When Will Banks Stop Seeing Financial Inclusion as Charity?

- Chris Skinner , Chairman at Financial Services Club

- 14.03.2017 10:45 am Banks , Chris Skinner is best known as an independent commentator on the financial markets through his blog, the Finanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal’s Financial News.

I was asked this question at a recent conference and yes, banks do believe that the mass poor are just that: poor. How do you make a profit out of the poor? Well, truth be told, the poorest are the most profitable. They’re the ones who need loans and go overdrawn, and therefore pay all the fees for the rest of us – the mass affluent – to get our banking for free. Thank you the impoverished.

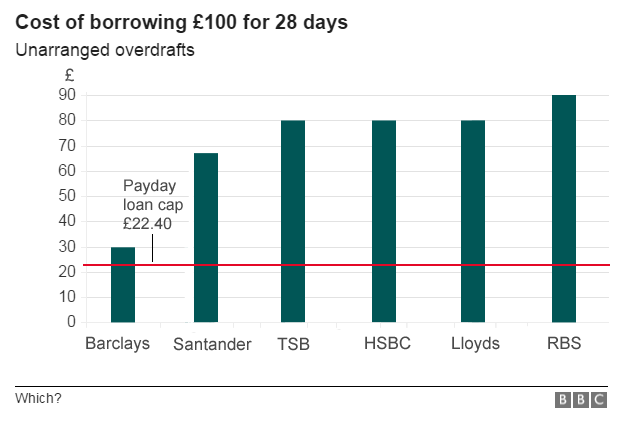

It is the poorest who take out payday loans, but they prefer to have a payday loan than to deal with a bank, because at least the payday loan firm is upfront about what it’s going to charge them. James Barth of Auburn University observes that payday lenders congregate in neighbourhoods with higher rates of poverty, lower education and minority populations, but at least they can get a loan, rather than an unauthorised overdraft that, here in the UK, charges more than a payday lender.

Source: BBC

At least they’re only paying £90 to borrow £100, which is less than some Kenyans were being charged before M-PESA. Sending money before mobile payments arrived used to be a tricky affair, involving getting a bus or taxi driver to take your £100 from Nairobi to the villages. Quite often, it wouldn’t arrive. Even if it did arrive, ti would often cost 25% or more.

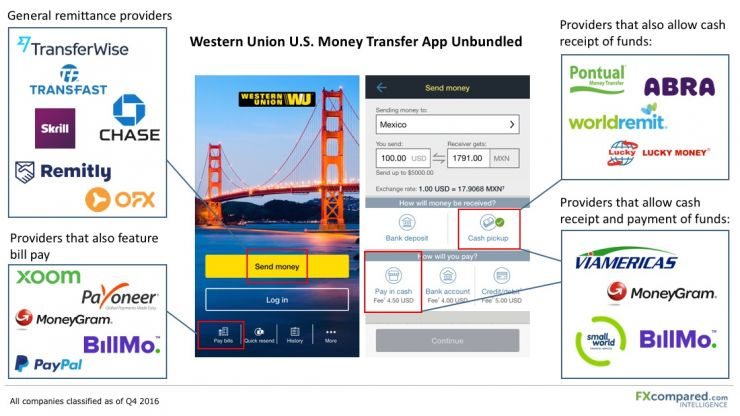

Similarly, the high fees of Western Union and other remittance providers were fairly punishing … until FinTech came along. Now those costs are dropping rapidly. For example, here are the comparisons of a few players when sending $1,000 from the USA to the Philippines.

Ria Money Transfer is the cheapest at $6, taking 3-5 days, or $10 if you want it to move in minutes. A bunch of other players are in the $10 or less mark – OFX, TransferWise and Abra – but this rises a little when you look at the more traditional players. Wells Fargo is $21 for a 3-5 day transfer whilst Western Union is $28 for a 5-7 day transfer. Interestingly, the most expensive choice would be a FinTech! Skrill would charge you $64 for $1,000 transfer, and take 3-5 days to do it. so don’t always assume a start-up new player is the best.

Meanwhile, as can be seen, there are many players trying to unbundle the old model of Western Union and co .

