Bank of Mauritius’ ADF-XBRL Initiative: Moving Forward at an Impressive Pace.

- Shivani Venkatesh, Lead Consultant at Fintellix Solutions

- 12.08.2015 01:00 am Banks

Bank of Mauritius’ ambitious ADF-XBRL project has started progressing at a rapid clip with Phase 3 returns being made available to banks. Of the 6 phases in BOM’s ADF-XBRL journey, only 4 are targeted at banks, while the remaining 2 would cover reporting by other entities, such as NBFCs. So in a sense, the regulator seems to have covered more than three fourths of the ground in terms of detailing what banks need to report on.

It is interesting to note that the complexity of the returns has only increased progressively. If we consider the number of data points to be reported, while Phases 1 and 2 put together had as many as 3257 data points, Phase 3 is expected to have roughly 26000 data points – about 8 times that of Phases 1 & 2! This clearly points towards increasing complexity in terms of the depth and diversity of information being sought. If we look at the subject areas on which information is sought, more than one quarter of the reports are focussed on the advances portfolio of the bank, while risk and general financials of the bank seem to be the other 2 dominant themes. This points to the fact that data will need to be integrated from multiple (if not all) source systems in the bank.

Several other nuances come to the fore, as we dive deeper into specific reports. Some of the advances reports, which ask banks to report on sector wise loans, require banks to specifically follow the ISIC (International Standard Industrial Classification) code. Hence banks need to build the intelligence required to segregate industries of their counterparties as per this standard. Similarly, many of the reports ask banks to actually provide a list of customers/applicants, pointing towards a demand for increasingly granular data. If we look at the metrics that banks have to report on, besides the traditional ones like outstanding, counts, etc., some unconventional metrics have also been sought –a case in point being the reasons for rejection (at the time of application processing).

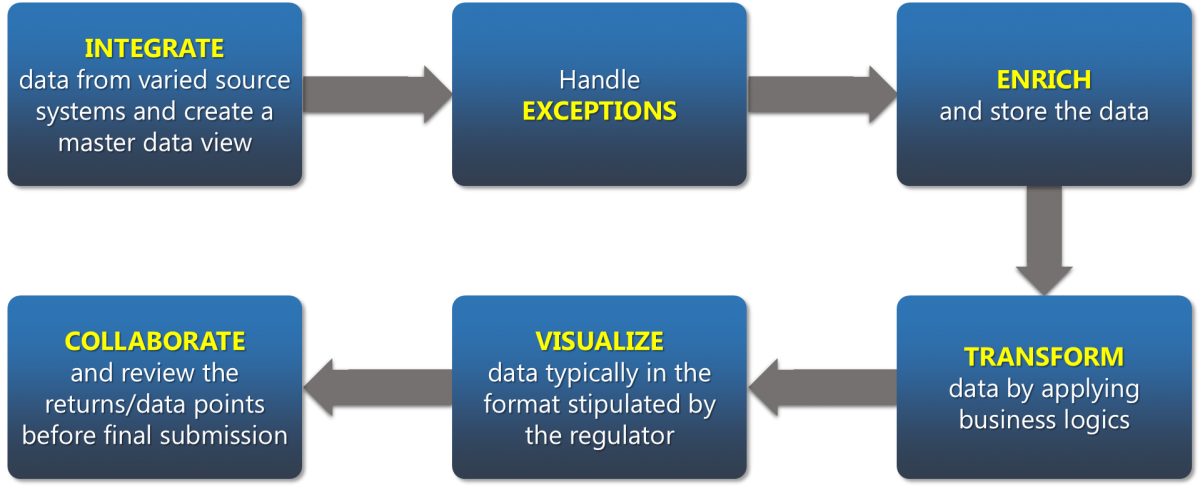

To meet any such exhaustive regulatory reporting requirement, banks need to perform certain specific steps.

Most part of the complexity lies in the first 3 steps where data is prepared for reporting. If these steps are performed accurately and comprehensively and clean/granular data is available, then the subsequent steps become significantly simpler. In fact it may not be wrong to say that 70% of the work lies here and a deep understanding of source system data and functional context are essential for success.

Bank of Mauritius in their ADF-XBRL approach has recommended that banks create a robust data infrastructure, i.e. a Common Data Repository (CDR) and build all the reporting out of this repository. Going by the progressively granular and nuanced reporting requirements in Phase 3, it is evident why this recommendation was made by the regulator.

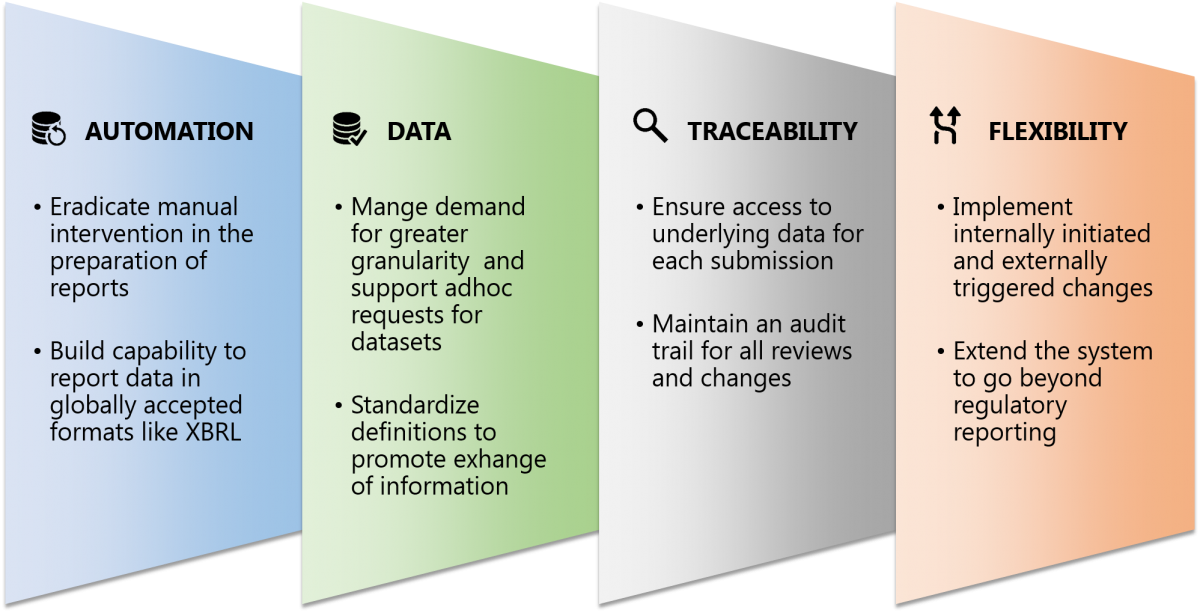

Considering the global regulatory environment, there are four key themes common across geographies and mandates.

Extrapolating this to the Mauritian context, the demand for automation has already been made by BOM. The data requirements are already fairly exhaustive and only likely to increase as supervision and governance intensify. Traceability is crucial for Mauritian banks to be able to respond to regulatory queries in a timely manner and be adequately prepared for onsite inspections. Finally, flexibility will help enhance maintainability of the solution which banks create for regulatory reporting, as well as extend it to meet more requirements.

Overall, it is both an exciting and challenging time for Mauritian banks as they gear up to meet the near-term and long-term demands placed on them by their regulator and international regulatory bodies. Taking a long-term view at this juncture will enable Mauritian banks to make technology choices that will simplify regulatory compliance in the long run.