AUD, EMFX Rebound, USD Retreats Ahead of Jackson Hole

- Michael Moran , Senior Currency Strategist at ACY Securities

- 24.08.2021 09:00 am undisclosed

Stocks, Oil, Metals Gain, Risk Climbs as Delta Fears Ebb

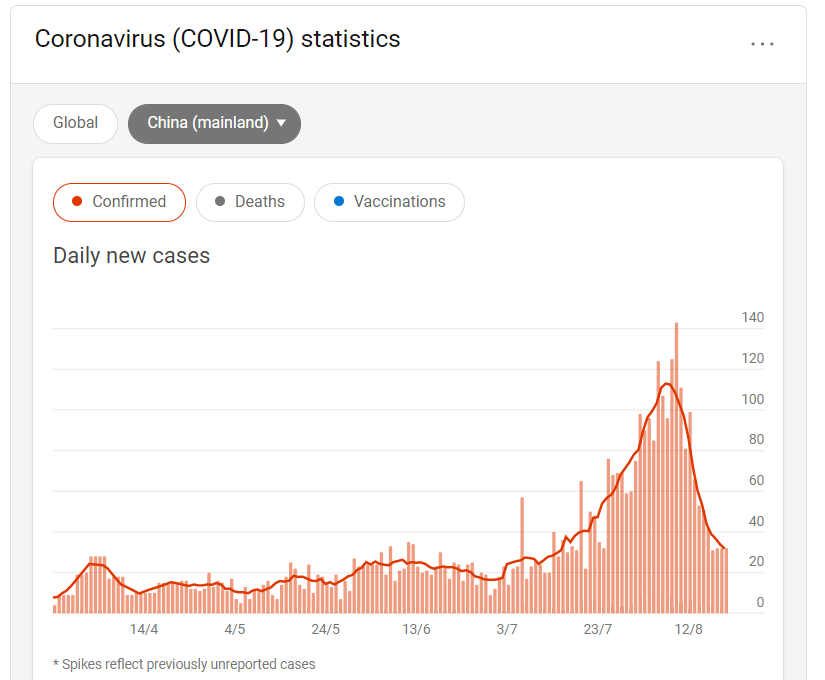

Summary: The Australian Dollar rebounded 1.26% against the Greenback, to 0.7212 (0.7111) as shorts were squeezed heading into this week’s Jackson Hole Symposium. News that China reported no new local Covid-19 cases since July lifted risk appetite, boosting commodities and related currencies.

Oil prices rocketed to finish over 5% higher. Brent Crude Oil settled at USD 68.55 (USD 65.00 yesterday). Against the Canadian Loonie, the Dollar tumbled 1.12% to 1.2660 from 1.2822. As markets looked ahead to the annual Jackson Hole summit which begins on Thursday, traders began unwinding positions. Sterling soared to 1.3723 in late New York from 1.3622, up 0.93%. The Euro rose 0.50% to 1.1745 (1.1700). The Dollar Index (USD/DXY) a gauge of the Greenback’s value against a basket of 6 major currencies, eased 0.53% to 93.00 after trading to a peak at 93.51 overnight. Against the Yen, the Greenback was little changed, settling at 109.70 (109.75). The Dollar retreated against the Asian and Emerging Market currencies. USD/SGD slid 0.46% to 1.3560 (1.3622) while the USD/THB pair eased to 33.27 from 33.37.

Wall Street stocks gained. The DOW rose 0.75% to finish at 35,375 (35,110) while the S&P 500 climbed to close at 4,485 from 4,435. Treasury bond yields steadied. The benchmark US 10-year note finished with a yield at 1.255 (1.26%). Germany’s 10-year Bund yield closed at -0.48% (-0.49%).

Data released yesterday saw Australia’s Manufacturing PMI in August slide to 51.7 from a previous 56.9. Australia’s Flash Services PMI eased to 43.3 from 44.2. Japan’s Jibun Flash Manufacturing PMI slid to 52.4, missing expectations at 52.7. France’s Manufacturing PMI matched estimates at 57.3. Germany’s August Manufacturing PMI fell to 62.7, underwhelming forecasts at 65.0. The Eurozone August Flash Manufacturing PMI missed expectations with a 61.5 reading versus 62.0. Eurozone Consumer Confidence slipped to -5 from -4.4, matching forecasts at -5. UK Flash Manufacturing PMI beat forecasts with a 60.1 read against 59.5. UK August CBI Industrial Orders Expectations rose to 18 from a previous 17. US August Chicago Fed PMI climbed to 0.53 from 0.09 in July. US Flash Manufacturing PMI eased to 61.2 from 63.4, missing median estimates at 62.8. US July Existing Home Sales climbed to 5.99 million units from 5.86 million, beating forecasts at 5.81 million.

