Embedded Finance: What it is And How is it Shaping the Financial Services?

- Sabrina Akramova, Editor & Content Manager at Financial IT

- 24.03.2022 07:00 am undisclosed , Sabrina is a freelance writer and editor for Financial IT

As Covid-19 and consequent lockdowns forced firms to reassess and accelerate their digitization initiatives in 2020 and 2021, years-long digitization initiatives were accomplished in a few months. These adjustments are still taking place in 2022, thus making the fintech sphere a remarkable illustration of how traditional firms engage finance on a new level. Embedded finance is here to stay, with approximately $138 billion projected market value by 2026.

What is Embedded Finance Exactly?

In short, embedded finance is the use of financial tools or services by non-financial providers. For example, an electrical retailer could offer in-store insurance. Embedded finance streamlines financial operations for consumers, making it easier to acquire services when needed. Historically, people had to go to a bank branch to apply for credit to make a large purchase. With embedded financing today, they may buy and acquire credit at the same time. Klarna and Afterpay are some examples of integrated financing.

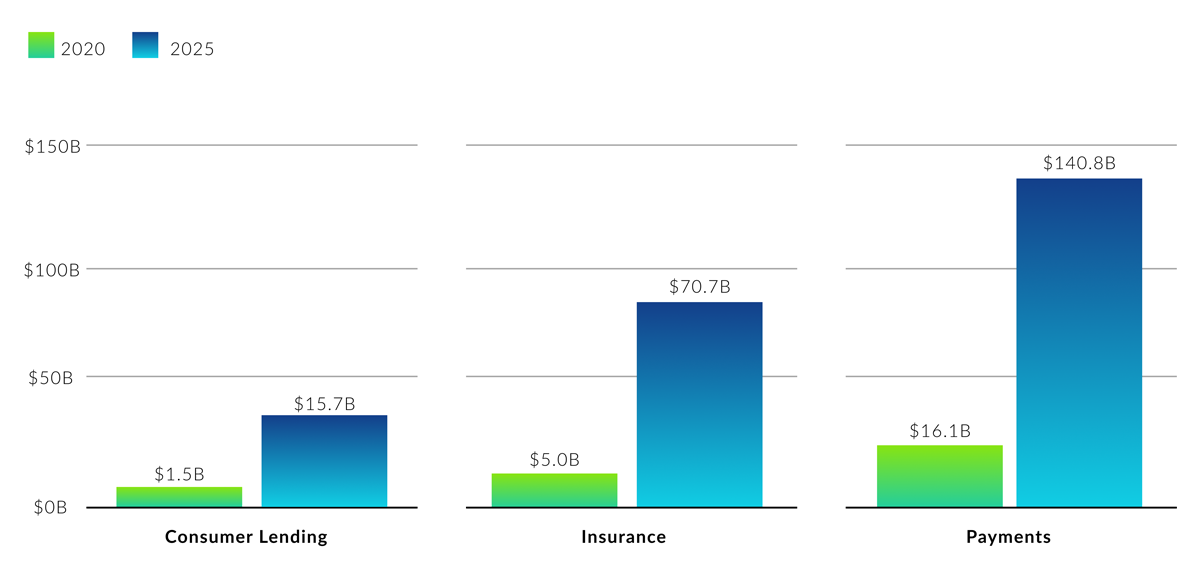

Credit cards for flights, automotive rental insurance, and payment plans for luxury items have been here for a while already. Online merchants are now offering financial services directly to customers without sending them to a bank. Firms such as Unit and Synapse, which use API connectors to integrate financial services into the user experiences of non-financial enterprises, are allowing this phenomenon. This tendency is expected to persist. By 2025, integrated financial services are estimated to produce $230 billion in revenue, more than tenfold the $22.5 billion generated in 2020.

Consumers appreciate embedded financing because it is user-friendly. They may be more likely to complete a purchase and experience customer satisfaction if certain pain points, such as the requirement to obtain credit elsewhere, are removed. This could result in increased profitability for firms since customers are more likely to purchase an item or service repeatedly. However, embedded finance is not all about convenience. Additionally, it enables a deeper understanding of consumers' demands and preferences, which can be used to fuel future business expansion.

