Product Profile

Language Support:

United Kingdom

Screenshots

Product/Service Description

SAS delivers a single solution that combines powerful analytics and visualization with robust data management capabilities, providing a solid foundation for all facets of risk data aggregation, governance and reporting – and enhancing your ability to identify and manage risk. SAS Risk Data Aggregation and Reporting connects data silos across your bank for a single, consolidated look at all your data.

Customer Overview

Total Number of customers undisclosed

Customer Size Large Enterprise , Medium

Customer Type Central Banks , Commercial Banks , Corporates , Fund Managers , Investment Banks , IT Integrators , Prime Brokers & Dealers , Securities Lending & Financing Organizations

Target Market Africa , Asia , Australia/New Zealand , Europe , Global , North America , South America

Specific georgaphical coverage United States of America

undisclosed

Demo & Case Study Urls http://support.sas.com/learn/

Features

- A comprehensive data store for all regulatory requirements.

- The ability to aggregate risk data using nonlinear methodologies

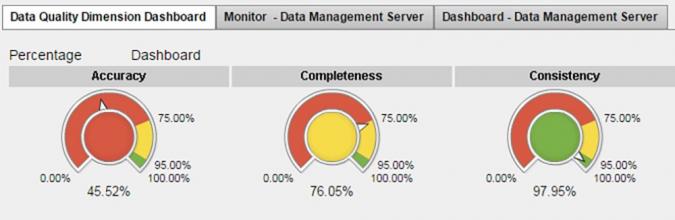

- Data quality rules for multiple dimensions

- Self-service visual analytics to convert data into meaningful metrics and information for a holistic view of your bank’s risk.

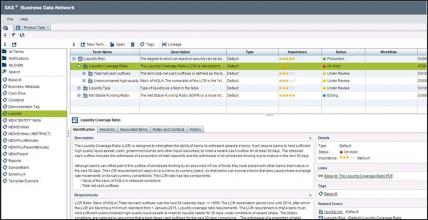

- Centralized capability for business analysts to develop and refine business rules that govern their data.

- Risk aggregations for banking and trading book

- Updateing business rule logic within a single rule-management environment

- Ability to categorize and assign responsibility for data quality errors

- Top-down correlated aggregation

- Bottom-up approaches

Benefits

- A single foundation for a complete data governance platform of risk data governance, data quality information accuracy, integrity and completeness

- Integration with many major platforms with a flexible and adaptable architecture that doesn’t require replacing existing technology investments.

- Processing of risk data calculations with high-performance, in-memory aggregation of positions (banking and trading book), exposures and data to the highest level of detail

- A high-performance risk engine to aggregate risk measures on demand (VaR, ES, etc.)

Platform & Workflow

Server OS AIX (IBM) , Cent OS , HP-UX (Hewiett-Packard) , Oracle Linux , Solaris (Sun Microsystems) , Windown Server 2008 and 2012; Linux , Windows 10 (Microsoft) , Windows 2000 Server/Advanced Server/Datacentre (Microsoft) , Windows Azure (Microsoft) , Windows Server , Windows Server 2003 R2 Standard/Enterprise/Datacentre/Web Server/Small Business (Microsoft) , Windows Server 2008 (Microsoft) , Windows Vista (Microsoft) , Windows XP (Microsoft)

Workstation OS Windows , Unix

Programming Language and API Java

SetUp and Installation Options undisclosed

Deployment Period Within months

Reporting Capabilities Filtering, pivoting, grouping, ranking. Ability to modify and extend dashboards and reports using SAS Visual Analytics. Set of standard templates that can be customized to meet regional or local regulatory requirements and then filed electronically.

Security Options Undisclosed

The product/service compliant with the following regulatory standards BASEL III

Connectivity, Hosting and Intergration

Hosting Option Inhouse , Hosted by provider

Hosting provider undisclosed

Devices Supported undisclosed

Compatibility with Database Management System (DBMS) SQL, MS Access,

Third party integration Apache Hadoop

Support Services

Support Option Online Support , Phone Support , Video Tutorials , Knowledge Base