Can banks help to fundamentally redefine our notion of trust?

- Thomas Pintelon, Co-founder at Capilever

- 21.11.2019 11:00 am undisclosed

Trust is the glue that holds society together. Historically we trusted people in our local community. Later this evolved to a centralized trust in large corporations and institutions, but recently this has shifted towards a more distributed trust, meaning that we sometimes need to place our faith in complete strangers.

With a growing number of online transactions, customers get access to service providers and producers from all over the planet. Especially with the rise of the sharing and gig economy, and the rise of marketplaces, which bring many (often small or even private) consumers and producers together, transactions happen between “strangers” all the time.

One of the main values created by marketplaces is their ability to facilitate this lack of direct relation and trust between the transacting parties. Whenever two parties engage in a transaction, there is anxiety. Will the product get delivered when I make my payment? Is the counterparty who he says he is? Will the product fit the online product description? What happens if my product is lost in the shipping process?

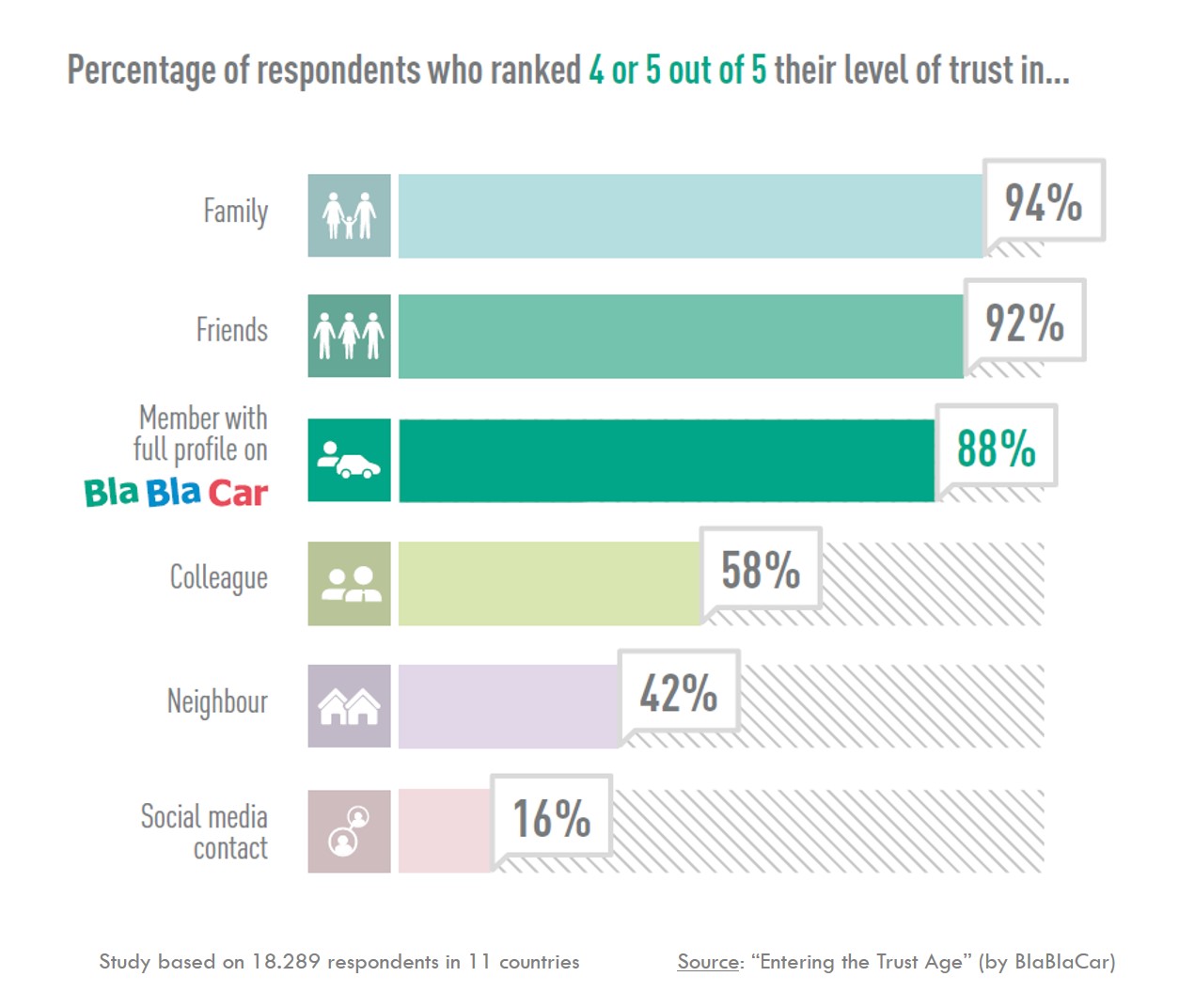

Marketplaces try to reduce this anxiety via technology, trying to provide a maximum of guarantees via rating systems, review processes, insurances, due diligence processes, etc. A study of the French ride-sharing marketplace “BlaBlaCar” shows that via these techniques, users can give more trust to a “stranger” on a marketplace, than to a colleague at their work (see picture below). This study shows the impact of these technologies, but nonetheless they also face some important issues, like the ability to manipulate reviews/ratings (e.g. via automated bots), the difficulty to defend against unfair negative reviews (trolls), the chicken-or-egg problem as a newcomer on a marketplace (i.e. the difficulty to get first reviews, as parties only transact with parties with reviews), etc.

Furthermore, these digital trust features are implemented separately in each digital marketplace, meaning a consumer or producer needs to build up “trust” (their reputation) on every marketplace again and cannot reuse his gained “trust” in the non-digital world.

Furthermore, these digital trust features are implemented separately in each digital marketplace, meaning a consumer or producer needs to build up “trust” (their reputation) on every marketplace again and cannot reuse his gained “trust” in the non-digital world.

In this digital era, it is surprising how many transactions (also often with “strangers”) we still do without any digital platform supporting the process. If you rent out your apartment or hire a contractor for a renovation, the counterparty is most of the time also a “stranger”. Usually people unconsciously execute a trust-evaluation process similar to a digital market place, i.e. they Google the counterparty, look them up on Facebook or LinkedIn, ask the counterparty for references, call friends and family to know if they have any info about the counterparty, ask certain documents to the counterparty (like e.g. a salary slip). These actions help us to reduce our anxiety and increase our trust in the counterparty, but they are all very inefficient, ineffective and also very invasive (who likes to share the details of his salary with his landlord).

It is unfortunate that everybody needs to go through these long and ineffective processes to get an (incomplete) idea of the counterparty risk, while banks have all this information at their disposal. Banks are legally obliged to do very extensive KYC due diligence processes, have very detailed information about the financial situation of their customers and are experts in risk management (including counterparty risk management). If one party can give a well-founded assessment on the social and financial trustworthiness of one of their customers, it is definitely the bank.

Today banks are already assessing their customer’s credit scoring, but it can be easily extended into a “life scoring”. With “trust” being such a valuable asset in our global, digital economy, it is time for banks to capitalize on this goldmine of information. By building added-value services on top of this “life scoring”, banks can not only attract interesting new revenues (by monetizing the scoring data and by providing products like insurances and bank guarantees to improve trust scoring), but can also help their existing customers reducing fraud, attract new customers and better retain existing customers.

My bank as a trusted party for expressing trustworthiness seems a very logical next step.