Using Social Media to measure and manage banks’ reputation risk

- Dimitrios Geromichalos, Principal Consultant at Capco

- 06.07.2015 01:00 am Banking , risk , social media

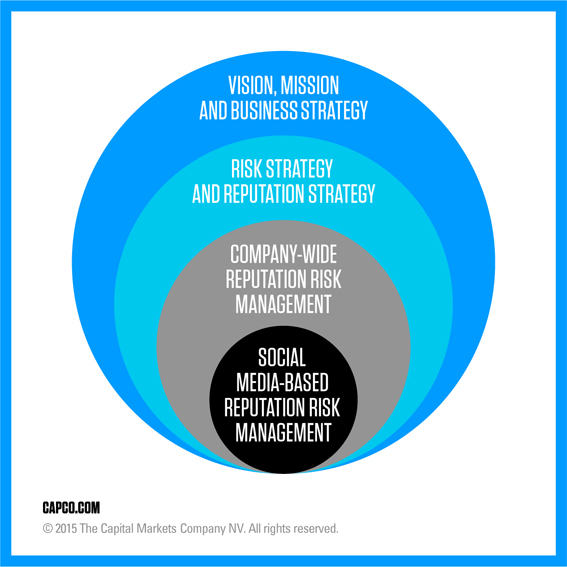

In finance, social media is generally perceived as a major source of reputation risk. Anyone can post an opinion, good or bad, that can spread all over the world in a matter of seconds. But social media can also become a central part of reputation risk management. With comprehensive analytics-based processes, social media can even provide the ‘quantitative core’ of a firm’s reputation risk strategy.

Risks and opportunities ‘how to’

Social media is the perfect tool for monitoring, quantification and management of reputation risks. First of all, companies need to identify groups with a vested interest in reputation and prepare a framework for ‘big data’ structuring and analysis. Once that’s done, firms are able to measure their standing and identify risk sources as well as opportunities. ‘Sentiment’ – the measurable part of reputation – can be gauged through automatic online tracking and keyword analysis of online news and social media entries. Assessing the sentiment for various segments such as customers, investors or the job market can help organizations form a view of their reputation, potential advantages and shortcomings, as well as the main contributors to their image.

In addition, companies can systematically identify negative news and their contributors and take appropriate counter-actions. A strong social media presence is an effective defense mechanism to protect against these potential reputation risk hazards.

SoMe or not SoMe?

The importance of social media has been recognized particularly by the retail and travel industries. Financial institutions generally take a different approach to reputation risk such as ESG tests

(environment-social-government).

However, despite past reputational issues, financial institutions still struggle, in many cases, to manage reputation risks. For example, there is typically no consideration for the fact that financial

gains can diminish reputation and reputational effects are rarely quantified.

Financial services reputation risk management

Before building a comprehensive, social media-based reputation risk management framework, financial services providers must consider the following:

Reputation affects the customer as well as refinancing and job market

Reputation damages (which lead to a sentiment downturn) can be caused by events:

- internal (strategic decisions, customer communications, legal affairs, rogue trading, security breaches)

- external (negative branch news, scandal at a competitor organization)

These events can often be self-accelerating (looming rumors, ‘difficult’ customers)

The affected stakeholders can be grouped into transactional (customers, counterparties,employees, authorities) and non-transactional (media, NGOs, unions)

Reputation damages influence several goals: non-monetary (customer rankings, market share) and monetary (funding spreads, revenues/profits, new employee salaries)

Once these criteria are clarified, a full-scale reputation risk management framework can be constructed using the following:

Quantification and organization of sentiment indexes that measure different reputational markets

Benchmarking against general index and competitors

Causal connection of reputation-relevant events with reputational effects

Identification of possible reputation risk sources and means of addressing them

Classification of reputation risks according to probability and severity

Association of rises or drops in the sentiment index with concrete monetary or non-monetary effects

Provision of quantified basis for reputation-critical decisions and mitigation strategies

Reputation risk is a strategic business issue. With reputation now a significant component of any company’s market value, the potential of social media, both as the root and the remedy, should not be left to chance.