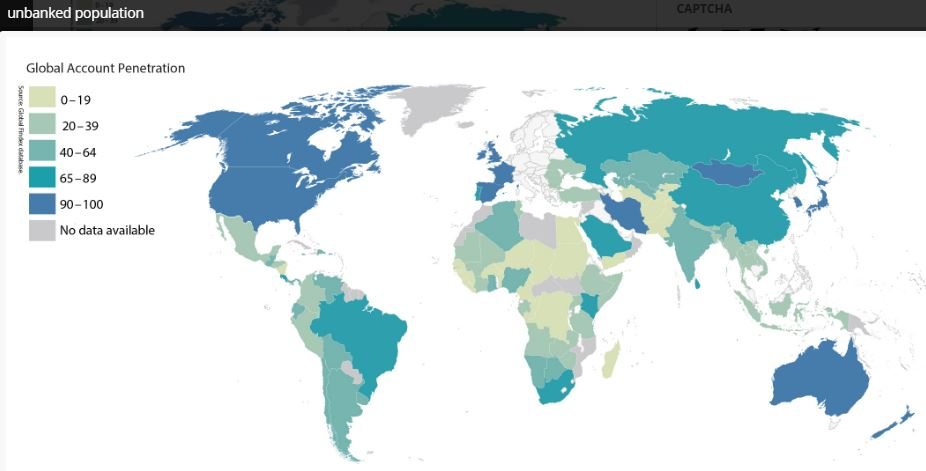

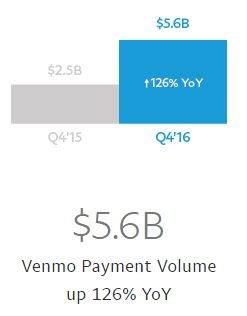

Finally, the most exciting area of change isn’t payday loans or remittance exploiting the poor, but the inclusion of billions of people thanks to mobile, who were never included before. These vary from the millions in China who are now using Ant Financial to those in India using Paytm to the Venmo’d of America. The numbers are stunning – 450 million people using Alipay; 200 million using Paytm; and Venmo’s user numbers aren’t quoted* – and it is the fact that mobile has moved from dealing with money in buildings, to dealing with money in apps.

Outside the apps is just, if not more, exciting as Africa and other nations stuck in poverty for decades are reinventing the whole concept of money with mobile. This is summarised neatly by Financial Inclusion Insights research, which notes that:

- more than 90% of the world’s poor are covered by a mobile signal

- 60% of Africans live in rural areas and mobile money is the only way to reach them cheaply, affordably, and at scale, which is why people in Cote d’Ivoire, Somalia, Tanzania, Uganda and Zimbabwe, are using mobile money more than a traditional bank account

- In Tanzania, ownership of mobile money accounts surged from 1% of the population in 2009 to 32% in 2014

- digital accounts cut the costs of transactions by as much as 90%

- digital accounts give people the ability to save and budget for the first time in their lives, allowing them to withstand financial shocks and direct money toward specific uses, such as education and healthcare.

- 4 out of 10 adult Nigerians have no access to any form of financial services, making life not only more difficult, but also more expensive for these people.

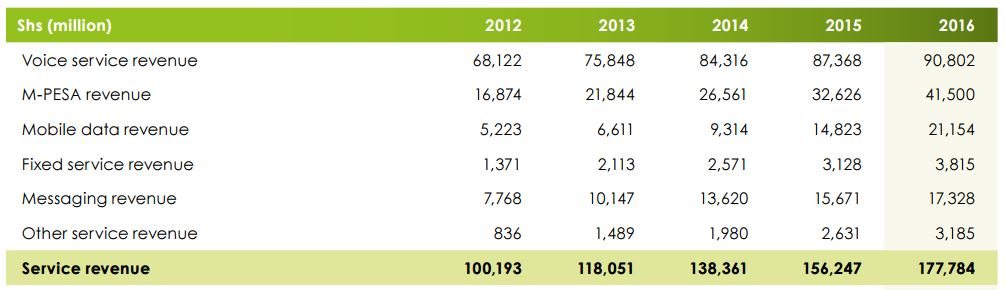

Now we get back to that question: When will banks stop seeing financial inclusion as a charitable venture? It’s not charity, otherwise M-PESA would be making no money. It is making money. In fact, it is the second largest revenue generator for the Safaricom Group, which is why they protect their monopoly in Kenya.

In other words, financial inclusion is a charitable venture if you are a bank with physical distribution; but it’s a good business if you’re a telco with digital distribution. And telco’s will upscale as they learn the model, as evidenced by Orange who, after learning that this was good business in Cote D’Ivoire and Mali, opening mobile money services in Poland, Romania and other European countries and finally realised that, with their 650 stores (branches?) in France, they might as well open a bank.

So what’s the bottom line here. The bottom line is that mobile financial inclusion is a massive market opportunity to bank the unbanked, make money out of it and eradicate the expense of being poor.

Two billion individuals and 200 million micro, small, and midsize businesses in emerging economies today lack access to savings and credit and, as a result, economic growth suffers. A research report from McKinsey in September 2016, finds that widespread adoption and use of digital finance could increase the GDPs of all emerging economies by 6%, or a total of $3.7 trillion, by 2025. This is the equivalent of adding to the world an economy the size of Germany, or one that’s larger than all the economies of Africa. This additional GDP could create up to 95 million new jobs across all sectors of the economy.

In other words, it’s worth it.

Source: Payments, Cards and Mobile

* Although PayPal has 200 million active users worldwide, Venmo is only available in the USA and user numbers aren’t quoted. The Q4 2016 v Q4 2015 difference speaks volumes though