Consumers appreciate embedded financing because it is user-friendly. They may be more likely to complete a purchase and experience customer satisfaction if certain pain points, such as the requirement to obtain credit elsewhere, are removed. This could result in increased profitability for firms since customers are more likely to purchase an item or service repeatedly. However, embedded finance is not all about convenience. Additionally, it enables a deeper understanding of consumers' demands and preferences, which can be used to fuel future business expansion.

Where is Embedded Finance Used?

How can financial tools be embedded?

1. BNPL (Buy Now Pay Later): These solutions provide a new credit line to modern clients. Allowing consumers to pay over time enables them to make varied purchases, whether for improved home appliances or a new collection of clothes in a shopping mall.

2. POS (point-of-service) lending: an advancement above BNPL. These financial strategies can be used by businesses trying to finance larger purchases. As a result, they frequently require additional information, such as creditworthiness data, in order to lend appropriately.

3. Integrated insurance services: Customers may desire to ensure that their money is not wasted in the event of a catastrophe. Thus, integrated insurance is necessary. By incorporating insurance financing technologies, businesses can provide insurance more quickly.

4. Investments: Users can establish a connection with their local bank to invest in a technique that is appropriate for their present financial situation and spending habits. This is another financial services company that utilizes embedded finance.

5. FaaS (Fintech-as-a-Service): Firm services are rapidly integrating invoicing, customer acquisition, and other financial technology-as-a-service solutions.

Best Ways to Embed Finance

In the beginning, firms can develop an embedded finance strategy that satisfies their requirements, analyze digital needs and choose which tools to integrate. The first stage is to define the company's embedded finance project objectives, which is followed by enhancing good customer service, expanding an existing client base, or establishing new initiatives to meet the needs of a particular target demographic. For instance, if executives are looking to boost customer service, an embedded payment may be a viable choice. A BNPL model may facilitate the acquisition of goods or services for some clients, while embedded insurance may assist in establishing a one-stop store. To choose the optimal solution, it is necessary to comprehend requirements in the market.

As finance and banking programs should be included in non-financial products and services, the initial objective is to launch a new digital service on the brand's platform, which may take the form of corporate lending or embedded bank accounts. The second alternative is to become a connector, a conduit between financial service providers and non-financial enterprises, which may resemble a financial services provider's data transfer network. Thirdly, firms can become a part of an ecosystem by partnering with a company that incorporates financial infrastructure into its product or service.

How Can Banks Overcome the Challenge?

Banks can also benefit from long-term technological use. They can provide primary offerings through embedded fintech, enhance revenue by utilizing fintech products and services. Rather than permitting non-financial platforms to offer financial services, traditional banks may now offer more tailored services as a result of embedded fintech instead. Embedded finance is sometimes seen negatively by conventional financial organizations, however, embedded fintech proves the opposite. Embedded fintech expands the alternatives available to traditional banks. Investing in cryptocurrency, managing asset transfers, negotiating bills, responding to data breaches, and protecting one's identity are just a few examples.

Identifying and evaluating recurring payments is another fintech opportunity. Subscription management, creditworthiness evaluation, and individualized selling all help banks increase digital engagement and revenue. Discover how banks can best serve their customers by delivering the best vendor solutions.

Embedded Finance and APIs

As financial APIs enable data connections between financial institutions, fintech enterprises, and non-financial firms, they play a critical role in embedded finance. Offering financial services to non-financial firms, such as e-commerce sites, needed considerable time and effort, including the formation of partnerships with financial institutions. The credit card offer made at the end of the flight is an excellent example of 'pre-digital' integrated banking.

However, APIs enable software programs to communicate, lowering the bar for embedded finance. Retailers can easily establish relationships with embedded finance providers to offer products such as point-of-sale loans or insurance. Financial API interfaces enable organizations of all sizes to provide financial services. This means that their clients will have a more positive shopping and financial experience.

Conclusion

Nowadays, consumers anticipate more convenient digital experiences. Embedded finance continues to influence global markets, making it more prevalent than ever. Although these trends appear to be a challenge to traditional banking, embedded finance enables fintech entrepreneurs to supply the banking industry with equipment. BaaS may soon become a required channel for all banks. Differentiation is tough in this case. However, banks must plan to overcome second-order obstacles. Rather than defending themselves, financial institutions might attempt to develop connections with service suppliers and expand existing networks. Thus, banks can stay ahead of the curve, identifying untapped opportunities and ensuring embedded finance's future viability.