Fintech attacks whilst bank CxO's snooze

- Chris Skinner, Chairman at The Financial Services Club

- 31.07.2015 01:00 am Fintech

Since asking a while ago who will be the Uber of banking, I’m fed up with everyone talking about the Uber of banking. For example, two headlines caught my eye this morning: Visa Invests in Stripe to Prep for the 'Uberization' of Retail; and Will Uber be the Uber of banking?

Both stories are interesting, and demonstrate the massively changing world of payments, but payments does not a bank make. It’s just part of the game. Equally, neither story is talking about a disruptive change to banking or payments. Stripe and Uber opening its own financing subsidiary are just evolutions of old systems of value transfer and trade finance. Stripe sits on the card networks and Uber does the same. There’s nothing new here.

So when we ask who will be the Uber of banking, we need to find a real disruptive change, which is why I always come back to shared ledgers, or the blockchain if you prefer. This area is clearly misunderstood by most, as they assume it’s bitcoin, but the shared ledger structures will reinvent the backbone of value transfer and how we contract, so this is clearly important.

Equally important is the rise of peer-to-peer connectivity through the mobile network and these two things combined are the reasons for so much Fintech investment being made. After all, with 83 Fintechs contending to be unicorns – startups since 2000 that are now valued at over $1 billion – up from just 70 two months ago and (46 unicorns and 37 nascents) compared to 70 (36 and 34) just two months ago and 17 a year ago, we are seeing a re-landscaping of payments, banking and finance.

That’s why the UK announced its backing for Innovate Finance, with David Cameron announcing his support for this initiative this week. Innovate Finance aims to maintain the UK’s global leadership in banking and finance through:

Innovate Finance’s vision for 2020 is:

- Investment: For the UK to become the most investment-friendly environment for Fintech globally, attracting $4bn of venture investment and $4bn of institutional investment in corporate venture funds, accelerators and innovation programmes. This is up from a UK total of $623m in 2014.

- Global Fintech leader: For the UK to become the premier location for at least 25 global Fintech leaders, whether by IPO, global market share or by valuation. The success of this target will be supported by proportionate and effective regulation, a proactive policy environment and a commitment to greater financial inclusion.

- Jobs: For the UK to increase investment in Fintech and develop more global leading companies that will generate 100,000 more jobs in UK Fintech. This will be supported by new Fintech apprenticeships and degree courses that will create the skilled workforce necessary to make the UK the global centre for Fintech.

This is important stuff, and it’s why I’m delighted to be at the heart of all the action in London. The next five years will prove interesting as we re-build the world of payments, banking and finance through technology. If you’re not part of this, then you’re not part of the next generation of payments, banking and finance.

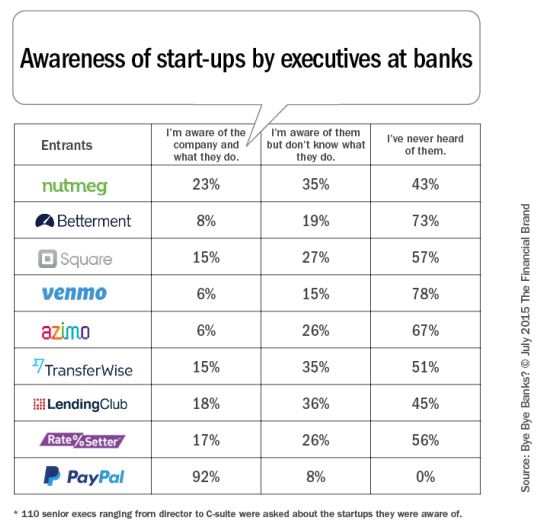

That’s the really worrying part of all of this, as the incumbents seem to have little or no idea of what’s going on. How can we claim this?

According to a survey of 110 C-suite UK bank executives released this month by Adaptive Lab, most of these C-level decision makers have no idea what’s happening in the world of Fintech change or, at least, have no idea who their new competitors are>