- AUD/USD – After sliding to an overnight low at 0.7111 following the release of weaker-than-forecast Australian PMIs, the Battler rebounded to finish at 0.7212. Net short speculative Aussie bets which saw an increase in the week to 17 August were forced to cover as the Greenback slid.

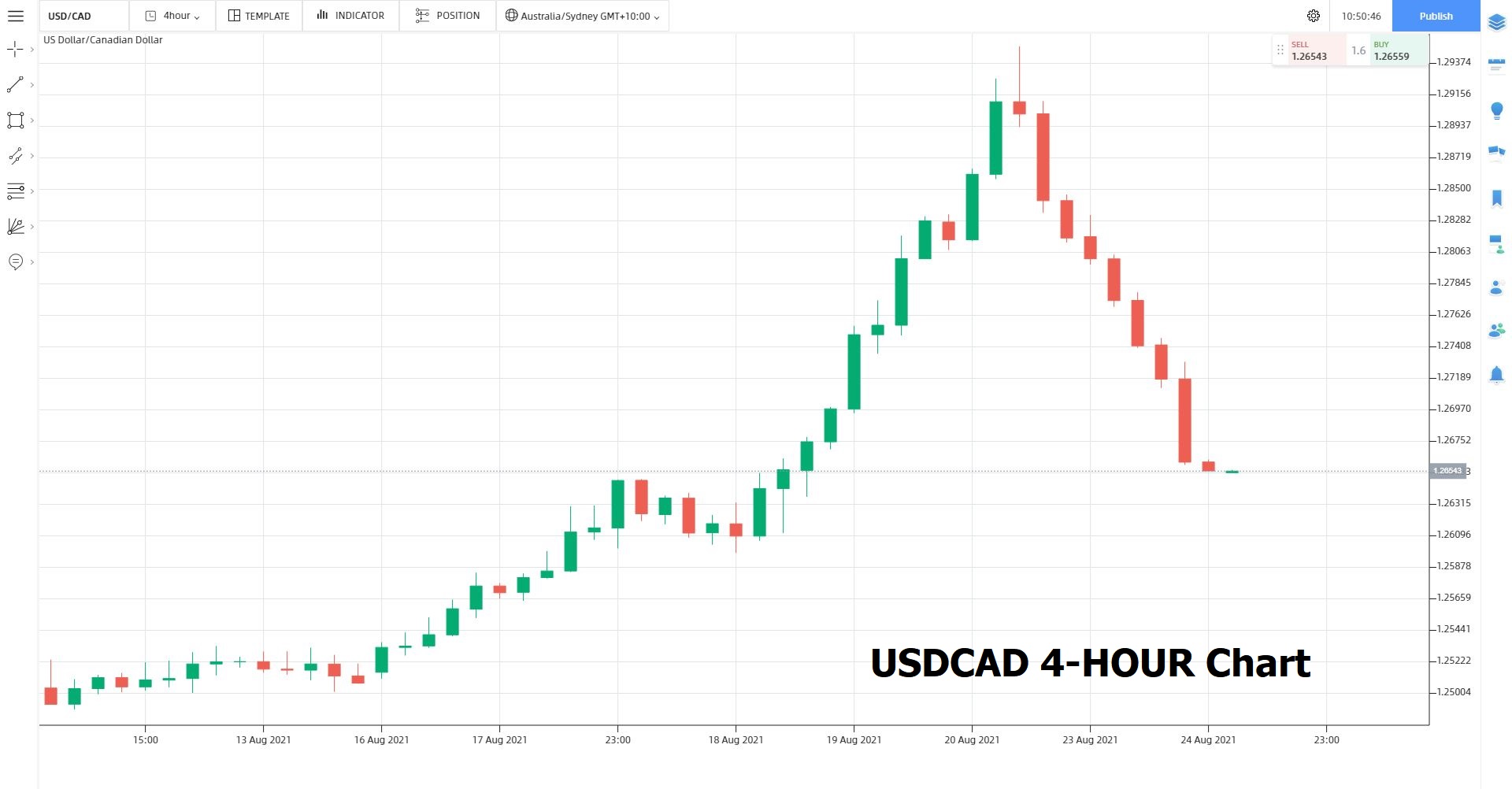

- USD/CAD – the US Dollar plunged against the Canadian Loonie to 1.2662 from 1.2822 yesterday. The Canadian Dollar benefitted from a 5.2% jump in Crude Oil prices (USD 68.55 from USD 65.00) and broad-based US weakness.

