Digital is in our DNA

- Chris Skinner , Chairman at Financial Services Club

- 12.04.2017 12:15 pm Digital , Chris Skinner is known as an independent commentator on the financial markets and fintech through his blog, the Finanser.com, as author of the bestselling bookDigital Bank and its new sequel ValueWeb. In his day job, he is Chair of the European networking forum: the Financial Services Club. He is on the Advisory Boards of many companies including Innovate Finance, Moven and Meniga, and has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), one of the Top 5 most influential people on BankInfoSecurity’s list of information security leaders, as well as one of the Top 40 most influential people in financial technology by theWall Street Journal’s Financial News.

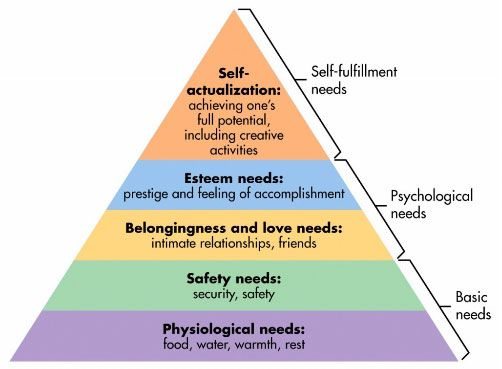

When you have your basic needs covered – food and shelter – what do you need then? According to Maslow’s hierarchy of needs, it’s our psychological needs – love, belonging, self-esteem.

This is exactly where digital plays into our hearts. Our love and belonging is in Facebook and Baidu, which is why these are so integral to our lives today.

Then the highest level of need is self-actualisation, which is served by blogs, emails, twitter and LinkedIn. Combined, the digital mobile world we live into day plays to our basic psychological and self-fulfilment needs, which is why it is so addictive.

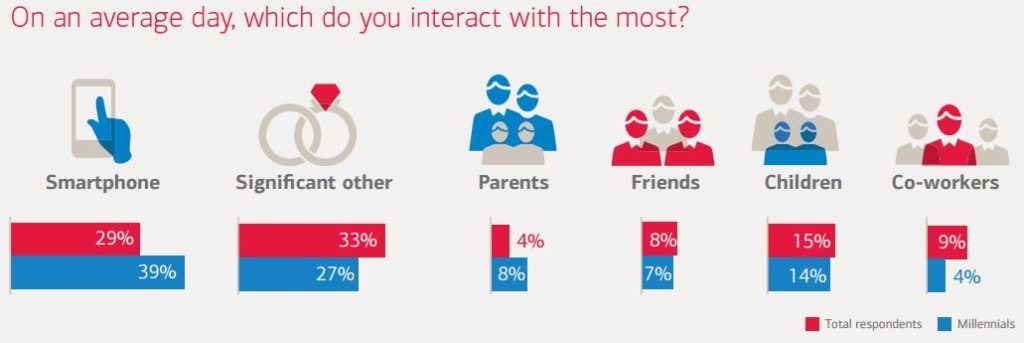

According to the Bank of America’s annual research into mobility, millennials spend more time interacting on their phone than with their partner, family, friends and colleagues.

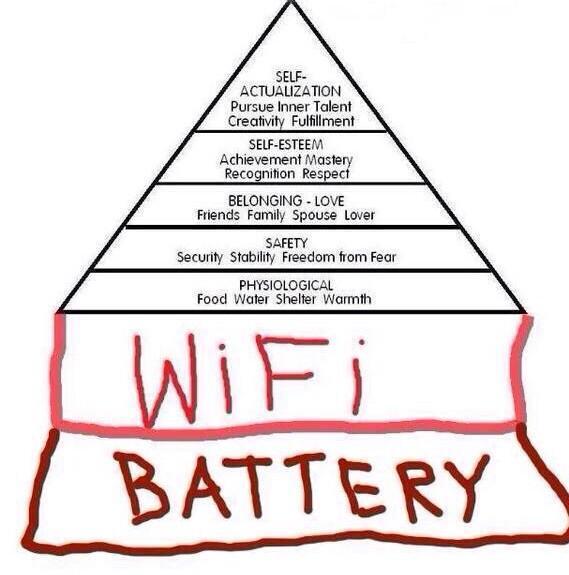

And most Americans think their mobile is more important than sex. This is maybe why we are so addicted to selfies and using the camera to stream our daily routines non-stop. It is also why some joker added WiFi and a battery to our hierarchy of needs …

