Blockchain: the ideal market infrastructure for Alternative Finance?

- Olivier Roucloux, Vision & Product Strategy at Finoryx

- 09.11.2015 12:00 am blockchain technology

Had a lot of positive feedback after I posted an article stating provocatively “Bitcoin may kill traditional CCPs, CSDs and Custodians... or not!” (read here if you missed it). Amongst the different returns, I regularly had the same question: “what will be the first application of blockchain technology in financial markets?”. There are obviously many use cases and I took the opportunity of the excellentBL0CKCHA1N conference last week in Paris to give my vision on a potential implementation of the blockchain in capital markets.

I made the arbitrary choice to firstly focus on “Alternative Finance” because I am convinced this area could be a very interesting testbed for global markets. Crowdfunding -in particular- is an emerging market that is promised to exponentially grow. The whole market is expected to reach €35 billion in 2015 (a) however the way crowdfunding works does not fit with traditional post trade infrastructure. There is a need for innovation here…

What could be this new market infrastructure?

Let’s imagine a “proprietary” blockchain –based on open source standards (b). That is launched by a major infrastructure, a key market player, a group of banks, or an already existing added value network provider.

Each market participants would become a "miner" -this activity being part of their obligations. Everybody would have access to the blockchain however access rights to the information and smart contracts would differ if you are a bank, an individual, a regulator,…

All technical (configuration, parameterisation,…) but also all business standards, could be created by market representatives working groups and committees; and by most recognized bodies. SEPA has proved that a community can join forces and produce comprehensive rulebooks, messaging standards and market organisations. One can imagine that the work jointly made by the banks, EPC, SWIFT and ISO could be an effective model to create and build (very) smart contracts.

Who would be the actors?

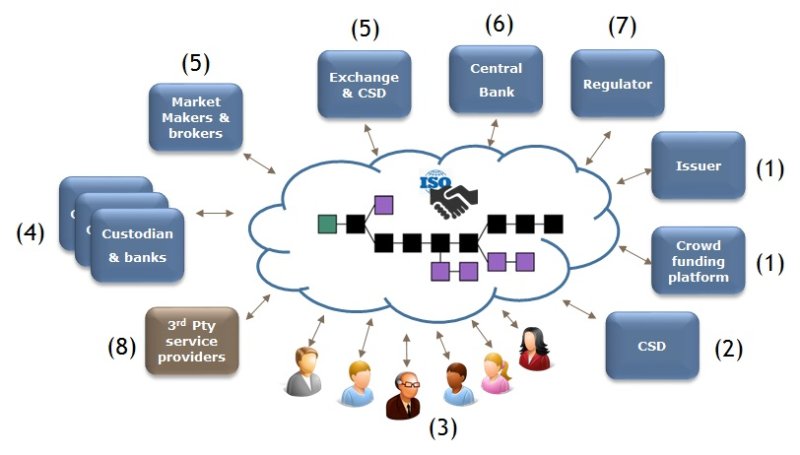

There are obviously different types of participants as shown on the following picture:

(1) The issuer, and because we’re talking of “Alternative Finance”, it will most likely use a crowdfunding platform to create shares/bonds. But some issuer may want to directly address the blockchain.

(2) CSD should continue to act as a notary for all share/bond issued. The instrument created on the blockchain should be a “property of ownership” and not crypto-securities; the main reason is legal, but also can be around state guarantee, …

(3) As “Alternative Finance” is a direct holding method (c), the “crowd” would have direct access to their properties on the blockchain.

(4) Even if the individuals owns their “shares”, some added value services will continue to be provided by custodians and banks. At a minimum the cash movements, but also some actions during the lifecycle of the stock, regulatory activities as well as tax operations.

(5) As investors expect a secondary market, exchanges are ideally positioned to provide a place for exchanging assets. A sufficient liquidity will be provided together with the help of specialised Market Makers.

(6) The Central Bank(s) will also be part of the community as it facilitates the finality of the settlement (as we are in a “delivery versus payment” model)

(7) Regulators shall need unlimited access (or almost) to the blockchain in order to control the issuance, follows market evolution and get automatically all required information to assess different risks.

(8) Third Party Providers are companies –traditional one or fintech- that will insource and process some business functions for the community. One can think of currency FX, corporate actions, account aggregations, tax, risk management, investment advices, lending/borrowing,…

This particular type of institutions can be the real disruptors and capture some business from the banks. Known example being Ripple but it can also be Bitcoin Exchanges aiming at becoming a true virtual bank by supporting securities markets,…

Does it provide cost savings ?

Why investing in such technology if it is not to make the industry more efficient and therefore reduce the cost for the SMEs to raise capital? It is very difficult to make a business case to affirm that this approach will help the industry save a lot of money –simply because there is no similar implementation that we can learn from.

However there are interesting points to point:

- Less errors between the different sources of information as the blockchain will be the unique source. And obviously a tremendous economy in reconciliation/exception management costs.

- Allowing regulators to have such access will make other participants save a lot of money as regulation is often on top of costly projects these last years.

- Competition between banks and custodian will be easier as the crowd hold directly their assets, reducing client stickiness and the cost to change operator

And many more…

If you reach this sentence I have to thank you for spending time reading this long article. Feel free to forward it to people who may be interested; add me and contact me if you have questions or want to set up a meeting.