(Source: Finlogix.com)

- EUR/USD – the shared currency lifted against the Greenback despite mixed Euro area and Eurozone PMI readings. A decline in the Eurozone Consumer Confidence for July and the overall weaker US Dollar lifted the Euro.

- NZD/USD – improved market risk sentiment boosted the Kiwi. NZD/USD soared to a 0.6892 close from 0.6835 yesterday. The Kiwi traded to an overnight low at 0.6810. Overnight high for the NZD/USD pair was at 0.6904.

On the Lookout: Today’s economic calendar is light. Reports kicked off with New Zealand’s Q2 Headline and Core Retail Sales which have just been released. NZ Headline Retail Sales rose to 3.3% from a previous upward adjusted 2.8% (from 2.5%). NZ Q2 Core Retail Sales climbed 3.4%, beating forecasts at 2.1%. Japan follows with its BOJ Annual Core CPI report (f/c 0.1% from 0.1%). Germany’s Final Q2 GDP starts off Europe’s reports (q/q f/c 1.5% from a previous 1.5%. y/y f/c 9.2% from 9.2%). China releases its Leading Index (no forecasts, previous was 0.6%) The US Richmond Fed Manufacturing PMI for August follows next (f/c 25 from 27). US July New Home Sales round up the day’s reports (f/c 698,000 from 676,000).

Trading Perspective: Ahead of the Jackson Hole Symposium we can expect more position adjustments. The Jackson Hole, Wyoming symposium is the longest running global economic summit today. The annual economic summit began in 1978. It is attended by up to 140 central bank representatives, Nobel Prize winners and top academics. It is held in Jackson Hole, Wyoming USA but this year will be a virtual event due to the coronavirus. The biggest focus is on the Fed Reserve and whether Jerome Powell will reveal the intentions of the US central bank to taper. On Friday Dallas Federal Reserve President Rober Kaplan, a known hawk, admitted that the Delta variant was having more of a negative effect on GDP growth, and it could cause him to adjust his view. The caveat is if Powell suggest that a taper would happen by the end of the year.

Market positioning will also have its impact. Last week the Commitment of Traders CFTC report saw speculators increase their net long US Dollar bets (week ended August 17). Yesterday was the start of the unwind of some of these bets (specially against the Aussie and Kiwi).

- AUD/USD – The Aussie, under pressure last week, managed to rebound in true Battler fashion, hopping to an overnight high at 0.7218 from 0.7135 opening yesterday. AUD/USD finished at 0.7213 in late New York. AUD/USD has immediate resistance at 0.7220 followed by 0.7250. Immediate support can be found at 0.7185 followed by 0.7155 and 0.7115. Look for consolidation in a likely range trade today between 0.7175 and 0.7225. The speculators are still short so looking to buy dips.

- EUR/USD – The shared currency rallied on the back of broad-based US weakness. The Euro hit an overnight high at 1.1750 before settling to 1.1743 in late New York. Yesterday the Euro opened at 1.1700 in Asia. Overnight low traded for the Euro was at 1.1688. Immediate resistance lies at 1.1755 followed by 1.1785 and then 1.1805. Immediate support can be found at 1.1720, 1.1700 and 1.1680.

- GBP/USD – Sterling soared 0.93% to finish at 1.3723 against the overall weaker Greenback. The British Pound opened at 1.3624 yesterday. Overnight low traded was at 1.3603 while the overnight peak was at 1.3732. Immediate resistance can be found at 1.3735 followed by 1.3765 and 1.3795. Immediate support lies at 1.3685, 1.3655 and 1.3615. Look for the GBP/USD pair to trade a likely range between 1.3675-1.3755.

- USD/SGD – Against the Singapore Dollar, the Greenback slid 0.46% to finish at 1.3560 (1.3622). Broad-based USD weakness and an improved risk sentiment lifted the Asian and Emerging Market currencies. USD/SGD has immediate support at 1.3550 (overnight low traded was 1.355) followed by 1.3520. Immediate resistance can be found at 1.3585 followed by 1.3615 and 1.3655. Look for the USD/SGD pair to trade in a likely 1.3550-1.3620 range today. Prefer to buy dips.

FX markets are looking lively, volatility is picking up as we approach Jackson Hole. Expect more to come. Happy days.

Top Tuesday ahead all. Happy trading!