly, treasurers can utilize best-case scenario models to make clear the opportunity costs of risk prevention measures.

The likely scenario is commonly represented by a forward market curve, with best- and worst-case scenarios modeled as parallel shocks to that curve. Treasurers can model specific potential shifts in circumstances that predict realistic or possible changes caused by certain scenarios.

2) Cashflow-at-Risk simulations (stochastic modeling)

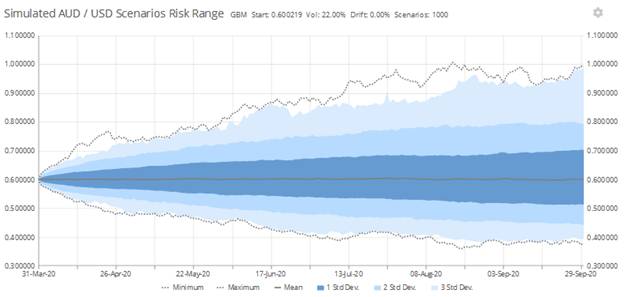

Cashflow-at-Risk (CFaR) simulations create myriad possible paths that FX rates may take by using Monte Carlo simulations; the simulations are collected to produce exposure forecasts. This approach takes the guesswork out of scenario forecasts by calculating tens of thousands of scenarios from fixed or random seed values (in contrast to simple scenario modeling that calculates just one).

CFaR simulations are adept in clearly displaying exposure risks, as well as the potential effects of various strategies for managing those risks. By producing a broad range of possible cashflow outcomes and calculating their statistical likelihood, CFaR simulations can project the degree of cashflow challenges to a selected level of confidence and within a certain timeframe.

To accurately represent their unique array of risk factors, treasurers should leverage the most appropriate simulation type and algorithm – such as Brownian Motionand Mean Reversion. Accurate modeling also requires factors such as volatility and long-term mean, among others, to be accounted for.

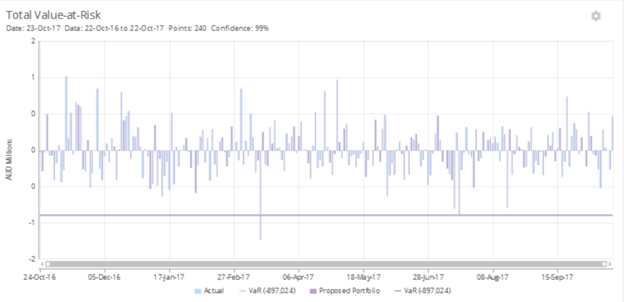

3) Value-at-Risk model

Instead of projecting future cashflows, the Value-at-Risk (VaR) model looks at historical market rates and price curve simulations to project possible shifts in market values. Using VaR analysis, treasurers can evaluate investment loss risks caused by FX volatility, and do so to a selected level of confidence and within a certain timeframe.

Scenario modeling and CFaR simulations enable cashflow analysis, while VaR modeling facilitates analysis of market impacts on investments. Treasurers may find significant value combining these approaches to create more dimensional risk profiles; for example, leveraging a CFaR model to define a worst-case scenario and then performing stress testing with scenario models.

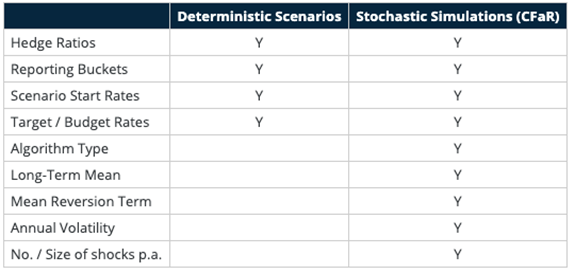

Consider all factors

Once a model is chosen and forecasts are applied, all hedging contracts must be incorporated into the models. Models also need to account for contingent cashflows, such as options that occur if a scenario includes a certain market price path. In deploying analytic models, treasurers need to address these factors:

Treasurers can also provide models with inputs in order to stress test their exposure profile against historically challenging scenarios, like the volatility and shock sizes we saw during the 2008 financial crisis. Modeling should also be used to compare cashflow metrics for the current book with those for potential hedging strategies before and after volatile events, in order to vet those proposals and make effective preparations.

Summing up

As the unprecedented global uncertainty created by COVID-19 continues to cause FX shocks and make revenue streams uncertain, risk management policies need to be continually reviewed, tested, and adapted. Decisions involving tolerable risk levels must be informed by accurate modeling and stress testing, in order for leadership to implement hedging policies aligned with the highest-potential for weathering the storm.