How Neobanks are Defining the Future of Banking?

- Sabrina Akramova, Editor & Content Manager at Financial IT

- 28.01.2022 10:30 am #fintech #neobank #banking

The year 2022 is expected to become a year of economic recovery, digital transformations, and, undoubtedly, neobanks. The digital transformation of the financial sector is massively changing the way how people conduct their monetary transactions, thus bringing new challenges for traditional banks and financial institutions. While some banking systems are providing digital alternatives to their brick-and-mortar branches, fintech companies are offering digital-only banking services that have true potential to reform the future of finance.

The differences between neobanks, traditional banks, and digital banks

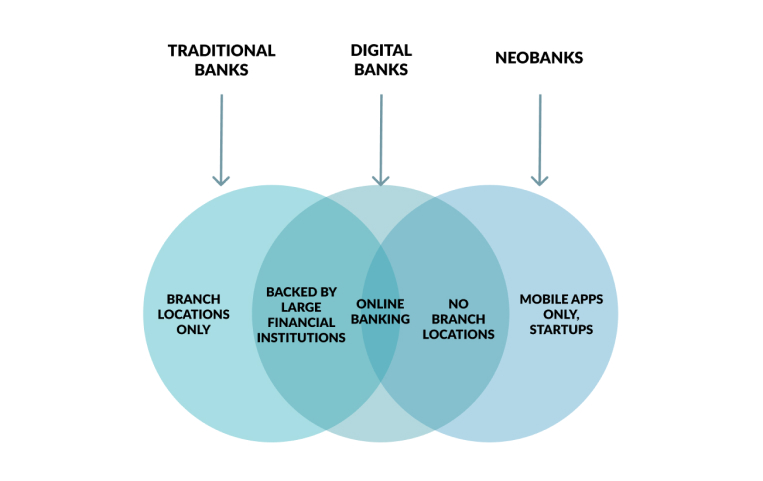

Innovations have always been scary, and neobanks are not the exception. At first glance, it may seem difficult to differentiate neobanks from digital and traditional banks, however, let us make it easy and understandable.

Traditional banks are physical banking establishments with market entry up to 100 years ago and long-term, in-person client relations. Neobanks, on the other side of the spectrum, are internet-only web & mobile services, with appeared up to 10 years ago during digital transformation and increased demand for internet services. Challenger banks usually form flexible and virtual relations with customers, which are easy to modify depending on the situation. Neobanks do not require any paper-based documents and set everything up for customers in a matter of seconds.

Digital banks are considered to be a mixture of traditional banks and neobanks, which allows users to enjoy both physical banking services and internet-based ones.

Gradually growing market?

According to Bloomberg reports, the number of neobank users is predicted to grow to 50 million by 2028, with a 50% annual rise. There are 37 active internet-only banks in the UK, including Monzo (5.8 million users), Revolut (3.1 million users), Starling (1.9 million users), Monese (1.8 million users), and Atom Bank. The main reason why these mobile applications were the most successful ones lies behind a favorable regulatory environment and early fintech adoption.

Apart from convenience and quick processing, the main advantages of challenger banks include low costs due to fewer regulations and the absence of credit risk. Although neobank applications allow checking and saving accounts, receiving payment and money transfer services, and getting budgeting help through financial education tools, they don’t fully replace traditional banks. In order to keep their risks under control, most neobanks offer limited or no credit, which allows them to keep their expenses down. Some neobanks, on the other hand, provide loans to people and businesses through partnerships with other financial institutions such as banks and credit unions. Others were lenders before they began offering neobank services, and as a result, they are able to provide both loans and deposit accounts to their customers.

Regulatory considerations for neobanks

Know-Your-Customer regulations & data protection. In case users have a certain problem with an application, internet services, or non-regulated third-party service providers, they may not have any legal resources or well-defined protocols to follow because neobanks are not recognized banks by law yet. There may be some ambiguity regarding who will be held accountable for potential fraud and errors. Furthermore, customers are responsible for making certain that their neobank provides some form of deposit insurance. In order to solve this, executives of neobanks should implement a Know-Your-Customer strategy, which allows covering digital identity verification more effectively. Moreover, the security of the user information should become a top priority as long as neobanks heavily rely on mobile and online account opening without brick-and-mortar branch options.

The Money Laundering Regulations 2017 in the United Kingdom require banking institutions to implement stringent client identification verification procedures. Almost all neobanks have linked automated ID document verification with facial comparison to digitally authenticate a potential customer's identification in order to fulfill these standards. After the ID document is confirmed, face comparison technology is used to match the document's photo to the selfie photo. If a match is found and both parties are found to be authentic, the applicant can proceed with the remote bank account application.

Traditional-banks-go-online requirement. Although it is becoming less complicated to do all banking activities online, and neobanks frequently retain agreements with ATM networks, some individuals prefer to visit a branch and conduct their banking operations in person, particularly when it comes to complicated transactions. While many neobanks provide comprehensive customer support options, some consumers may prefer to speak with a representative face to face. However, in the long run, the benefits of challenger banks will outweigh the disadvantages as it has always been with technological innovations. Neobanking should not be considered a threat to traditional banking systems as long as banks follow the path of digitization and provide alternative online services.

Open banking initiatives. Numerous open bank projects have been launched globally during the last several years. Through the use of application programming interfaces, open banking enables third-party financial service providers (TPPs) to access customer data from banks or financial institutions (with the customer's consent) (APIs). By enabling additional businesses to enter the financial services sector, open banking strives to improve customers' financial service alternatives. Neobanks must adhere to the particular criteria of each regulator and should be cognizant of both regulated and unregulated local open banking efforts when expanding into a new country. Neo-banks lacking the massive compliance teams seen in bigger banks should seek vendors and partners with significant subject matter expertise in these rapidly evolving and diverse activities.

While open banking has been effectively defined and implemented in the European Union (with financial institutions needing to adhere to PSD2 legislation), Asia Pacific, including Hong Kong, Japan, Singapore, and South Korea, is also expanding its open banking ambitions. In Australia, the Consumer Data Right (CDR) legislation passed in February 2020 acted as a spur for open banking, with Australia's "Big 4" banks (including Commonwealth Bank, ANZ, Westpac & NAB) compelled to disclose "product reference data with approved data receivers" from July 1, 2020.

Main trends affecting neobanking industry

Although the neobanking industry is still young and growing, 2022 will become a year of increased competition between neobanks and incumbent banks, where executives will focus more on differentiation. Most neobanks are reaching their 4th or 5th year since launch, which is the most probable time to break even and make a profit. This means that executives will be under investors’ pressure to reduce costs and implement profitable strategies by targeting the right (profitable) clients instead of supporting the idea of “Banking for All”.

As challenger banks are expanding throughout the global market, they will encounter different regulatory environments – somewhat stricter process controls. Moreover, the level of customer awareness and readiness for new digital offers varies from one country to another, which will drive the need for local leadership teams and better project governance. Another factor affecting the neobanking industry is, indisputably, COVID-19. It is not a secret that coronavirus waves are causing reduced payment transaction activities and consequent lower interchange fees. The number of non-performing loans rises, uncertainty levels fluctuate, thus forcing banks to search for new revenue streams.

Concluding, it is important to point out that neobanking is another fintech innovation that provides convenience and effective management of one’s financial well-being. It drives change, a shift in the mindset of customers, and takes care of transactions’ speed. In order to remain profitable, traditional banks should learn how to adapt to increasingly changing customer demands in the era of digital transformation. Challenger bank is indeed a revolutionary innovation, but it can be perceived as an opportunity rather than a threat.