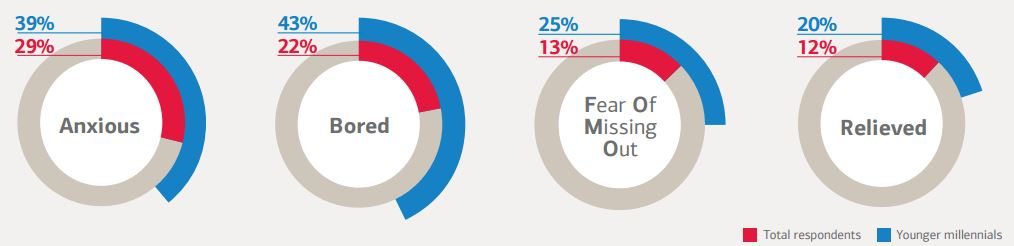

…. but maybe they’re right as, when we don’t have our phone, we feel anxious and bored with a fear of missing out (FOMO) on what’s going on …

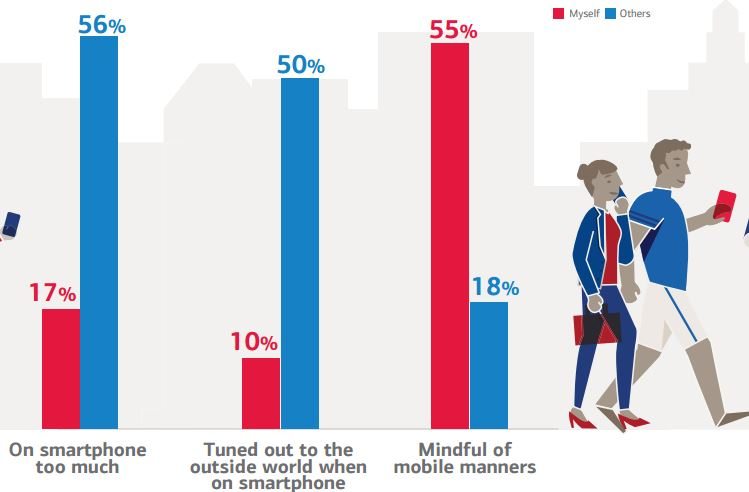

We even walk and talk differently when we have a mobile. The University of Bath found that texters had developed a protective shuffle that prevents them bumping into obstacles, or tripping over hazards. This means that it takes those texting 26% longer to complete a walking task compared to those who were not distracted by their phones, and it is really annoying. You know, you’re walking along the pavement and someone is shuffling slowly in front of you with that hunched over look of someone who is playing with their mobile. You kind of want to hit them in the back of the head and tell them to get out of the way, but you don’t because you know you do it yourself. For example, when asked if you are too focused on your phone, we believe that we are not but everyone else is.

This is the world today, and the reason why some cities are introducing texting and non-texting pavements.

Just before we look at banks, a little test. Turn off your mobile phone and see how many minutes or hours you can wait before turning it back on again. Do this when you’re not in a meeting or sleeping, as in you can use your phone. I bet none of you last more than an hour.

The reason for giving this insight into the mobile digital age being part of our DNA is that, if our relationships are with and through our digital devices, how does a bank become part of that world? That’s a difficult question. Most banks think that mobile and digital is a project to invest in, not a cultural transformation. But this dependency on our devices is a cultural transformation. The very fact that in a short decade we have transformed from a phone being to talk to a phone being our lives is incredible, but true.

Meanwhile, what banks are offering the best mobile experience? In the USA, it’s Chase, according to Magnify Money.

Chase was voted the best mobile banking app in the country for a large bank, and applauded by users for a combination of design and functionality. The app has a lot of the features deemed most important by consumers, which includes fingerprint sign-on, mobile check deposit and the ability to see images of deposited checks. Consumers want to be able to do everything on the app, and Chase has been adding functionality throughout the year to keep people satisfied.

Forrester ranks the world’s best retail mobile banking services

Forrester benchmarked the retail mobile banking services of 46 large retail banks across four continents on 40 criteria, and found the average bank scored 65 out of 100.

Westpac outstripped the average bank by being strong in every category. The bank earned the highest score in the transactional features category and did particularly well in its range of touchpoints, account and money management, and marketing and sales.

It is one of the few banks to enable near-field communication (NFC) contactless mobile payments. The bank has also rolled out innovative features — such as letting customers take pictures of their credit cards to activate them.

Of the other banks reviewed, nine stood out from their peers for their impressive mobile banking capabilities: CaixaBank in Spain, Canadian Imperial Bank of Commerce (CIBC) and Scotiabank in Canada, Garanti in Turkey, Bank of America in the US, Bank Zachodni WBK in Poland, Lloyds Bank in the UK, and Wells Fargo in the US.