Data-driven business models are key to banks' survival

- Artak Vardanyan, Product Marketing Manager at Strands

- 02.11.2015 12:00 am undisclosed

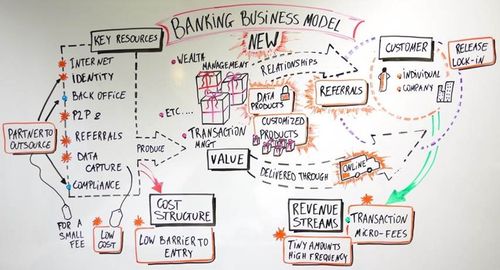

The call for retail banks to reinvent their business models has never been more urgent. On one hand, banks are challenged by shrinking revenues and struggle with achieving operational cost efficiencies. On the other, they must face the rising threat of FinTech startups that are attacking their core businesses, with the likes of Lending Club, Funding Circle, TransferWise and Venmo quickly becoming household names.

Especially challenging are incumbent tech giants (think Google, Amazon, Facebook and Apple) that are deploying new business models to disrupt financial services. What makes these players especially threatening is that they already have huge customer bases, endless resources and the element of unpredictability to their advantage.

While some ambitions are widely known, such as Google Wallet, others like Facebook's new PFM project remain shrouded in mystery. But with the prospect of bringing PFM to 1.5 billion Facebook users, imagine the potential business models Facebook could create by integrating its wealth of social data with PFM. Or take Apple - after launching Apple Pay, the behemoth is working on a new e-commerce solution similar to Card-Linked Offers (CLO) that uses mobile devices to deliver targeted offers to users after analyzing their credit and debit transactions to find out what they can or can't afford.

Banks can learn 3 things from FinTech players:

- Start with the clear objective to create new value for customers by deploying entirely new business models.

- These new models must be underpinned by robust consumer data - both financial and social.

- Deploy solutions like PFM and CLO to deliver these new data-driven services.

Typically, tech heavyweights excel in the 1st: creating new value for their customers though entirely new business models. The proof? 73% of Millennials would be more excited about a new financial product offering from Apple or Facebook than from their own bank. In contrast, this is the weakness of most retail banks. They have the benefits of large customer bases and access to rich transactional data, but are struggling to leverage both. If banks don’t find ways to monetize data while creating new value for customers, their chances of survival are slim. Hungry FinTech start-ups together with tech giants will not only eat banking's lunch, as JP Morgan Chase CEO Jamie Dimon put it, but also their breakfast and dinner!

In order to capitalize on their strengths and transform threats into opportunities, banks should focus on the following 2 strategies:

- Develop customer-centric business models focused on value creation instead of constantly trying to invent new banking services. Banks are uniquely placed to break into sectors such as retail, entertainment or tourism and incorporate them into the financial services value chain. Secondly, banks must see data as the ace up their sleeve that will help them to make offers more personalized and contextual. Notable examples include thePostFinance mobile banking app, where customers can top up their iTunes credit directly, or Standard Chartered Bank and America First Credit Union who have rolled out location-based mobile offers.

- Deploy next-generation digital money management tools and CLO as the bases for developing these new business models. Integrating PFM with online banking alone already generates a host of benefits both for banks and their customers. But connecting the tool with CLO gives banks a powerful business model that many FIs are already exploiting, such as PostFinance in Switzerland, Lloyds UK and a few other banks in Europe. For some, integrating PFM tools with CLO helped customers save between 200-400 EUR per month.

The quickest and easiest way for banks to make these strategies work is to partner with an experienced FinTech player that can design and deliver customized digital money management tools already integrated with relevant data-driven solutions (such as card-linked offers). These can create new value for customers and open up new revenue streams for the banks at the same time.